06 May 2024, 12:25

Price forecast from 6 to 10 May 2024

-

Energy market:

Against the backdrop of increased prospects of nuclear war, Gazprom’s losses are taken lightly. One should realize that if Russia uses nuclear weapons against the French Legion, all the straits will be closed and trade with the country will be halted. Actually, so what. The main thing then will be the wind rose, not quotations.

Bitcoin has suddenly gone up in price. Why? There may be no electricity anywhere. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

The American White House is sanitizing Saudi Arabia. They are killing the wrong cockroaches in their heads, from their point of view, and leaving the right ones behind. They say, be friends with Israel, drill more, behave well. Then you can build skyscrapers not only up and sideways, but also underwater and on Mars. And in general, you’re great when you do as you’re told. And a gold M16, of course. And a saber. And a new Maserati. And a horse. I smell the end of OPEC history.

In April, India increased its oil purchases from Russia by almost 20% compared to March. Indians took 1.96 million barrels of oil per day from Russia. That’s right, then the gasoline goes to Britain. Everybody’s fine. And it’s like nothing’s happening anywhere. India and China will be the main markets for Russia in the foreseeable future. Besides oil, fertilizers and diamonds are in demand.

Grain market:

There is concern in the global market about weather conditions in southern Russia, which could lead to some, let’s not use the word «substantial» reduction in wheat harvest. This is pushing prices up.

The bigger concern is not Russia, but Ukraine’s inability to harvest and deliver anything to the foreign market this year. This information has been somehow hidden in the background, but in case the conflict expands, the shortfall of agricultural products from the Black Sea region could be significant: 8 — 10 million tons. This fact can play for bulls, in case the EU will not collect its 135 million tons of wheat. Sending European military contingent under the flags of the states can cause crisis on the food market as well. Everything will go up.

Due to the significant increase in energy prices, locally, the rise in food prices in the EU is felt by residents quite painfully. In general, Europe is a comfortable region for agriculture, but it is also suffering against the background of the SWO. Sanctions are not only hitting Russia, it should be understood. The existing practice of regularly raising food prices, in Italy they are now rewritten every day (believe the blogs), will support grain prices in the future.

Based on what is happening at the Chicago stock exchange and the growing hysteria in a number of countries about hot weather conditions (Morocco, Turkey, regions of Italy and Spain), the upward trend in wheat and corn may intensify after the USDA report, even if it does not show a significant (minus 3 — 5%) decline in volumes compared to last year.

USD/RUB:

The U.S. interest rate has been left unchanged, but the prospects for a rate cut have now been moved to the fall. And it is not clear whether it will be lowered or not. Maybe they will continue to raise it. It is not possible to bring inflation back to 2 percent domestically.

For the ruble, the US high rate is not as important now as the trade balance, as well as the volume of money inflow into the country on the one hand and spending on SWOs on the other. So far, Moscow is coping. It even manages to postpone it a bit, judging by the dynamics of gold reserves.

The ruble, if the West does not get into Ukraine, so to speak, personally, will not experience strong problems. After descending to 85.00 (80.00), a new round of smooth devaluation to 110.00 will begin. Under SWO conditions, this is an understandable and acceptable story.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers increased by 17.3 contracts. Buyers came in, sellers ran in about the same volumes. Buyers are in control.

Growth scenario: we consider May futures, expiration date May 31. We do not buy. We wait for a pullback to 81.00. And then we can go to 120.00.

Downside scenario: we will keep shorting from 89.50. It is possible that we will manage to go down to 81.00.

Recommendations for the Brent oil market:

Buy: when approaching 81.00. Stop: 79.00. Target: 120.00!

Sell: no. Those who are in position from 89.50, move your stop to 88.00. Target: 81.00. You can close 15% of the position.

Support — 80.50. Resistance — 85.09.

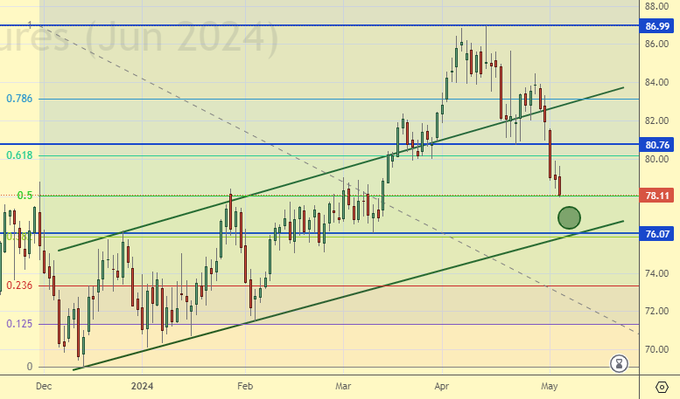

WTI. CME Group

US fundamentals: the number of active drilling rigs fell by 7 to 499.

U.S. commercial oil inventories rose 7.265 to 460.89 million barrels, with a forecast of -2.3 million barrels. Gasoline inventories rose 0.344 to 227.087 million barrels. Distillate stocks fell -0.732 to 115.85 million barrels. Cushing storage stocks rose by 1.089 to 33.456 million barrels.

Oil production remained unchanged at 13.1 million barrels per day. Oil imports increased by 0.275 to 6.772 million barrels per day. Oil exports fell by -1.261 to 3.918 million barrels per day. Thus, net oil imports rose by 1.536 to 2.854 million barrels per day. Oil refining fell -1 to 87.5 percent.

Gasoline demand increased by 0.195 to 8.618 million barrels per day. Gasoline production increased by 0.254 to 9.396 million barrels per day. Gasoline imports rose 0.197 to 0.977 million barrels per day. Gasoline exports increased by 0.142 to 0.92 million barrels per day.

Distillate demand rose by 0.126 to 3.678 million barrels. Distillate production fell -0.271 to 4.508 million barrels. Distillate imports fell -0.035 to 0.103 million barrels. Distillate exports fell -0.096 to 1.038 million barrels per day.

Demand for petroleum products increased by 0.882 to 20.417 million barrels. Production of petroleum products increased by 0.041 to 21.91 million barrels. Petroleum product imports rose 0.319 to 2.286 million barrels. Exports of refined products fell -0.514 to 6.401 million barrels per day.

Propane demand rose by 0.716 to 1.155 million barrels. Propane production fell -0.027 to 2.796 million barrels. Propane imports fell -0.008 to 0.083 million barrels. Propane exports fell -0.646 to 1.689 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 2.7 th. contracts. Both buyers and sellers entered the market. Bulls keep control.

Growth scenario: we consider June futures, expiration date May 21. We are waiting for the market around 76.00. Current levels for buying are already interesting, but not ideal.

Downside scenario: we will keep the short, which we opened earlier. The market is able to roll back before the next saber dance.

Recommendations for WTI crude oil:

Buy: ideal on a pullback to 76.20. Stop: 75.20. Target: 100.00.

Sell: no. Those in position from 85.66, move stop to 83.76. Target: 76.20 (revised). It is possible to close 20% of the position.

Support — 76.07. Resistance — 80.76.

Gas-Oil. ICE

Growth scenario: we consider June May futures, expiration date is June 12. We will buy now and when approaching 740.00.

Downside scenario: there are no interesting levels for selling.

Gasoil Recommendations:

Buy: now and when approaching 740.0. Stop: 720.00. Target: 880.00.

Sale: no.

Support — 734.50. Resistance — 761.25.

Natural Gas. CME Group

Growth scenario: we consider June futures, expiration date May 29. We hold the long opened earlier. Sooner or later this thing should have rebounded.

Downside scenario: refrain from selling, market is low.

Natural Gas Recommendations:

Buy: no. Those in position from 1.988, move your stop to 1.880. Target: 3.000?!

Sale: no.

Support — 1.905. Resistance — 2.389.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we are above 80000, we don’t think about buying. At the same time: purchases from 62000 are welcome.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: on approach to 62000. Stop: 58000. Target: 100000!

Sale: no.

Support — 65254. Resistance — 75459.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: and again we will be persistent in buying, but only after rising above 11000. We will stop burying sooner or later.

Downside scenario: we stay out of the market. A move to 5000 is possible, but selling is risky now. It is better to be in commodities than in cash.

PBT Market Recommendations:

Buy: in case of growth above 11000. Stop: 8800. Target: 25000. You can be aggressive.

Sale: no.

Support — 6846. Resistance — 15459.

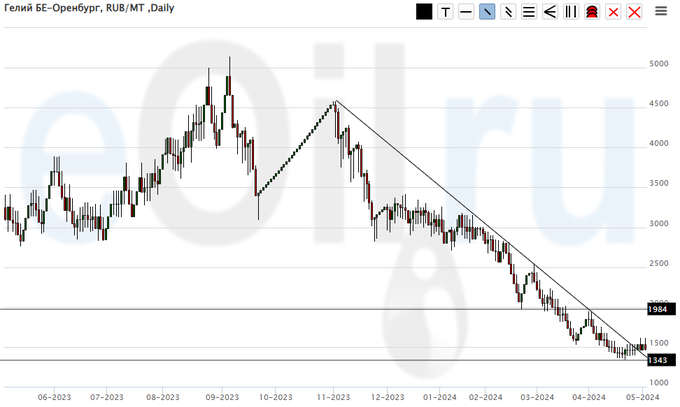

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market gives us a chance to take it at a low price. Those who wish can buy, we will keep longs.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no. Who is in position from 1450, 1500 and 1600, keep stop at 1300. Target: 3500.

Sale: no.

Support — 1343. Resistance — 1984.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 25.9 th. contracts. Sellers have scattered. Bears risk losing control.

Growth scenario: we consider July futures, expiration date July 12. The hot weather triggered the growth. We will have to think about buying in case of a move above 650.0. It would be very reasonable to wait for the USDA report in May.

Downside scenario: let’s hold shorts. It is worth recognizing that the bulls have aggressively taken over the market and it is a bit unnerving.

Recommendations for the wheat market:

Buy: not yet.

Sell: no. Those in position from 622.2, keep your stop at 643.0. Target: 450.0?!

Support — 589.2. Resistance — 633.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 12.8 th. contracts. Sellers continue to run. Buyers have maintained their positions. Bears are maintaining control for the time being.

Growth scenario: we consider July futures, expiration date July 12. We will hold the long. If the bulls have very serious intentions, we should accelerate in the next two weeks.

Downside scenario: we suggest shorting, but only in case of falling below 432.0.

Recommendations for the corn market:

Buy: no. Those who are in position from 442.0, move the stop to 441.0. Target: 500.0.

Sell: in case of falling below 432.0. Stop: 454.4. Target: 360.0!!!

Support — 443.6. Resistance — 474.4.

Soybeans No. 1. CME Group

Growth scenario: we consider July futures, expiration date July 12. It is not excluded that we went to the area of 1320. We will have to buy.

Downside scenario: we’ve been knocked out of the shore. We take a break for a week.

Recommendations for the soybean market:

Buy: now (1215), and also in case of fall 1170. Stop: 1140. Target: 1320. Count the risks!

Sale: no.

Support — 1191.0. Resistance — 1238.4.

Growth scenario: we continue to want a correction to buy. Good to 2100, ideal to 2020.

Downside scenario: hold shorts from 2415. Those who wish can increase shorts.

Gold Market Recommendations:

Buy: from 2100 would be interesting, from 2000 would be perfect.

Sell: No. Who is in position from 2415, move the stop to 2380. Target: 2100 (2020).

Support — 2223. Resistance is 2352.

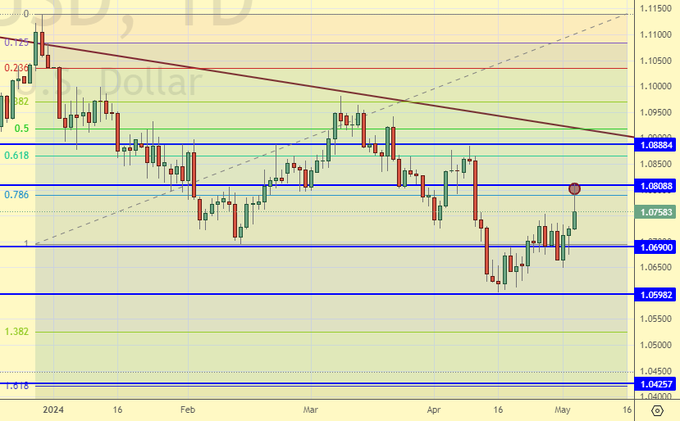

EUR/USD

Growth scenario: you should not buy now. Euro will be under pressure amid continued high interest rates in the US.

Downside scenario: we clung to 1.0800, which is not bad. We expect a move to 1.0000.

Recommendations on euro/dollar pair:

Buy: no.

Sell: no. Who is in position from 1.0800 and 1.0690, keep stop at 1.0860. Target: 1.0000.

Support — 1.0690. Resistance — 1.0808.

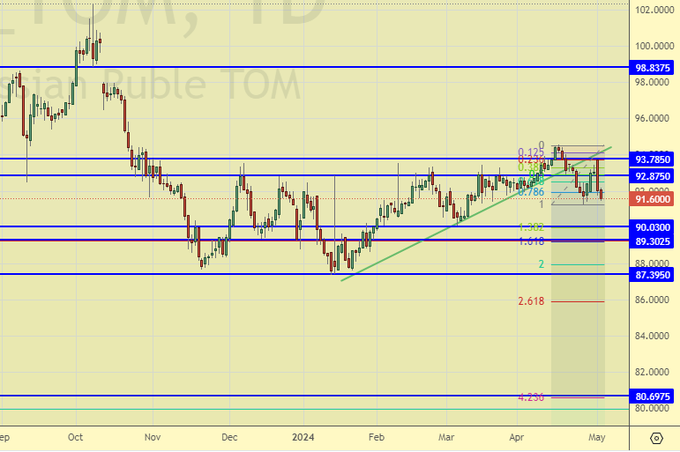

USD/RUB

Growth scenario: somewhat fearful for our positions with stop order at 90.00. It is worth recognizing that the market is behaving aggressively.

Downside scenario: want to sell, but scared. So, that’s the way to do it.

Recommendations on dollar/ruble pair:

Buy: no. Who is in position from 92.79 and 92.90, keep stop at 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: now. Stop: 93.30. Target: 86.00?! Count the risks!

Support — 90.03. Resistance — 92.87.

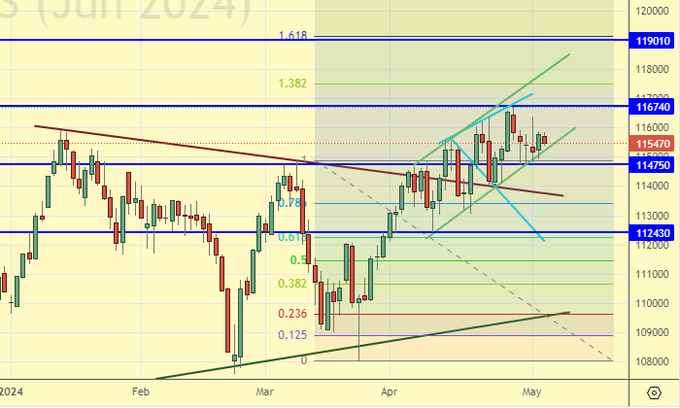

RTSI

Growth scenario: we consider June futures, expiration date June 20. We are growing very shakily. Jumps and deep pullbacks do not inspire optimism. We are looking for other markets.

Downside scenario: nothing new. Freezing again in a way that couldn’t be worse. Total equilibrium. No recommendations.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 114750. Resistance — 116740.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.