27 February 2023, 13:41

Price forecast from 27 February to 03 of March 2023

-

Energy market:

At this day and hour, even unfriendly analysts estimate the damage from the embargo on Russian hydrocarbons in the amount of 100 billion dollars a year. The amount is small. Judge for yourself: two stables, a golf course, a 14th-century service, a brooch, a wine cellar with wine, a pier decorated with Italian tiles and a set of old fountain pens. That’s all the damage. And then it will be necessary to apply to the district court for damages.

Everything will be fine. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

To calculate taxes, the price of Russian oil in April will be determined by the formula: the price of a barrel of Brent oil minus $34, $31 will be deducted in May, $28 in June, and $25 in July. What happens next is not yet clear, but it is clear even without glasses that the scheme for calculating taxes to the budget has been revised.

There is a lot of talk about the revival of China, but oil is in no hurry to grow. Moreover, there is a threat of falling below the 80 level, which could lead to a rapid drop in prices of 10 percent amid bulls’ frustration with the fact that Russia has both supplied oil, and delivers. We are not talking about any shortage of supply now. Everyone is dissatisfied, but they continue to work. With red faces they sell, with gray faces they buy.

Poland stopped receiving oil through the Druzhba pipeline. Now Warsaw will live independently. Let’s see how long. Note that in general Europe likes to engage in masochism. Well, the energy accumulated in comfortable offices should be used somewhere, for example, in the search for alternative energy sources.

Grain market:

China, as part of its proposal to resolve the conflict in Ukraine, mentioned supporting the «grain deal», which immediately led to a drop in prices on the exchanges. China, with its gigantic influence, will be very hard to ignore. Under current conditions, this means that there will be no obstacles to the export of Ukrainian grain to the foreign market this summer.

1.5 million tons of wheat were shipped from Russia in the first half of February. Bad weather in southern ports is hindering exports, but overall the process is well under way. Yes, it will hardly be possible to talk about 4 million exports for the current month, but 3.5 million will most likely be exported. Egypt, Turkey, Sudan, Pakistan and Algeria are now the main export destinations.

Domestic prices continue to remain at low levels. So, in the south you can buy a ton of wheat of the 4th grade for 12 thousand rubles, in the Volga region already for 10.5 — 11 thousand.

USD/RUB:

The Russian currency did not strengthen after the message of the President to the Federal Assembly. There were many points in the keynote speech that will require significant financial expenditures in the future. At the moment, there is no doubt that the state has the opportunity to fulfill the instructions of the president. There are no such doubts, in particular, and the Minister of Finance Siluanov. As long as Russia manages to sell oil and receive money for it, for example, Chinese yuan, there is no doubt that funds will be found.

However, the market does not work with the present, but with the future. We see that traders have serious doubts that by the middle of the year the situation in the economy will be better than what we have now.

If next week there is no rollback from the level of 76.00, presumably to the area of 72.00, then it is worth preparing for the fact that the dollar / ruble pair will quickly rise to the level of 80.00.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers decreased by 20.8 thousand contracts. Buyers fled the market in small numbers, while sellers increased in number. The spread between long and short positions has narrowed, however, the bulls are in control.

Growth scenario: consider the January futures, the expiration date is February 28. Current levels can be used for purchases. If prices fall below the level of 80.00, long positions will have to be left.

Fall scenario: balance is maintained. If we can break below the 80.00 level, then we can increase the existing shorts.

Recommendations for the Brent oil market:

Purchase: now. Stop: 79.70. Target: 110.00. Who is in position from 84.00, keep the stop at 79.70. Target: 110.0.

Sale: no. Who is in position from 87.30, move the stop to 86.30. Target: $70.00 per barrel.

Support — 79.16. Resistance is 86.96.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 7 units and now stands at 600 units.

Commercial oil reserves in the US increased by 7.647 to 479.041 million barrels, with the forecast of +2.083 million barrels. Inventories of gasoline fell -1.856 to 240.066 million barrels. Distillate inventories rose by 2.698 to 121.935 million barrels. Inventories at Cushing rose 0.7 to 40.411 million barrels.

Oil production has not changed and stands at 12.3 million barrels per day. Oil imports rose by 0.094 to 6.326 million barrels per day. Oil exports rose by 1.451 to 4.597 million barrels per day. Thus, net oil imports fell by -1.357 to 1.729 million barrels per day. Oil refining fell by -0.6 to 85.9 percent.

Gasoline demand rose by 0.636 to 8.91 million barrels per day. Gasoline production increased by 0.339 to 9.428 million barrels per day. Gasoline imports fell -0.113 to 0.476 million barrels per day. Gasoline exports fell by -0.018 to 0.768 million bpd.

Demand for distillates fell by -0.123 to 3.771 million barrels. Distillate production increased by 0.191 to 4.7 million barrels. Distillate imports rose by 0.193 to 0.414 million barrels. Distillate exports fell -0.062 to 0.958 mb/d.

Demand for oil products rose by 0.916 to 20.218 million barrels. Production of petroleum products increased by 1.165 to 21.383 million barrels. Imports of petroleum products fell by -0.188 to 2.065 million barrels. Exports of petroleum products fell by -0.068 to 5.992 million barrels per day.

Demand for propane rose by 0.284 to 1.316 million barrels. Propane production increased by 0.048 to 2.404 million barrels. Propane imports rose by 0.012 to 0.165 million barrels. Propane exports fell by -0.17 to 1.675 mb/d.

Information from the US on open interest will not yet be in our review, as there are continuing problems with the publication of data due to computer failures.

Growth scenario: we are considering the April futures, the expiration date is March 21. Until we buy. Only if the market rises above 81.50 will we go long.

Fall scenario: we will continue to hold the shorts. Prices remain inside a wide falling channel, sellers have nothing to worry about.

Recommendations for WTI oil:

Purchase: after rising above 81.50. Stop: 80.40. Target: 110.00.

Sale: no. Those in positions between 82.00 and 80.50 keep the stop at 80.80. Target: 66.00 (55.00) dollars per barrel.

Support — 70.84. Resistance — 80.78.

Gas-Oil. ICE

Growth scenario: we consider the March futures, the expiration date is March 10. You can buy at current levels. If quotes fall below 750.0, you will have to leave the long position.

Fall scenario: we will keep the shorts. Since no shortage is foreseen, prices may move lower.

Gasoil recommendations:

Purchase: now. Stop: 748.0. Target: 1100.0.

Sale: no. Who is in position from 900.0, move the stop to 870.0. Target: 670.0.

Support — 761.75. Resistance — 863.25.

Natural Gas. CME Group

Growth scenario: we are considering the April futures, the expiration date is March 29. You can hold the long opened last week. We are not opening new positions.

Fall scenario: we will not sell anything. The levels are extremely low for sales. Out of the market.

Recommendations for natural gas:

Purchase: no. Who is in position from 2.200 move the stop to 2.130. Target: 3.480.

Sale: no.

Support — 2.108. Resistance is 2.741.

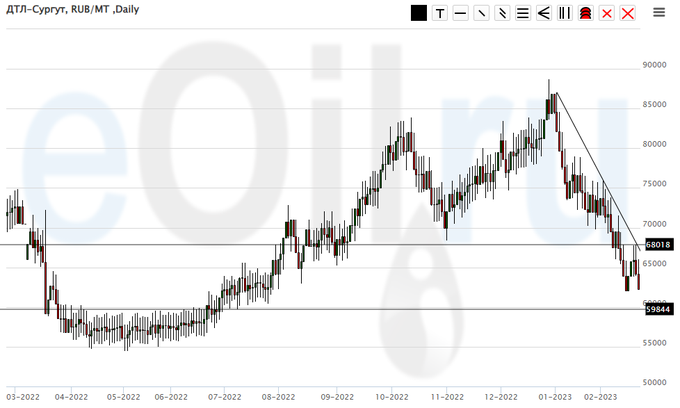

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: we see a trend to increase the collection of taxes from the oil sector. It is unlikely that fuel in the current conditions will cost less than 60,000 rubles per ton. The current area can be used for shopping.

Fall scenario: we will continue to recommend unloading your sell positions. The market has worked out the information on the embargo, a further fall in prices will look too aggressive.

Diesel market recommendations:

Purchase: when approaching 60000. Stop: 57000. Target: 70000.

Sale: no. Those who are in positions between 84000 and 74000, move the stop to 69000. Target: 55000 rubles per ton. At current levels, you can close another 20% of the position. Thus, only 40% of the original sales should remain.

Support — 59844. Resistance — 68018.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: the market was approaching the level of 5000. It is possible that there will be another attempt to rise. You can keep longs in anticipation of further price growth.

Fall scenario: we will continue to refuse sales. Prices are extremely low.

Recommendations for the PBT market:

Purchase: no. Those who are in positions from 1000, move the stop to 2200. Target: 5000 (7500) rubles per ton. Those who previously closed the long position and fixed the profit can enter the position again.

Sale: no.

Support — 2388. Resistance — 4912.

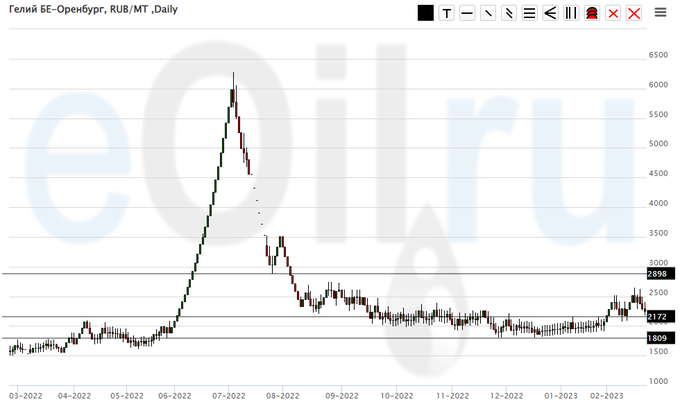

Helium (Orenburg), ETP eOil.ru

Growth scenario: we are holding above the 2000 level, which gives good chances for a move to the 2800-3000 area. We will keep the previously open longs.

Fall scenario: when approaching the level of 3000, you can sell in case of a red daily candle.

Recommendations for the helium market:

Purchase: no. Those who are in positions from 1800, 1900 and 2000, keep the stop at 1900. Target: 2750 (3000) rubles per cubic meter.

Sale: when approaching 3000. Stop: 3200. Target: 2100.

Support — 2172. Resistance — 2898.

Wheat No. 2 Soft Red. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. The bulls left the market, which caused prices to fall. It is likely that we will reach the level of 675.0 within this decline. Until we buy.

Fall scenario: sales are possible if prices return to the level of 740.0. We consider the potential for a fall to be limited, so we will not sell on the market.

Recommendations for the wheat market:

Purchase: no.

Sale: on the rise to 740.0. Stop: 770.0. Target: 675.0 cents per bushel.

Support — 673.0. Resistance — 770.4.

Growth scenario: consider the May futures, the expiration date is May 12. Buyers fled after China supported the extension of the grain deal. The market is able to fall to the level of 580.0 cents per bushel.

Fall scenario: our long patience was rewarded last week. Prices have finally come down. Prices may fall by more than 10%.

Recommendations for the corn market:

Purchase: no.

Sale: no. Who is in position from 688.0, move the stop to 678.0. Target: 580.0 cents per bushel.

Support — 631.0. Resistance — 685.0.

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We see a wedge. If its lower limit breaks through, the market will fall sharply. We don’t buy.

Fall scenario: you can increase sales. If we fall below 1500, we can see a fast down move.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1547.0. Target: 1000.0. Who is in position from 1540.0, move the stop to 1547.0. Target: 1000.0 cents per bushel.

Support — 1472.4. Resistance — 1549.2.

Growth scenario: from 1790 you can buy if there are signs of a reversal up. Up to this level, we do not think about purchases. The far target is at 1730.

Fall scenario: we will continue to hold the short from 1920 with the target at 1790. It makes sense to leave part of the position to work out the fall to the level of 1730.

Recommendations for the gold market:

Purchase: think when approaching 1790.

Sale: no. If you are in position from 1920, move your stop to 1890. Target: $1790 (1730) per troy ounce.

Support — 1791. Resistance — 1859.

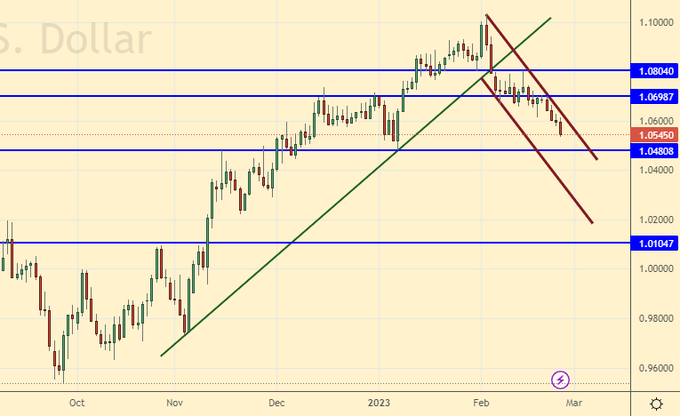

EUR/USD

Growth scenario: slowed down the fall. Most likely we will reach 1.0480. If the fall does not stop, then we can go to 1.0100, this must be taken into account.

Fall scenario: we continue to hold shorts in the expectation of a fall to 1.0480. The move to 1.0100 will also continue to be considered as very probable.

Recommendations for the EUR/USD pair:

Purchase: think when approaching 1.0480. From 1.0100 it is obligatory to buy.

Sale: no. Who is in position from 1.0690, keep the stop at 1.0830. Target: 1.0480 (1.0120).

Support — 1.0480. Resistance is 1.0698.

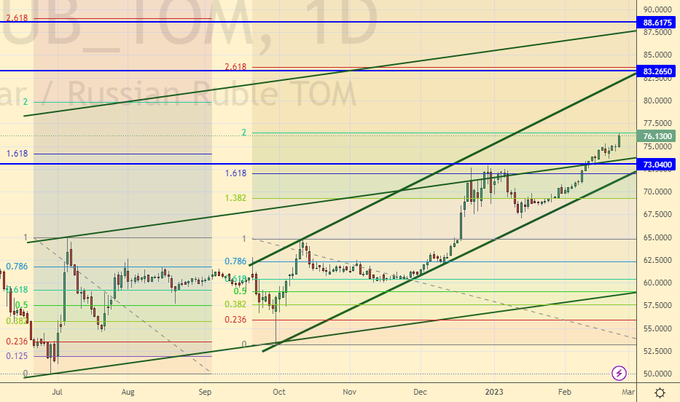

USD/RUB

Growth scenario: in terms of technology from 76.10, we can roll back down. The strengthening of the ruble is possible up to the level of 72.00. In the current conditions, we consider a correction to the level of 65.00 a miracle, but this move down remains theoretically possible until we rise above the level of 80.00.

Fall scenario: at current levels, you can sell. The chances of falling are small, but the market is overbought. We need to stay in the range for at least a week.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 72.00. Stop: 71.00 Target: 88.00. Who is in positions from 71.50 and 74.00, move the stop to 75.80. Target: 88.00.

Sale: now. Stop: 76.70. Target: 72.00 (65.00).

Support — 73.04. Resistance — 83.26.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. In the near future, no one will be able to count on tax breaks. Each large dividend payment will be viewed by the tax authorities under a microscope. There will be no dividends, there will be no interest in the market. As long as we have nothing to grow on. We don’t buy.

Fall scenario: continue to assume that if the market goes below 90000, then we are in for a quick fall to the level of 80000, possibly 75000. After falling below 90000, we can add to the shorts.

Recommendations for the RTS index:

Purchase: no.

Sale: no. Who is in position from 106000, 103000, 101000 and 98000, keep the stop at 101000. Target: 80000 (50000, then 20000) points.

Support — 91340. Resistance — 96020.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.