25 September 2023, 12:58

Price forecast from 25 to 29 of September 2023

-

Energy market:

It turns out that China’s entire population of 1.4 billion people is not enough to fill all the empty apartments in the country. That’s all the Chinese economic miracle is. A square meter contributed up to 25% to GDP. They drew him, in hieroglyphs, of course. They ate rice and waved flags. Everything is as it should be.

We hire the wrong migrant workers, the wrong ones. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The oil market suddenly stumbled out of the blue and did not want to go to 98.00 Brent. The growth of quotations was interrupted. There is a threat of a move below 90.00, and this despite the fact that OPEC+ complies with agreements to reduce production. What’s happening? There are two explanations: a strong dollar is currently putting pressure on the economy, which is why real consumption is falling, or traders are already betting that there will be no more new round of production cuts in January.

It is worth admitting that Saudi Arabia may be pissed off by Iran, which is now actively reaching out to China by giving discounts on its oil, while KSA and the UAE are raising prices. Russia also doesn’t need low prices, so we can expect that one of our officials, for example, Novak, will march on Tehran, demanding an end to the disgrace.

It is worth recognizing that increased defense spending turns into extortion for business, which leads to underfunding in the development of new fields and maintenance of old fields, this can lead to a reduction in production within 2 years. Saudi Arabia may soon have to replace Russia’s volumes rather than engage in voluntary circumcision.

Let us note that the ban on the export of diesel and gasoline has already reduced prices on the domestic market, but we should be prepared for the fact that in a couple of weeks, when the imbalance is eliminated, export quotas will be introduced, which will not allow prices to drop to mid-summer price levels .

Grain market:

Eastern European countries continue to insist that Ukraine cannot transport grain through their territory. In Poland, for example, transit allegedly resulted in wheat ending up with flour millers, which led to local farmers losing the market. In such a situation, when there is a lot of everything around, we should expect new attempts from the wheat market to move lower. Despite the conflict between Russia and Ukraine, no one is afraid of going hungry, which was clearly visible a year ago, including in prices.

A strong dollar, among other things, puts pressure on the commodities sector, which makes new debt expensive, and will inevitably cause an increase in the burden of servicing them in the future. Argentina (inflation for the year 140%) is the first candidate for defaulting again (for the 3rd time in the 21st century, it seems). Well, so what… In the meantime, while the peso is weak, this agricultural giant can easily remain competitive no worse than Ukraine. If in the future they unite with Brazil through the introduction of a single currency, then an eternal carnival will begin there. Robots and drones will work here and there. The rest are dancing. Nobody needs anything. Everything grows on its own. As the number of agricultural drones increases, agricultural products will become cheaper.

The gross grain harvest in Russia is currently estimated at 130 million tons, of which 87.5 million tons are wheat.

USD/RUB:

It is interesting to watch the RGBI index. The cost of government debt securities issued earlier has been falling for several weeks in a row. Raising rates doesn’t help. Bankers, and only they can now lend to the state, demand better conditions. How much do they want 20%?! That’s why Nabiullina has to raise the rate to 13% (and this is not the limit), with her own estimates of inflation at 5.5% (we won’t discuss how they get this figure here, they somehow get it).

Financiers predict an increase in inflation and, at the same time, an increase in the budget’s needs for new borrowings. In such conditions, it will be extremely difficult for the ruble to strengthen. Note that technically it is still possible to move to 87.00, but if we see growth above 99.00, then we will have a mark of 115.00 at the top. If it rises above 101.00, there will be another panic buying of dollars. And then Happy New Year.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 16.8 thousand contracts. The sellers fled. Buyers slightly increased their position. The spread between long and short positions has widened and the bulls remain in control.

Growth scenario: we are considering the October futures, expiration date is October 31. We are finally seeing a pullback. If it falls to 88.00, buy.

Fall scenario: it’s a pity that we didn’t arrive at 98.00. We haven’t seen this level. Can be sold when rising to 94.00.

Recommendations for the Brent oil market:

Purchase: when approaching 88.00. Stop: 84.00. Goal: 98.00.

Sale: when approaching 94.00. Stop: 95.70. Goal: 88.00.

Support – 90.96. Resistance – 93.31.

WTI. CME Group

US fundamentals: the number of active drilling rigs decreased by 8 to 507.

Commercial oil reserves in the US fell by -2.136 to 418.456 million barrels, with the forecast of -2.2 million barrels. Gasoline inventories fell by -0.831 to 219.476 million barrels. Distillate inventories fell by -2.867 to 119.666 million barrels. Inventories at the Cushing storage facility fell by -2.064 to 22.901 million barrels.

Oil production remained unchanged at 12.9 million barrels per day. Oil imports fell by -1.065 to 6.517 million barrels per day. Oil exports increased by 1.977 to 5.067 million barrels per day. Thus, net oil imports fell by -3.042 to 1.45 million barrels per day. Oil refining fell by -1.8 to 91.9 percent.

Gasoline demand increased by 0.103 to 8.41 million barrels per day. Gasoline production increased by 0.499 to 9.711 million barrels per day. Gasoline imports fell by -0.388 to 0.511 million barrels per day. Gasoline exports increased by 0.233 to 1.144 million barrels per day.

Demand for distillates increased by 0.588 to 4.166 million barrels. Distillate production fell by -0.229 to 4.782 million barrels. Imports of distillates fell by -0.102 to 0.083 million barrels. Exports of distillates increased by 0.052 to 0.177 million barrels per day.

Demand for petroleum products fell by -0.077 to 20.914 million barrels. Production of petroleum products fell by -0.98 to 22.725 million barrels. Imports of petroleum products fell by -0.015 to 1.886 million barrels. Exports of petroleum products fell by -0.335 to 5.627 million barrels per day.

Demand for propane increased by 0.743 to 1.245 million barrels. Propane production increased by 0.023 to 2.58 million barrels. Propane imports increased by 0.059 to 0.12 million barrels. Propane exports increased by 0.073 to 0.131 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 17.6 thousand contracts. The bulls keep coming. Sellers kept their rates at the same level. The bulls’ advantage grew again.

Growth scenario: we are considering November futures, expiration date October 20. It is extremely inconvenient to buy in this situation. Need a rollback.

Fall scenario: can be sold. The chances are not great, but the risk is small.

Recommendations for WTI oil:

Purchase: on a rollback to 83.50. Stop: 81.00 Target: 96.00 (105.00).

Sale: now. Stop: 92.10. Target: 83.60.

Support – 88.33. Resistance – 92.39.

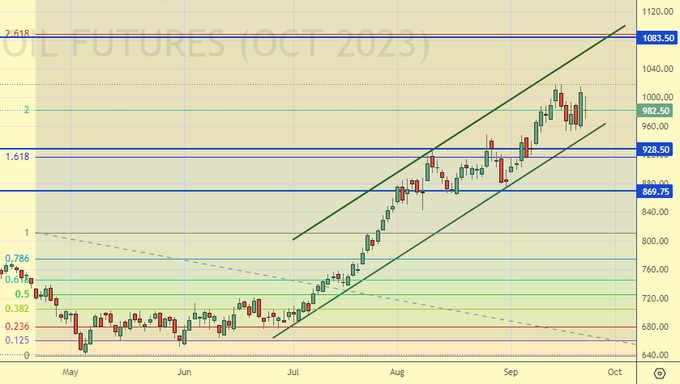

Gas-Oil. ICE

Growth scenario: we are considering the October futures, expiration date is October 12. A ban on diesel exports from the Russian Federation will support the market, but not for long. Can buy.

Fall scenario: you can enter short only from 1080.0. Most likely we will reach this mark.

Recommendations for Gasoil:

Purchase: Now. Stop: 944.0. Target: 1080.0. Consider the risks.

Sale: when approaching 1080.0. Stop: 1094.0. Goal: 930.0.

Support – 928.50. Resistance – 1083.50.

Natural Gas. CME Group

Growth scenario: switched to November futures, expiration date October 27. Gas in the US remains cheap. For now, we expect that requests from the EU will increase quotes in the future.

Fall scenario: do not sell, levels are too low.

Natural gas recommendations:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, move the stop to 2.640. Goal: 3.900.

Sale: no.

Support – 2.822. Resistance – 3.087.

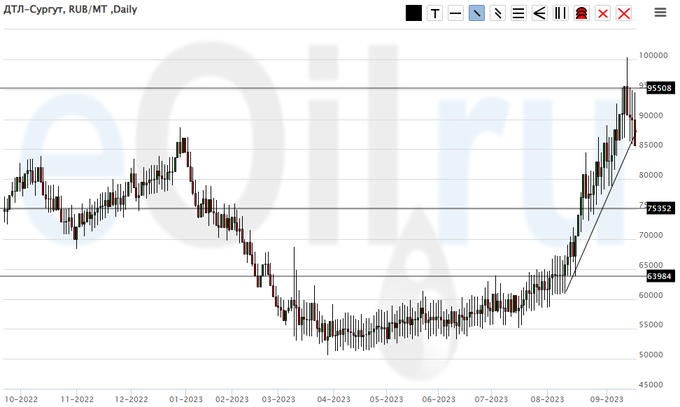

Diesel arctic fuel, ETP eOil.ru

Growth scenario: the export ban will most likely reduce prices to 70,000. There you can think about shopping.

Fall scenario: keep short. The position is quite comfortable.

Recommendations for the diesel market:

Purchase: think when approaching 70,000.

Sale: no. Who is in position from 94000 and 88000, keep stop at 96000. Target: 71000 (revised).

Support – 75352. Resistance – 95508.

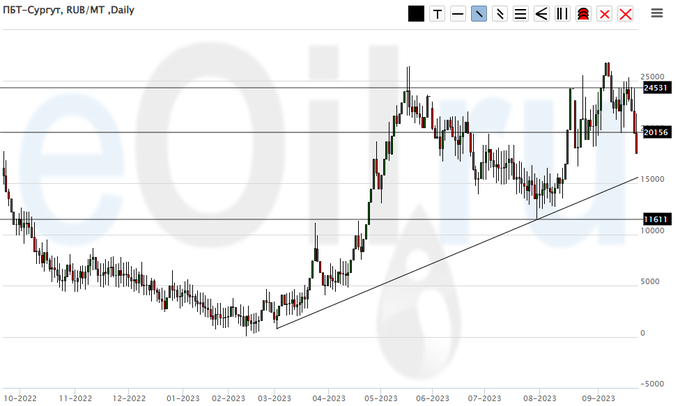

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we continue to remain outside the market. The fall is aggressive.

Fall scenario: correction intensifies. We keep short. Against the backdrop of a ban on the export of petroleum products, PBT will also fall.

Recommendations for the PBT market:

Purchase: no.

Sale: no. Who is in a position from 24000, move the stop to 22000. Target: 8000 (revised).

Support – 11611. Resistance – 20156.

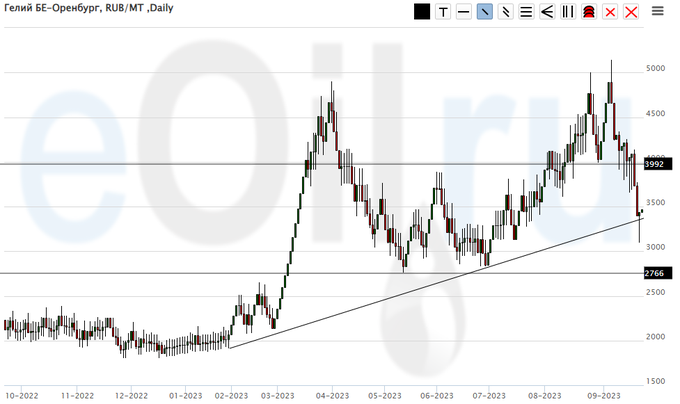

Helium (Orenburg), ETP eOil.ru

Growth scenario: back to 3000. This is interesting. But for now, let’s take a break for a week.

Fall scenario: they didn’t sell last week. But on this one there is nowhere. It happens. Off the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 2766. Resistance – 3992.

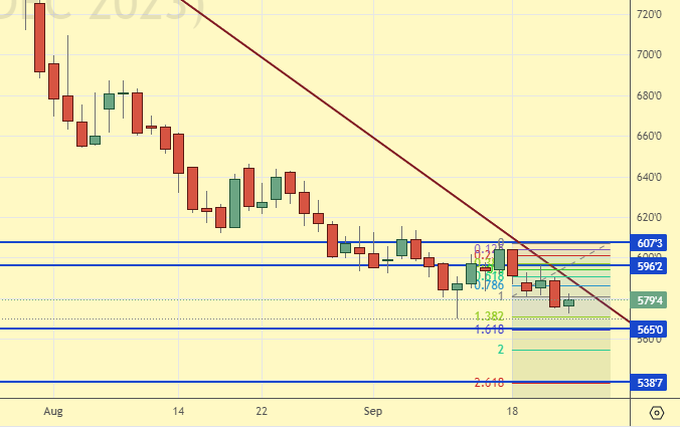

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 14.7 thousand contracts. The sellers are going wild. There are still few buyers; we note that in the medium term prices are starting to become attractive.

Growth scenario: we are considering December futures, expiration date is December 14. We will keep the long from 570.0, but it may be destroyed. The chances of growth from current levels are low. From 540.0 a must buy.

Fall scenario: shorts from current levels can only be worked out on the clock with a target of 540.0. On daily intervals outside the market.

Recommendations for the wheat market:

Purchase: when approaching 540.0. Stop: 530.0. Target: 650.0 (710.0). For those in position from 570.0, keep your stop at 568.0. Goal: 710.0.

Sale: no.

Support – 565.0. Resistance – 596.2.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers increased by 11.3 thousand contracts. There are buyers, but there are still more sellers. The bears have tightened their control over the market.

Growth scenario: we are considering December futures, expiration date is December 14. We expect the market to be 10% lower than current levels. We are not buying yet.

Fall scenario: shorting is possible with a close stop order.

Recommendations for the corn market:

Purchase: when approaching 425.0. Stop: 405.0. Goal: 600.0.

Sale: now. Stop: 486.0. Target: 426.0. Anyone in position from 475.0, keep a stop at 486.0. Target: 426.0.

Support – 467.6. Resistance – 482.6.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date is November 14. We’re falling well. We wait. We don’t buy.

Fall scenario: keep short. If the minimum at 1281 is broken, then 1000.0 will again appear on the horizon.

Recommendations for the soybean market:

Purchase: no.

Sale: no. If you are in a position from 1370, move your stop to 1372.0. Goal: 1000.0!

Support – 1281.6. Resistance – 1383.7.

Growth scenario: we will buy only after growth above 1955. Out of the market for now.

Fall scenario: we will go short again, and add on approaching 1940 and 1950!

Recommendations for the gold market:

Purchase: no.

Sale: now, approaching 1940 and 1950. Stop: 1957. Target: 1600?!

Support – 1911. Resistance – 1947.

EUR/USD

Growth scenario: nothing happened in a week. We continue to believe that a move below 1.0600 could open the way to 1.0100. We don’t buy. The Fed left the rate, but the commentary was harsh, clearly in favor of the dollar.

Fall scenario: if we go below 1.0600 we will sell. Euro bulls are unlikely to be able to hold the market.

Recommendations for the euro/dollar pair:

Purchase: no.

Sale: when it falls below 1.0600. Stop: 1.0730. Target: 1.0100.

Support – 1.0612. Resistance – 1.0735.

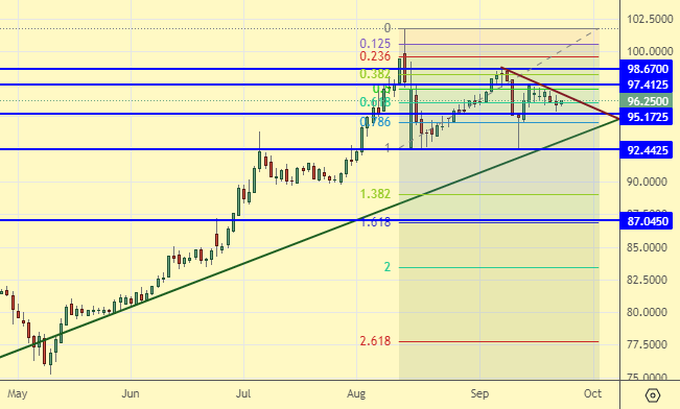

USD/RUB

Growth scenario: do not buy. But if it rises above 99.30, we will be forced to go long.

Fall scenario: levels remain attractive for sales. But that’s all. We don’t see a real fall in the dollar. Everything is very subtle.

Recommendations for the dollar/ruble pair:

Purchase: in case of growth above 99.30. Stop: 97.00. Target: 114.50!

Sale: no. For those in positions between 97.50 and 96.80, keep your stop at 99.30. Target: 87.00.

Support – 95.17. Resistance – 97.41.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. The purchase from 104,000 did not survive. R.I.P. We will refrain from opening new longs. You may have to abstain for a long time.

Fall scenario: Continue to hold shorts from 105800 and 105000. Continue to note that a move below 99000 could cause a nervous breakdown for bulls with a fast move at 90000.

Recommendations for the RTS Index:

Purchase: no.

Sale: no. For those in positions between 105800 and 105000, move your stop to 106200. Target: 90000 (50000, 20000).

Support – 99390. Resistance – 105030.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.