13 February 2023, 11:33

Price forecast from 13 to 17 of February 2023

-

Energy market:

Kurdistan strongly denied allegations of selling oil to Israel. Note that if he had done this not only decisively, but also loudly, it would still hardly have cost more than one line in the Bloomberg terminal. And if the Kurds wanted two lines in Bloomberg, they would have to pay extra.

Let in your life every year there will be at least one event worthy of the news window of the trading terminal. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Russia will reduce production by 500 thousand barrels per day from March. Most likely, the produced oil simply has nowhere to go because of the embargo, so production will have to be reduced.

The disappearance of half a percent of world consumption from the market is significant. Over the week, oil rose by $7 per barrel. If Saudi Arabia takes a break and does not rush to increase production, then we will quickly go to the level of $100 per barrel. If there is no increase in supplies from OPEC countries at all, for example, for reasons of principle, then we can see oil at $120 per barrel.

If energy prices start to rise again, then along with rising food prices, they will not allow inflation to slow down this year, which may lead to a continuation of the policy of raising rates in the EU and the US, and this will slow down the growth of the global economy by the end of 2023 year.

About America. There are indirect data indicating that it was the United States that blew up the second branch of the Nord Stream. China has already asked Washington to explain its behavior, but, as expected, the Americans only express satisfaction that Nord Stream will not work, but they are in no hurry to take responsibility.

At the moment, significant harm is being done to the economies of Russia and Germany. Joyful cries on this occasion are heard not only in France, but even in Spain. In Europe, many wish Berlin to dry up quickly, as the Germans are too hard-working, and this annoys the relaxed southerners. Apparently, this year there will not be enough oil and gas in the EU for everyone. Use solar panels.

Grain market:

At the end of the week, grain prices began to rise. Virtually every country in the world will increase defense spending this year and next. Food is a strategic resource that will be stockpiled on a larger scale than usual. Europe has already done this at the expense of Ukrainian grain, and it is unlikely that it will remain with the same storage facilities that it had in 2021. Storage volumes will grow, it is inevitable. The same applies to other countries, first of all we think about India and China.

Demand for food will remain strong this year. Against our expectations, as long as grain prices do not fall and stay at the level of 325 dollars per ton, as the latest Egyptian tender tells us eloquently. In the current situation, we can say that prices are unlikely to go below three hundred dollars per ton.

Inside Russia, there is a situation where supply far exceeds demand. Approximately 20 million tons of grain may not find an owner by the beginning of the new harvest. At the same time, the state refuses to purchase, as the State Reserve is full. A gigantic surplus will put pressure on prices both domestically and in Kazakhstan.

USD/RUB:

The Bank of Russia left the rate at 7.5%. This decision was expected and did not cause any significant shifts in the coordinates in the minds of analysts.

The bank noted that pro-inflationary risks persist and did not rule out an increase in the rate in the future in the event of a deterioration in the situation with inflation, which, by the way, is slowing down and from January 22 to January 23 amounted to 11.8%.

Against the backdrop of a growing deficit, the ruble continues to weaken. It is possible that after reaching the level of 74.00, the pair will roll back down, as companies that make a voluntary contribution to the budget will have to take rubles from somewhere, for this very contribution. Some of them will sell dollars.

It is worth suggesting that the one-time fundraising procedure in February may become reusable, which will make the situation inside Russian business sad. Fundraising can become monthly, and then take the form of a law.

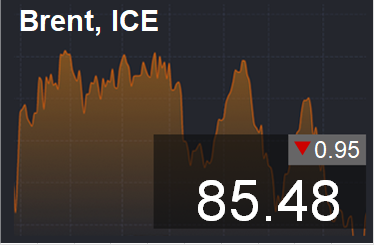

Brent. ICE

Growth scenario: consider the January futures, the expiration date is February 28. Against the backdrop of Russia’s statement about the reduction in production, we can climb up. After rising above 87.50, we will buy.

Fall scenario: on Friday, the market froze at strong resistance around 87.00. If the sellers hold this area, then the prospects for a fall to 70.00 will remain.

Recommendations for the Brent oil market:

Purchase: after rising above 87.50. Stop: 83.50. Target: 110.00.

Sale: no. Who is in position from 87.30, keep the stop at 87.50. Target: 70.00 (55.00; 45.00?!!!) dollars per barrel.

Support — 83.08. Resistance — 86.84.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 10 units and now stands at 609 units.

Commercial oil reserves in the US increased by 2.423 to 455.111 million barrels, with the forecast of +2.457 million barrels. Inventories of gasoline rose by 5.008 to 239.606 million barrels. Distillate inventories rose by 2.932 to 120.522 million barrels. Inventories at Cushing rose by 1.043 to 39.052 million barrels.

Oil production increased by 0.1 to 12.3 million barrels per day. Oil imports fell by -0.225 to 7.058 million bpd. Oil exports fell by -0.592 to 2.9 million barrels per day. Thus, net oil imports increased by 0.367 to 4.158 million barrels per day. Oil refining increased by 2.2 to 87.9 percent.

Gasoline demand fell by -0.063 to 8.428 million bpd. Gasoline production fell by -0.35 to 9.093 million barrels per day. Gasoline imports rose by 0.488 to 0.989 million barrels per day. Gasoline exports rose by 0.017 to 0.943 million barrels per day.

Demand for distillates rose by 0.07 to 3.762 million barrels. Distillate production fell -0.028 to 4.664 million barrels. Distillate imports rose by 0.379 to 0.692 million barrels. Distillate exports rose by 0.195 to 1.176 million barrels per day.

Demand for oil products increased by 0.43 to 20.536 million barrels. Oil products production fell by -0.048 to 21.234 million barrels. Imports of petroleum products increased by 0.96 to 2.982 million barrels. The export of oil products increased by 0.484 to 6.262 million barrels per day.

Demand for propane rose by 0.371 to 1.853 million barrels. Propane production increased by 0.042 to 2.394 million barrels. Propane imports rose by 0.017 to 0.188 million barrels. Propane exports fell by -0.045 to 1.344 million barrels per day.

Growth scenario: we consider the March futures, the expiration date is February 21. The chances of growth have increased, but so far we will not buy below the level of 83.00.

Fall scenario: we will continue to hold the shorts. While we are inside the falling channel, the psychological advantage is on the side of the sellers.

Recommendations for WTI oil:

Purchase: after rising above 83.00. Stop: 80.40. Target: 110.00.

Sale: no. Those in positions between 82.00 and 80.50, move the stop to 80.80. Target: 66.00 (40.00) dollars per barrel.

Support — 76.45. Resistance — 82.76.

Gas-Oil. ICE

Growth scenario: we consider the March futures, the expiration date is March 10. We will continue to refrain from shopping. While we are below 950.0 we will not buy.

Fall scenario: we will keep the shorts. So far, the turning point in the market is not obvious.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 900.0, keep the stop at 910.0. Target: 700.0.

Support — 761.75. Resistance — 861.25.

Natural Gas. CME Group

Growth scenario: we consider the March futures, the expiration date is February 24th. The situation is not easy. It is possible that there will be a strong gas surplus in the US. Refrain from transactions.

Fall scenario: a move to the level of 1.000 cannot be ruled out. However, the levels are extremely low for sales. Out of the market.

Recommendations for natural gas:

Purchase: no.

Sale: no.

Support — 2.312. Resistance is 2.974.

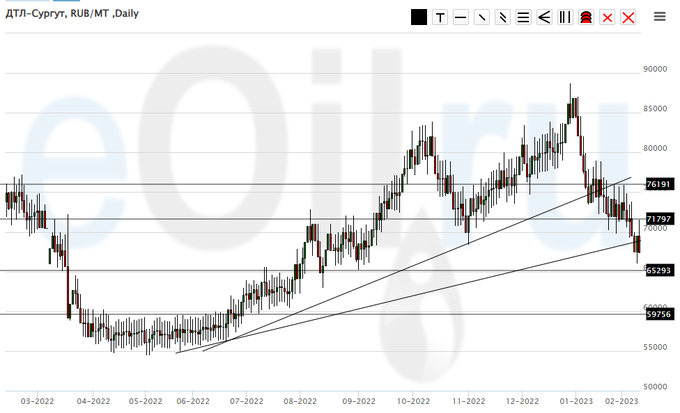

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: in general, the market came to the target area of 65000, which we predicted based on the embargo from the EU. For the time being, we will refrain from buying, but we urge you to monitor possible changes in legislation regarding taxes, as some fees may be initiated by the government through fuel. Additional taxes will stop the fall.

Fall scenario: The 60000 level continues to be a good ambitious downside target. When approaching 65,000, you can also take profits. We do not open new positions for sale.

Diesel market recommendations:

Purchase: think when approaching 60,000.

Sale: no. Whoever is in a position between 84,000 and 74,000, keep a stop at 77,000. Target: 60,000 (55,000) rubles per ton. At current levels, you can close 20% of the position.

Support — 65293. Resistance — 71797.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: continue to recommend buys. The minimum price was at the level of 50 (fifty) rubles per ton. This situation must be taken advantage of.

Fall scenario: we will continue to refuse sales. Prices are extremely low.

Recommendations for the PBT market:

Purchase: now. Stop: 0 (zero). Target: 4000 (6500) rubles per ton.

Sale: no.

Support — 0 (zero). Resistance — 3945.

Helium (Orenburg), ETP eOil.ru

Growth scenario: after breaking through the resistance line, we test it from the reverse side. If the market holds above 2000, then the chances of a move to 3000 will increase significantly.

Fall scenario: As we approach 2750, it will be possible to think about selling. While out of the market.

Recommendations for the helium market:

Purchase: now. Stop: 1700. Target: 2750 (3000). Those who are in positions from 1800, 1900 and 2000, move the stop to 1700. Target: 2750 (3000) rubles per cubic meter.

Sale: no.

Support — 1809. Resistance — 2887.

Wheat No. 2 Soft Red. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. The bulls were able to gain a foothold above the level of 750.0 against the background of the aggravation of the situation in Ukraine. It is possible that we are waiting for a trip to 840.0.

Fall scenario: let’s remember about sales only when we approach the level of 840.0, not earlier.

Recommendations for the wheat market:

Purchase: when approaching 760.0. Stop: 734.0. Target: 840.0. Who is in position from 780.0, move the stop to 734.0. Target: 840.0.

Sale: when approaching 840.0. Stop: 860.0 Target: 650.0 cents per bushel.

Support — 741.2. Resistance — 798.4.

Growth scenario: we consider the March futures, the expiration date is March 14. We will keep purchases from 679.0. Friday’s long green candle inspires optimism in the bulls.

Fall scenario: we will not open new positions for sale. We keep the old ones. As long as we have not risen above 690.0, the chances of falling to the level of 550.0 cents per bushel remain.

Recommendations for the corn market:

Purchase: no. Who is in position from 679.0, keep the stop at 667.0. Target: 800.0.

Sale: no. Who is in position from 688.0, keep the stop at 698.0. Target: 590.0 (550.0) cents per bushel.

Support — 669.0. Resistance is 689.0.

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. Forced to react to Friday’s long green candle. Let’s go long.

Fall scenario: don’t get nervous. Keep shorts. We do not open new positions.

Recommendations for the soybean market:

Purchase: now. Stop: 1510.0. Target: 1700.0.

Sale: no. Who is in position from 1540.0, keep the stop at 1557.0. Target: 1000.0.

Support — 1477.2. Resistance — 1548.2 (1572.0).

Growth scenario: we continue to consider a rollback to 1790 as the most likely scenario. We do not buy at current levels.

Fall scenario: continue to hold shorts from 1920 with a target at 1790. Dollar positions will be strong. There are suspicions that inflation in the West will not stop and the Fed will continue to raise rates.

Recommendations for the gold market:

Purchase: no.

Sale: no. If you are in position from 1920, move your stop to 1912. Target: $1,790 a troy ounce.

Support — 1833. Resistance — 1891.

EUR/USD

Growth scenario: The pair is falling as there is no guarantee yet that the FS will stop raising the rate. Let’s return to thinking about purchases after the market falls to 1.0480.

Fall scenario: you can sell here. The prospects are not clear yet, but we can count on a move to 1.0480.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: now. Stop: 1.0830. Target: 1.0480 (1.0000).

Support — 1.0480. Resistance is 1.0790.

USD/RUB

Growth scenario: the ruble frankly upsets its fans. We do not see any strengthening even despite the Ministry of Finance selling foreign currency in the amount of 126.6 million dollars a day. Note that if the pair rises above 74.00, then we will quickly move to 79.00.

Fall scenario: it is possible that the market will not be able to immediately take the level of 74.00. However, so far we do not see a single red candle. We do not sell.

Recommendations for the dollar/ruble pair:

Purchase: now. Stop: 69.80. Target: 88.00. Who is in position from 71.50, keep the stop at 69.80. Target: 88.00.

Sale: no.

Support — 72.94. Resistance is 79.58.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. The situation cannot be called frankly bad. Small chances for growth remain. Until we fall below 96500 there will be glimmers of hope before our eyes. However, given the beginning of the practice of extortions to the budget, one simply does not want to look for some papers on the Russian market. By the way, as a result of additional taxation, there will be less money to buy shares from those who still have them.

Fall scenario: in this situation, sellers do not need to invent anything, they need to push further. If we manage to push the market below 96500, then we will quickly go to 90000. Since we sold earlier and added to the shorts once, we will not increase the position further for now.

Recommendations for the RTS index:

Purchase: now. Stop: 97000. Target: 112000. Anyone in position from 100000, keep stop at 97000. Target: 112000.

Sale: no. Who is in position from 106000, 103000, 101000 and 98000, move the stop to 102000. Target: 80000 (50000, then 20000) points.

Support — 96500. Resistance — 101780.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.