12 December 2022, 16:08

Price forecast from 12 to 16 of December 2022

-

Energy market:

They are there looking for fuel oil for heating, diesel for cars, gas carriers for gas, grain for bread, fertilizer for farmers and firewood for the fire, on which some Ursula will soon be burned, and we have the second decade of December, and we are not looking for anything, we have everything.

Hello everybody!

Russia reacted rather sluggishly to the imposition of an embargo by the EU. Despite the fact that the statements were made at the highest level, they do not contain any specifics. I would like to hear the names of those countries to which we will no longer supply our oil either directly or through intermediaries.

Our brothers and sisters across the Amur River, as well as the population that divides itself into castes and lives along the Ganges River, take advantage of the opportunity and demand not at all childish discounts on Russian oil. 25% is such a new normal in trading. Even Pakistan chimed in. Previously, he was ready to take oil only at a discount of 40% of the market price. Last week, some kind of agreement was concluded, some kind of discount was given. Let’s hope that, along with the discount, the Islamabad comrades were not given a non-repayable loan in dollars for the purchase of this very Russian oil.

It should be noted that at the moment the market price of Brent oil is at the level of $76 per barrel, while Urals oil is sold below $46 per barrel.

In European capitals, temperatures began to drop below zero at night, which led to an increase in the rate of gas withdrawal from storage facilities. So far, the situation does not cause concern, but in some countries people go to rallies and demand that everything be returned to the way it was. But the palaces are unlikely to hear the huts. Because it won’t be before. The utilities will be very expensive.

Comrade Xi suggested that the Arab countries sell oil for yuan and do it through the Shanghai Stock Exchange. It is possible that the process will be launched in the near future, since such things at the highest level would hardly be voiced by China spontaneously.

Reading our forecasts, you could make money on the Gasoil market by taking a move down from the level of 917.0 to the level of 800.0 dollars per ton.

Grain market:

China reduced grain imports by 11.8% from January to November compared to last year. The contraction was caused by weakening domestic demand. China imported 133.2 million tons of grain in 11 months. Thus, prices have now lost support from the second world economy.

The regular data on the gross harvest of grains and oilseeds from the USDA has been released. Changes in estimates compared to November are insignificant, so wheat is planned to be taken in the 22/23 season 780.5 million tons, corn — 1168.8 million tons, soybeans — 391.2 million tons. The indicators are good. Those who have some money are not in danger of starvation. Will be given to the poor. Mr. Patrushev promised to deliver 500,000 tons of Russian grain free of charge to poor countries.

The grain deal between Russia and Ukraine continues to work. Belarus offered its services for the transit of Ukrainian grain to Lithuanian ports, but the Baltic republic itself was wary of this proposal.

This example vividly illustrates the current situation: there is supply on the market, but logistical problems and international contradictions are so great that they prevent the normal distribution of goods, which will inevitably create distortions in local pricing.

In the near future, in the absence of an aggravation of the confrontation between Russia and the West, we expect a moderate drop of about 5% from the wheat and corn markets.

USD/RUB:

Next week, meetings will be held on the interest rate of both the US Federal Reserve and the Bank of Russia.

Most likely, the Fed will raise the rate by 0.5% to 4.5% on Wednesday, but at the same time say that the increase will be more modest in the future. The labor market in the US remains strong, the rate increase has not yet greatly affected the business environment, however, in January, the statistics for the 4th quarter may turn out to be worse than expected and the US regulator will have less room to maneuver.

The ruble against the dollar in the face of uncertainty will remain under pressure. The prospect of a move to level 65 for the pair is visible. A stronger recovery will take place only if it becomes clear that the embargo imposed by the West really works and causes significant damage to the Russian economy.

We expect the Bank of Russia to leave the rate at 7.5% on Friday.

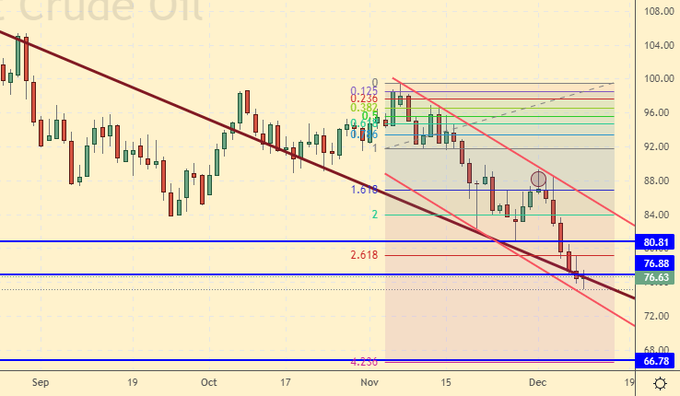

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers has decreased by 2.5 thousand contracts. The spread between long and short positions narrowed slightly, the bulls continue to control the market.

Growth scenario: consider the December futures, the expiration date is December 30th. As a week earlier, we continue to refuse purchases. We are waiting for the market to fall to the level of 67.00.

Fall scenario: we continue to hold shorts. We went below 80.00, which should attract new sellers to the market.

Recommendations for the Brent oil market:

Purchase: on touch 67.00. Stop: 63.20. Target: 90.00.

Sale: when approaching 85.00. Stop: 88.00. Target: 67.00. Those in positions between 90.00 and 85.00 move the stop to 77.30. Target: $67.00 per barrel. You can close another 25% of the position.

Support — 66.78. Resistance is 80.81.

WTI. CME Group

Fundamental US data: the number of active drilling rigs decreased by 2 units and now stands at 625 units.

US commercial oil inventories fell by -5.186 to 413.898 million barrels, while the forecast was -3.305 million barrels. Inventories of gasoline rose by 5.319 to 219.087 million barrels. Distillate inventories rose by 6.159 to 118.807 million barrels. Inventories at Cushing fell -0.373 to 23.942 million barrels.

Oil production increased by 0.1 to 12.2 million barrels per day. Oil imports fell by -0.025 to 6.012 million barrels per day. Oil exports fell by -1.518 to 3.43 million barrels per day. Thus, net oil imports rose by 1.493 to 2.582 million barrels per day. Oil refining increased by 0.3 to 95.5 percent.

Gasoline demand rose by 0.041 to 8.358 million barrels per day. Gasoline production fell by -0.295 to 9.065 million barrels per day. Gasoline imports fell by -0.016 to 0.519 million barrels per day. Gasoline exports fell by -0.126 to 1.012 million barrels per day.

Demand for distillates fell by -0.106 to 3.55 million barrels. Distillate production increased by 0.021 to 5.332 million barrels. Distillate imports rose by 0.22 to 0.372 million barrels. Distillate exports fell -0.026 to 1.274 million barrels per day.

Demand for petroleum products fell by -0.091 to 19.626 million barrels. Production of petroleum products fell by -0.465 to 21.787 million barrels. Imports of petroleum products rose by 0.409 to 2.319 million barrels. Exports of petroleum products fell by -0.533 to 6.295 million barrels per day.

Propane demand rose by 0.383 to 1.293 million barrels. Propane production increased by 0.003 to 2.556 million barrels. Propane imports fell -0.029 to 0.144 million barrels. Propane exports fell by -0.042 to 1.544 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 4.3 thousand contracts. Both buyers and sellers entered the market, but the bulls did it more actively. The spread between long and short positions has increased, the bulls continue to control the situation.

Growth scenario: consider the January futures, the expiration date is December 20. We will continue to stop shopping. It will be possible to enter long only after approaching the level of 66.00.

Fall scenario: Sellers hold control. Keep open shorts. The target may be extremely low, for example at the level of 40.00

Recommendations for WTI oil:

Purchase: when approaching 66.00. Stop: 64.00. Target: 80.00.

Sale: no. Who is in position from 86.80, move the stop to 83.80. Target: 67.00 (40.00) dollars per barrel.

Support — 66.21. Resistance — 83.38.

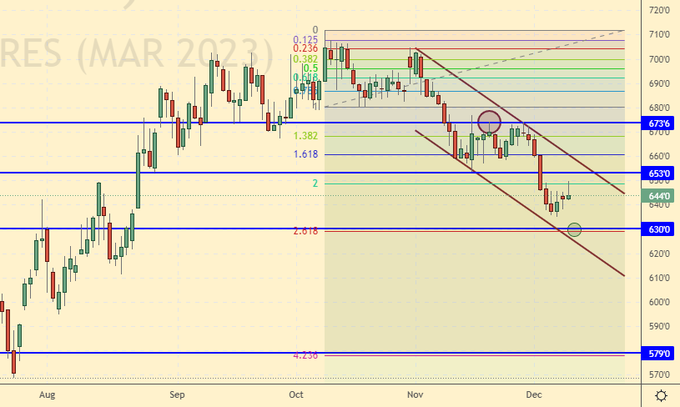

Gas-Oil. ICE

Growth scenario: consider the January futures, the expiration date is January 12. You can buy from current levels with little risk.

Fall scenario: we will sell again when prices return to the level of 925.0. All with a profit.

Gasoil recommendations:

Purchase: now. Stop: 790.0. Target: 940.0.

Sale: on the rise to 925.0. Stop: 936.0. Target: 750.0.

Support — 744.25. Resistance is 866.75.

Natural Gas. CME Group

Growth scenario: consider the January futures, the expiration date is December 28. Despite the fact that the weather is relatively warm in the US and the demand for gas has fallen, we will continue to buy.

Fall scenario: we will not sell. The market is oversold. At least we need to see what we will draw next week.

Recommendations for natural gas:

Purchase: now. Stop: 5.300. Target: 15.000 per 1 million BTUs.

Sale: no.

Support — 5.322. Resistance — 8.197.

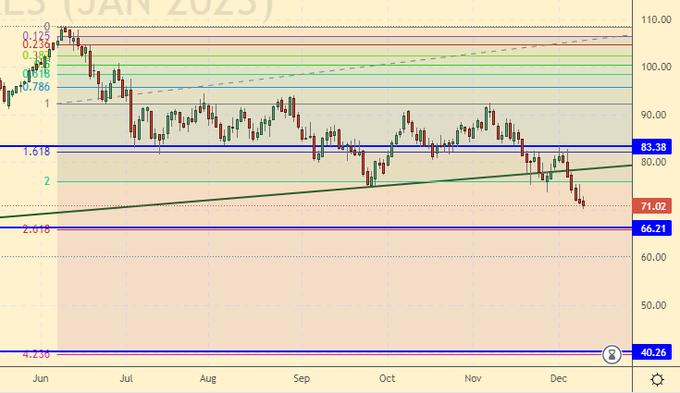

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has increased by 10 thousand contracts. Sellers entered the market, while there were also a few buyers. The spread between short and long positions has widened, sellers retain the advantage.

Growth scenario: we consider the March futures, the expiration date is March 14. Buying from the level of 650.0 cents per bushel remains our main idea. We do not buy from current levels.

Fall scenario: we continue to hold shorts from the level of 840.0. The target remains the same: 650.0 cents per bushel.

Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 620.0. Target: 800.0.

Sale: no. Who is in position from 840.0, move the stop to 762.0. Target: 650.0 cents per bushel. You can close 25% of the position.

Support — 722.6. Resistance — 755.2.

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 74.8 thousand contracts. The change is gigantic. Bulls are fleeing the market, sellers are actively increasing their positions. The spread between long and short positions has narrowed, the advantage of the bulls has decreased significantly.

Growth scenario: we consider the March futures, the expiration date is March 14. Modest purchases from 630.0 are possible, however, it should be understood that a deeper recoilless dip to 580.0 is also possible.

Fall scenario: continue to hold shorts. If we break below 630.0 it will be a pleasant surprise. There are still many bulls in the market, and sooner or later they will all run.

Recommendations for the corn market:

Purchase: when approaching 630.0. Stop: 619.0 Target: Target: 670.0.

Sale: no. Who is in position from 670.0, move the stop to 663.0. Target: 580.0 cents per bushel. At the level of 630.0, 25% of the position can be closed.

Support — 630.0. Resistance — 653.0.

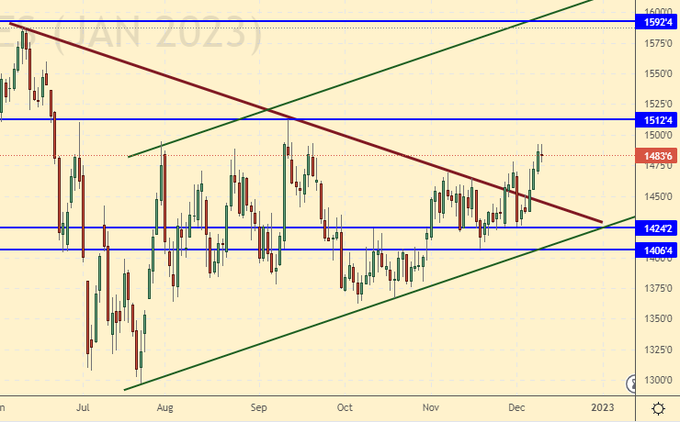

Soybeans No. 1. CME Group

Growth scenario: consider the January futures, the expiration date is January 13th. We will continue to hold longs from 1425.0. We are not opening new positions. Note that fundamentally we should not grow at all.

Fall scenario: let’s leave attempts to enter short. Bulls can seize the initiative.

Recommendations for the soybean market:

Purchase: no. Who is in position from 1425.0, move the stop to 1428.0. Target: 1600.0.

Sale: no.

Support — 1424.2. Resistance — 1512.4.

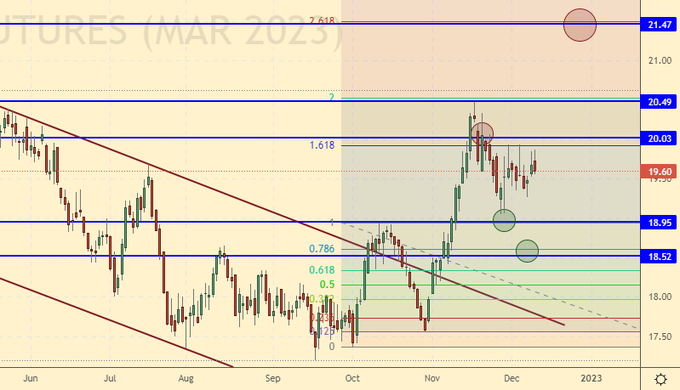

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. The market is in equilibrium. We will keep open earlier longs. We are not opening new positions.

Fall scenario: do not sell. Keep open shorts. Even if there is an increase by 21.50, before it we are able to go to 18.50 and even to 18.00.

Recommendations for the sugar market:

Purchase: when approaching 18.50 and 18.00. Stop: 17.70. Target: 21.45. Who is in position from 19.05, keep the stop at 18.95. Target: 21.45.

Sale: no. Who is in position from 20.00 and 19.50, keep the stop at 20.10. Target: 18.00 cents per pound.

Support — 18.95. Resistance — 20.03.

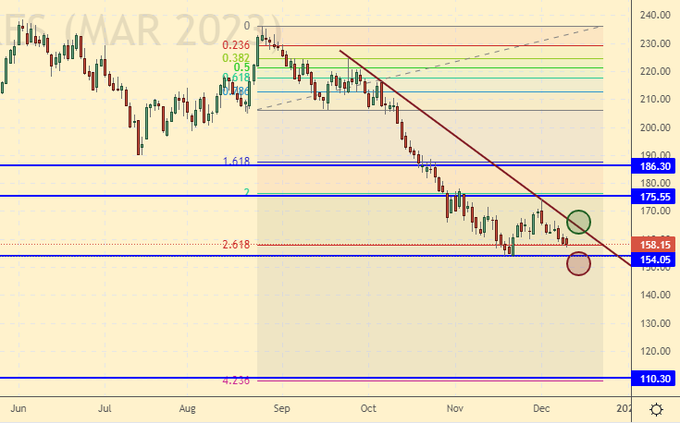

Сoffee С, ICE

Growth scenario: we consider the March futures, the expiration date is March 21. We wait. If we rise above 165.00, then it will be possible to buy. While out of the market.

Fall scenario: we remain out of the market. In case of a pass below 150.00, you will have to sell, since you cannot miss the move at 110.00.

Recommendations for the coffee market:

Purchase: in case of growth above 165.00. Stop: 158.00. Target: 210.00 cents per pound.

Sale: in case of falling below 150.00. Stop: 164.00. Target: 110.00.

Support — 154.05. Resistance is 175.55.

Gold. CME Group

Growth scenario: Growth continues. We hold longs. The market could potentially rise well above 1890.

Fall scenario: Sellers can’t show us anything of interest. Out of the market. On Wednesday, after the Fed meeting, there may be strong movements.

Recommendations for the gold market:

Purchase: no. Those in positions between 1675 and 1780 move the stop to 1759. Target: $2,350 a troy ounce.

Sale: not yet.

Support — 1766. Resistance — 1889.

EUR/USD

Growth scenario: possible hit to 1.0800 on Thursday, against the backdrop of the ECB meeting. Above this level, the market is not visible.

Fall scenario: we will sell when we approach 1.0800. Short from 1.0680 is possible, but looks weak.

Recommendations for the EUR/USD pair:

Purchase: when approaching 1.0400. Stop: 1.0370. Target: 1.0800.

Sale: when approaching 1.0800. Stop: 1.0870. Target: 0.8700?!!!

Support — 1.0397. Resistance is 1.0679.

USD/RUB

Growth scenario: bulls gradually seize the initiative. Until Wednesday evening, changes are unlikely to be significant, and after the Fed meeting, strong movements are possible. The prospects for the ruble against the backdrop of Western sanctions are poor. We are waiting for the growth of the pair until 65.00.

Fall scenario: most likely Nabiullina will leave the rate at 7.5%, with official inflation of 13%. This decision will leave no chance for the ruble to grow.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 61.40. Stop: 60.40. Target: 74.00. Those in positions between 60.00 and 61.60 keep the stop at 60.40. Target: 74.00 rubles per dollar.

Sale: no.

Support — 61.38. Resistance — 63.38.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. Western sanctions continue to have a negative impact on the domestic economy. Lukoil’s refineries in Sicily may be nationalized, and the assets of GAZPROM and ROSNEFT in Germany are also being nationalized. This is a banal expropriation of assets. There can be no rainbow background. We have nothing to grow fundamentally on, but there are always fanatics who will buy at any price, and this has to be taken into account. If there is an increase above 110,000, then we will have to think about buying. When approaching 101000, you can buy with little risk.

Fall scenario: we can easily reach the level of 101000, a stronger fall is still questionable. It is worth recognizing that a fall was expected due to the embargo on Russian oil supplies to the EU. The current reaction of the stock market to the long-term negative factor is close to neutral, which is strange.

Recommendations for the RTS index:

Purchase: think when approaching 101000.

Sale: now and when approaching 108000. Stop: 109300. Target: 80000 (50000) points.

Support — 100840. Resistance — 107370 (109760).

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.