03 August, 12:38Отчеты

|

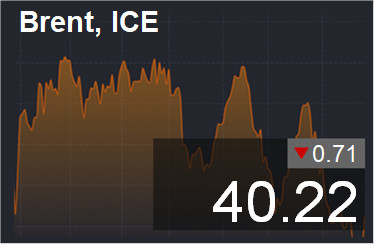

Energy market: Royal Dutch Shell losses in the second quarter reached $ 18 billion. Other companies in the energy sector have similar difficulties. If oil prices continue to be at current levels and, moreover, they prefer to fall against the background of a 32.9% drop in the US economy in the second quarter, then the underfunding of new projects will become chronic, which will lead to a drop in production in the regions where the cost is at the high level. Note that the problems of major European and American players play into the hands of OPEC. The regulated hysteria over the second wave of coronavirus begins to intensify, which could lead to pressure on prices. Even if we see a largely provocative upside breakout in Brent towards 46.00, the pullback from there could be quite strong. Until there is confidence in the growth of demand for energy on the horizon, the oil market will be extremely difficult in the region of $ 50.00 per barrel. Reading our predictions, you could earn: buying a Gasoil contract, taking a move from 305.0 to 369.0, as well as buying a euro against a dollar, taking a move from 1.0800 to 1.1775, and in addition buying a dollar against a ruble, taking a move from 68.00 to 74.50.

|

27 July, 13:57Отчеты

|

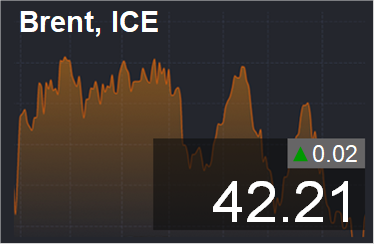

Energy market: The market is in a difficult spot. Any fundamental factor that plays into the bear’s hands will lead to a strong fall of $ 5-7 in a short period. Now we see that production in the United States increased by 0.1 million barrels to 11.1 million barrels per day. The fall in the number of drilling rigs was replaced by a symbolic increase: plus one rig per week to 181 units. It remains to appear on the stage for a representative from among the OPEC + countries, who will express doubts about the advisability of a control production deal. This will be enough for a quick down to 35.00 Brent.

|

20 July, 13:14Отчеты

|

Energy market: The OPEC + agreement about increasing production did not have a significant impact on prices, since the real supply in August will grow by only 1 million barrels per day. The cartel indicated in the report that it expects a growth of demand in 2021 from 90 to 96 million barrels per day, which supports the market. Note that, such scenario will possible if the pandemic problems are eliminated. The current downturn in US drilling activity and the lack of capital investment in the energy sector this year and next will certainly lead to a decline in production. If OPEC will not very zealous with increasing its own market share, but rather monitors the price, then we may expect prices to return to the level of $ 70.00 per barrel and above in the future.

|

13 July, 13:17Отчеты

|

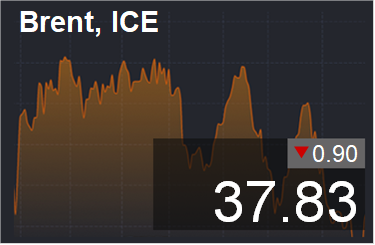

Energy market: The pandemic continues to spread havoc in the United States. The US tries to ignore the coronavirus at the federal level and let local authorities to go their own way. Not the dollar, nor the debt, nor the stock market can withstand a second stop in the economy. Economic problems will increase in both the member countries and non-member countries of the OPEC organization, which will sooner or later lead to a breakdown of agreements by a number of participants. Representatives of the OPEC group say that they are being pushed to increase the production of “black gold” already in August. This is taking place against the backdrop of growing demand after the removal of a number of restrictions previously introduced against the backdrop of a pandemic. The main initiator of the increase in oil production is Saudi Arabia. If these rumors are confirmed next week, Brent crude will roll back to 30.00.

|

06 July, 13:28Отчеты

|

Energy market: A story with an increase in the number of diseased people up to 50 thousand cases per day can end in repeated paralysis of the economy for at least a month. Nevertheless, the second cycle of restrictions should be easier, as there is experience, and there are already drugs, albeit experimental ones. The inability of the US to curb the epidemic and its own citizens is bad news for the oil market. Last month, OPEC reduced production to 22.69 million barrels per day. This is the lowest figure since May 1991. Who knows, maybe this will not be enough in the coming weeks. If the OPEC + countries want to maintain their market share, they will have to be content with a low price: $ 30 per barrel. If the price is higher, production will be supported both in the United States and in other countries outside the OPEC + deal.

|

29 June, 13:59Отчеты

|

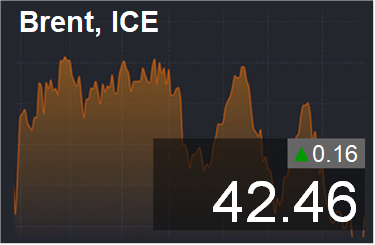

Energy market: Numbers confirmed fears for the second wave of coronavirus. The new outbreak of the disease occurred in the USA and Israel after the weakening of the quarantine measures. It is not necessary to rely on the full recovery of consumer demand in the current circumstances. Those whose incomes remained at the same level have already changed their consumption model to a more cautious one. OPEC + countries will have to meet almost every month in order to regulate production. It’s unclear what will happen with the limited production in August. Really nervous. Last week, the market could not settle above the level of 44.00, which creates good conditions for increasing bearish pressure, as the resistance level of 43.75 was tested twice and both times the attack ended not in favor of the buyers.

|

22 June, 14:47Отчеты

|

Energy market: The decline of oil production accelerated -0.6 mn barrels over the week to 10.5 mn barrels in the US, which supports the oil market at the current stage. But it is unlikely that OPEC+ participants of the deal (the collusion) want to see oil above $40.00, as in this case US shale production will quickly recover. There will be another week of growth in the oil market, after which the prices will go down. Technically, everything is ready for another round of price decline. Definition: a recession is a decline in the economy for two consecutive quarters. There is no doubt that the US and EU economies are already in recession. In the third quarter, we can count on a slight recovery, but it is already clear that, at best, the global economy will show zero growth for the year. The fall of the European economy is projected at 12% per annum, in the United States everything could be even worse. In addition, these scenarios don’t take into account the second wave of coronavirus and a new quarantine. We cannot talk about high prices for goods except gold in the current circumstances.

|

15 June, 13:10Отчеты

|

Energy market: Cautious position of OPEC+ countries about a further reduction of oil production caused a comedown on the market: prices preferred not to test the area 45.00 and turned down. Oil consumption is recovering in China, but it is not clear to whom the export-oriented economy will sell its goods. In a couple of months we will realize that it will be impossible to talk about the same pace of development. Oil consumption is unlikely to reach levels that were before the quarantine. Oil production in the US continues to decline. The level of 11.1 mn barrels per day is very optimistic against the background of the total reduction of active drilling rigs to 199. It is not excluded that in two or three weeks we will receive data on a sharp decline of domestic production of the US. And the figures will be less than 0.1 mn barrels that EIA draws for us now.

|

08 June, 16:02Отчеты

|

Energy market: OPEC+ countries have agreed to extend the current deal with the same terms for another month. The decline of production by 9.7 mn bpd will last until the end of July. Those members who did not fully fulfilled their responsibilities in the first months of the deal will compensate it in July and September. The airlines will start active passenger traffic from mid-summer, which will increase demand for jet fuel. The demand for motor fuel will also grow, as travel by private transport is still the part of the quarantine. The number of drilling rigs in the United States continues to decline. There is a possibility of surprise in the market – demand can increase edgily as U.S. own production shrinks after the start of active human vaccination.

|