07 December 2020, 12:10

Price forecast weekly from 7 to 11 of December 2020

-

Energy market:

OPEC + decided to increase the supply on the oil market by 0.5 million barrels per day every month, starting in January. With the proviso that each step will be analyzed and agreed between the parties to the transaction on a monthly basis.

The position was chosen cautiously. It is good that there is an agreement, and there is interaction between the parties. However, who knows how the UAE and Kazakhstan, as well as Russia, will behave if prices rise to $ 60.00 per barrel. After all, all managers have the notorious «market share» in their heads, which must certainly be expanded.

Note that drilling activity in the US is reviving. And it is not excluded that in the second half of next year, the Americans will again produce 13 million barrels of oil per day without a peep.

Reading our forecasts, you could make money on the oil market by taking a move from 42.00 to 50.00 dollars per barrel. And also, you could earn on the gas oil contract, taking the move from 340.0 to 400.0 dollars per ton.

Grain market:

China has drafted a new bill to oblige provinces to have storage facilities filled with grain. Food can be used only in case of emergencies. Thus, in 2021, one can expect high activity of China in the foreign market, since the storage facilities themselves will be built in three to six months and they will already have to be filled with something.

In Canada, wheat production rose 7.7% to 35.2 million tonnes in 2020. Total corn production for grain rose 1.2% to 13.6 million tonnes. The increase in indicators occurred both due to an increase in yield and due to the cultivated areas.

On the electronic trade platform IDK.ru, the OZK Group purchased 1,200 tons of wheat with a total value of over 22 million rubles on the Novorossiysk basis. 19 accredited traders took part in the auction. Trading scheme — English and Dutch auctions.

USD/RUB:

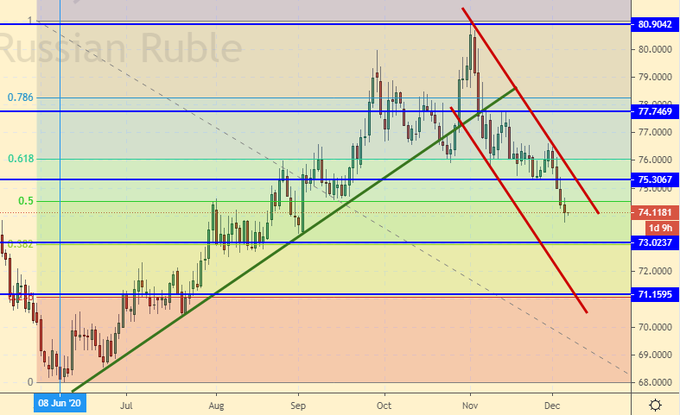

The index of Russian government bonds does not want to fall so far, which tells us about the continuing demand for Russian debt securities, which supports the ruble.

The national currency continues to strengthen over the past week. A move to the 73.00 level is very likely. For now, we will question further strengthening.

It is not clear how strong the budget deficit will be next year. If we are talking again about four to five trillion rubles, then they will lend with less enthusiasm.

Biden began to communicate with the press in a much less aggressive manner, saying that lockdown is not necessary, just everyone needs to wear masks. He even mentioned Russia and spoke in favor of a multi-vector approach when communicating with Moscow. A decrease in verbal aggression by one hundred of Washington’s side will no doubt support the ruble.

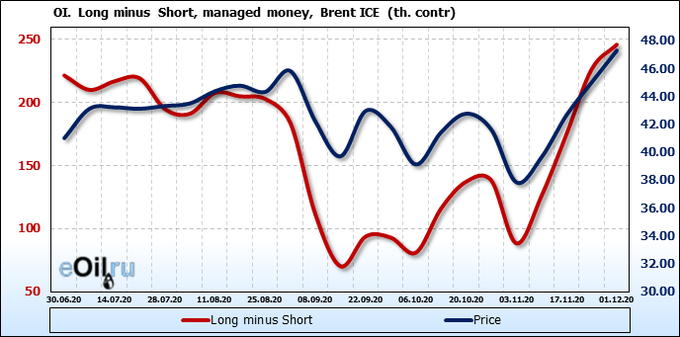

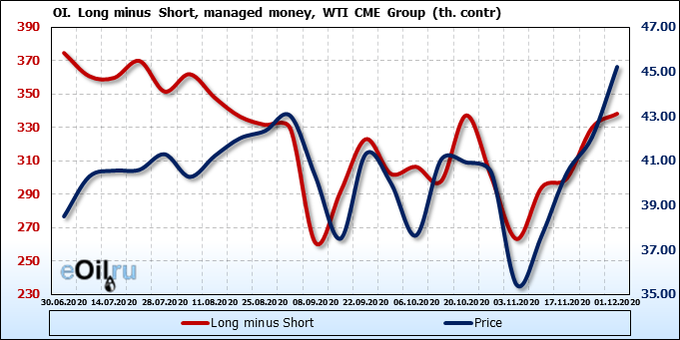

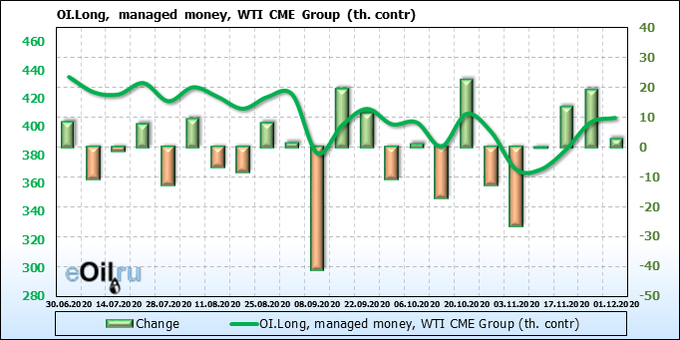

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Speculators began to sell oil futures quite briskly while closing purchase positions, which confirms our assumptions that from the $ 50.00 per barrel there will be many willing to sell, which may lead to a reversal.

Growth scenario: December futures, expiration date December 31. The goals have been achieved. Those who wish can stand still, but at the same time it is worth tightening stop orders, but for the rest who bought from 42.00, we recommend closing longs. Falling scenario: here we need to sell up to the level of 52.00. We have the right to count on a correction to 45.00.

Recommendations:

Purchase: no. All with a profit.

Sale: now and until 52.00. Stop: 52.60. Target: 45.60. Whoever is in position from 50.00, keep the stop at 52.60. Target: 45.60.

Support — 45.42. Resistance — 50.26.

Fundamental US data: the number of active drilling rigs increased by 5 units to 246 units.

US commercial oil reserves fell by -0.679 to 488.042 million barrels. Gasoline inventories rose by 3.491 to 233.638 million barrels. Distillate inventories rose 3.238 to 145.87 million barrels. Inventories at Cushing’s storage dropped by -0.317 to 59.575 million barrels.

Oil production increased by 0.1 to 11.1 million barrels per day. Oil imports rose by 0.171 to 5.399 million barrels per day. Oil exports rose 0.625 to 3.456 million barrels per day. Thus, net oil imports fell by -0.454 to 1.943 million barrels per day. Refining fell by -0.5 to 78.2 percent.

Gasoline demand fell by -0.156 to 7.973 million barrels per day. Gasoline production fell by -0.266 to 8.584 million barrels per day. Gasoline imports rose 0.081 to 0.522 million barrels per day. Gasoline exports fell by -0.071 to 0.689 million barrels per day.

Distillate demand fell by -0.386 to 3.789 million barrels. Distillate production fell by -0.021 to 4.587 million barrels. Distillate imports rose by 0.428 to 0.614 million barrels. Distillate exports rose 0.124 to 0.949 million barrels per day.

The demand for refined products fell by -0.688 to 18.468 million barrels. Production of petroleum products fell by -0.4 to 19.68411 million barrels. Imports of petroleum products rose by 0.462 to 2.401 million barrels. Exports of petroleum products rose by 0.708 to 5.263 million barrels per day.

Propane demand fell by -0.161 to 1.01 million barrels. Propane production fell by -0.004 to 2.291 million barrels. Propane imports fell by -0.032 to 0.12 million barrels. Propane exports rose 0.198 to 1.521 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

It is possible that the WTI will show stronger growth than Brent next week, as it has the potential for a rise of about $ 2, in contrast to the British grade, where you can talk about only one dollar. But, one way or another, we are waiting for a downward reversal in oil. The activity of the bulls on WTI begins to fade.

Growth scenario: January futures, the expiration date December 21. Things haven’t changed all that much this week. We still have the target at 48.30. Failure to reach this level can lead to a strong drop in prices, as the bulls will show their weakness.

Falling scenario: nothing new. We will sell from 48.00. If the market rises above 50.00 it will be a surprise. Then the next attempt to enter the short will be made from 58.00.

Recommendations:

Purchase: no. Those who are in positions between 40.00 and 40.30, move the stop to 43.80. Target: 48.30.

Sale: when approaching 48.30 and up to 50.00. Stop: 50.80. Target: 43.60.

Support — 43.26. Resistance — 48.33

Gas-Oil. ICE

Growth scenario: January futures, expiration date is January 12. Those who have not fixed a profit can do it now. The long shadow of the Friday candlestick clearly tells us about a downward reversal.

Falling scenario: sell here. A rollback to 370.0 is very likely.

Recommendations:

Purchase: no. Close everything, everyone with a profit.

Sale: now and up to 420.0. Stop: 426.0. Target: 371.0.

Support — 368.75. Resistance — 412.50.

Natural Gas. CME Group

Growth scenario: January futures, expiration date December 29. Let’s take a break from our fight for a good long entry point. Let’s wait until the market rises above 2.800.

Falling scenario: we did not sell a week earlier, much less we will not sell now. There are no speculative opportunities at the bottom for us in this market.

Recommendations:

Purchase: think after a rise above 2.800.

Sale: no.

Support — 2.422. Resistance — 2.658.

Wheat No. 2 Soft Red. CME Group

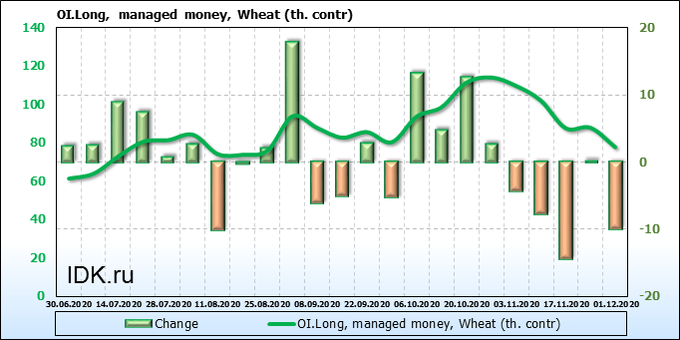

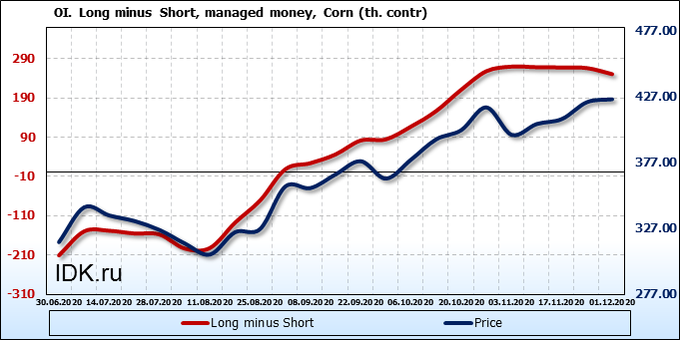

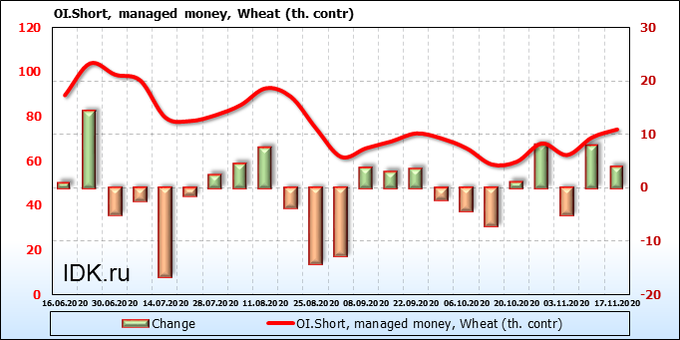

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

The speculators have developed an interest in shorts. So far, sales are insignificant, but the volume of purchases has been falling for three weeks in a row, and the exit from longs is proceeding with an ever increasing speed. This behavior tells us that the market is quite capable of falling 10%.

Growth scenario: December futures, expiration date December 14. Having passed the level of 600.0, the bulls could not return. They will now prepare to meet the market at 560.0.

Falling scenario: if you could not enter the short, then it is frankly late to do so now. Only if prices return to 595.0 will it be possible to sell. Recommendations:

Purchase: wait for a long green candlestick after touching 560.0. Stop: below the low of a long green candlestick. Target: 670.0.

Sale: on touch 595.0. Stop: 603.0. Target: 560.0.

Support — 559.4. Resistance — 592.2.

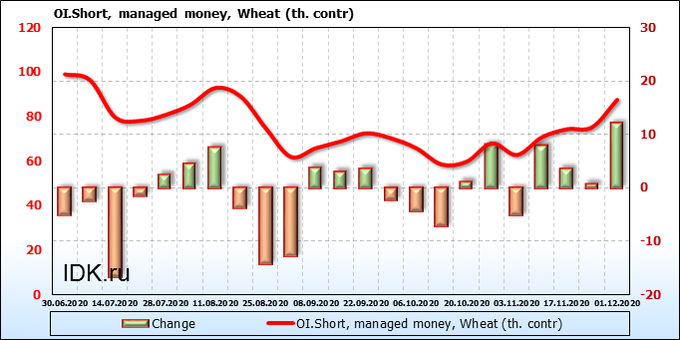

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

The first sellers appeared in the market, while buyers began to reduce their positions. Next week we may see a drop in quotes.

Growth scenario: December futures, expiration date December 14. We see that there is a threat of a breakdown of the growing channel downward. If this happens, we can count on a move to 390.0.

Falling scenario: keep counting that the current picture is an unambiguous short. Thanks to our recommendations, you could have gotten into the short last week well. We will not give the market room, we will tighten stop orders. Recommendations:

Purchase: no.

Sale: no. Who are in positions between 425.0 and 435.0, move the stop to 433.0. Target: 390.0 (376.0).

Support — 414.4. Resistance — 427.2.

Soybeans No. 1. CME Group

Growth scenario: consider the January futures, expiration date January 14. The market came to its senses. After we covered the theoretical target at 1170 by 30 cents, there was a fear that the rally would continue. However, this did not happen. If we return to the area 1000.0, then it will be possible to think about shopping there.

Falling scenario: in the previous forecast, we noted that a rollback was ripe. And now, he is in front of us. We must fall to 1050. A stronger fall (to 1000.0) is still in question.

Recommendations:

Purchase: think when approaching 1000.0.

Sale: no. Those who are in the position from 1199.0., Move the stop to 1998.0. Target: 1051.0 (1000.0).

Support — 1043.6. Resistance — 1172.4.

Sugar 11 white, ICE

Growth scenario: March futures, expiration date February 26. Expect a fight in the 13.90 area as the bulls should defend the lower support line of the rising channel. If it is taken, then we can fall to 12.50. We are not buying yet.

Falling scenario: sorry. The market did not go to 16.00, we could not sell. The current levels are not interesting for the short. We are out of the market.

Recommendations:

Purchase: from 12.50, not higher.

Sale: no.

Support — 13.88. Resistance — 15.95.

Сoffee С, ICE

Growth scenario: December futures, expiration date December 18. Another branch up suggests itself, so we will keep longs. If it is not there, then sellers will have a chance to bring down the market. Those interested can add here.

Falling scenario: consider shorts if the market falls below 112.0. But selling on a breakout is not very good, there you will need to look for options.

Recommendations:

Purchase: no. Whoever is in position from 110.0, keep the stop at 111.0. Target: 140.0 ?!

Sale: think after falling below 112.0. Those who are in the position from 120.0, move the stop to 121.0. Target: 80.00?!

Support — 108.45. Resistance — 121.75.

Gold. CME Group

Growth scenario: 1850 level is the key for next week. If the bulls fail to take it, then we will have to admit the possibility of a fall to 1666.66.

Falling scenario: I really want to sell. So we need to do it. If we have the fourth wave of the forming downward impulse (wave “C” of the current correction), then there should be the fifth one, and only there we will see an upward reversal with targets at 2260.

Recommendations:

Purchase: no. Anyone in the position from 1765, move the stop to 1775. Target: 2260.

Sale: now. Stop: 1880.0. Target: 1670.

Support — 1765. Resistance — 1849.

EUR/USD

Growth scenario: and on Friday, Biden took and said that the lockdown could not be introduced. This is a reason for a pullback to 1.1950. However, we are unlikely to go below. The target at 1.2400 remains.

Falling scenario: in such a situation, you can sell at «1H» with targets at 1.1950. On the «1D» we are out of the market.

Recommendations:

Purchase: no. Those who are in positions between 1.1840 and 1.1820, move the stop to 1.1870. Target: 1.2400 (1.2900).

Sale: no.

Support — 1.2106. Resistance — 1.2418.

USD/RUB

Growth scenario: when the pair approaches 73.00, it is worth preparing money to buy dollars. In the worst case, we will fall to 71.20. The market is not visible below this level in modern realities.

Falling scenario: current levels are understated for sales. If you stay in shorts from 75.80 when approaching 73.00, take your profit. We do not open new deals.

Purchase: on touch 73.10. Stop: 72.70. Target: 80.00.

Sale: no.

Support — 73.02. Resistance — 75.30.

RTSI

Growth scenario: there is no doubt that we will touch 138000. Then a pullback to the 126000 area should follow, after which the upward movement may resume. If Biden does not make harsh statements in the direction of Russia, then we can meet the second half of December in high spirits.

Falling scenario: the market easily passed above 130,000, now we will meet it from 138,000. We do not support the theory of unrestrained growth, without correction branches down on the eve of 2021.

Recommendations:

Purchase: no. Who entered from 112000 and from 120,000, move the stop to 125300. Target: 138000 (170,000!).

Sale: on touch 138000. Stop: 139600. Target: 126000.

Support — 125650. Resistance — 138080.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.