17 April 2023, 12:10

Price forecast from 17 to 21 of April 2023

-

Energy market:

Since the beginning of the year, the MOEX has revealed an increase in the number of attempts to destabilize share prices. So there is money in the country! There is something to carry out operations and frauds. This is clearly positive news!

We also continue our atypical intellectual activity. Hello!

The OPEC report continues to write about the growth in oil consumption by the fourth quarter. Demand, they say, will grow by as much as 2%, that is, by a little more than 2 million barrels per day. The beautiful is far away, don’t be cruel to me. It would be nice if consumption remained at the same level. The G7 countries agreed to reduce car emissions by 50% by 2035 compared to 2000. And from 2035, vehicles with internal combustion engines will not be sold. That’s all. OPEC will resolve itself as unnecessary.

What now? And now there is no big increase in demand. If it had been, then after the cut in OPEC production at the previous meeting, prices for the month would have risen above $100 per barrel, but this did not happen. No American funds, acting on the order of the Democrats, could contain the market, traders are clearly short on the orders of politicians. However, the bears can not yet be called unequivocally the losing side. It certainly cannot be said as long as Brent prices are below $90.00 per barrel. Among other things, everyone is confused by China.

Russian oil continues to enter the foreign market. Yuan and rupees flow into the country. At the same time, there was information that Indian banks did not miss deals with oil above the ceiling set by Western countries. That is, there is control over the Indians. And it is sad to realize this, since in the event of a revision of the price ceiling for Russian oil down, Delhi will submit to its curators.

Grain market:

Corn stocks could be threatened as vehicle fuel alternatives are sought. Brazil is already converting sugar cane to bioethanol, and America will be destroying corn. Since it is necessary to somehow fight inflation, part of the growth of which is rising fuel prices.

Grain prices in Russia continue to remain at low levels. At the same time, forecasts for the 23rd year, only for the wheat harvest, are at the level of 85 million tons, and this despite the fact that the current weather conditions are regarded as unfavorable. Earlier forecasts were 87-88 million tons.

Taking into account the available surpluses of wheat in the amount of 17 million tons, it can be argued that this year and next year there will be no high prices within the country. Some of the farms will obviously switch to growing other crops in the 24th year in order to finally try to earn money.

If the exchange rate of the ruble against the dollar stabilizes around 80.00, and the prices for the 4th class will be at the level of 11,000 rubles on average in the country, then we can talk about prices at the elevator less than 140 dollars per ton. These are extremely favorable conditions for exporters; all that remains is to find orders abroad for the supply of huge volumes of wheat.

USD/RUB:

I wonder if Siluanov will be able to find another 2.5 trillion. rubles by the end of the second quarter, just like he found the money by the end of the first. If so, then we have nothing to worry about. And if not? In this case, the budget deficit will become indecent and it will be patched up by any means. It is precisely that dollar buyers bet that it will be closed, including with the help of a printing press.

The ruble does not want to strengthen. The bulls on the ruble have a couple more days to indicate a downward movement to 78.00. If it doesn’t happen, then we should seriously start talking about the rise to 88.00. And after reaching the level of 88.00 we will count on a rollback to the area of 82.00.

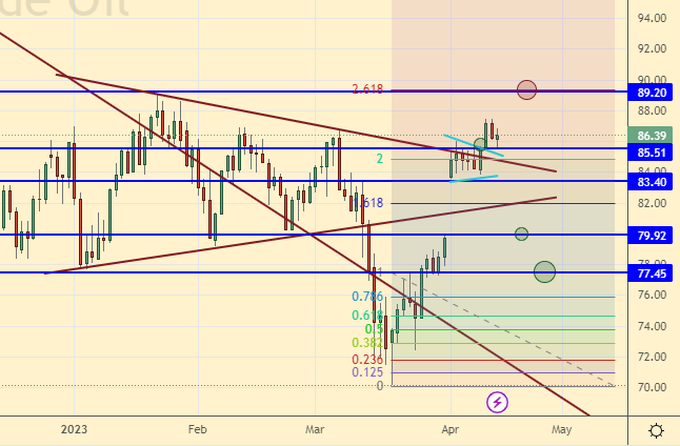

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 1.6 thousand contracts. The market is worth it. The activity of speculators is close to zero. The spread between long and short positions widened slightly. Buyers control the market.

Growth scenario: we are considering the April futures, the expiration date is April 28. Since we do not close the gap, we should go to 89.20 and only then will we correct.

Fall scenario: from 89.20 it is mandatory to sell. It is not certain that oil prices will receive support from China’s economic success.

Recommendations for the Brent oil market:

Purchase: no. Who remained in the position from 70.10, move the stop to 84.40. Target: 89.20 (110.00?).

Sale: now and when approaching 89.20. Stop: 89.90. Target: $66.64 per barrel.

Support — 85.51. Resistance is 89.20.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 2 units to 588 units.

Commercial oil reserves in the US increased by 0.597 to 470.549 million barrels, while the forecast was -0.583 million barrels. Inventories of gasoline fell by -0.33 to 222.245 million barrels. Distillate inventories fell -0.606 to 112.445 million barrels. Inventories at Cushing fell -0.409 to 33.838 million barrels.

Oil production increased by 0.1 to 12.3 million barrels per day. Oil imports fell by -0.951 to 6.193 million barrels per day. Oil exports fell by -2.512 to 2.727 million barrels per day. Thus, net oil imports increased by 1.561 to 3.466 million barrels per day. Oil refining fell by -0.3 to 89.3 percent.

Gasoline demand fell by -0.359 to 8.936 million barrels per day. Gasoline production fell by -0.033 to 9.818 million barrels per day. Gasoline imports rose by 0.1 to 0.813 million barrels per day. Gasoline exports fell -0.074 to 0.785 million bpd.

Demand for distillates fell by -0.477 to 3.763 million barrels. Distillate production fell -0.157 to 4.583 million barrels. Distillate imports rose by 0.118 to 0.233 million barrels. Distillate exports rose by 0.006 to 1.14 million barrels per day.

Demand for petroleum products fell by -1.544 to 19.055 million barrels. Oil products production fell by -0.13 to 20.861 million barrels. Imports of petroleum products increased by 0.361 to 2.275 million barrels. The export of oil products increased by 0.014 to 5.944 million barrels per day.

Propane demand fell -0.326 to 0.975 million barrels. Propane production fell by -0.021 to 2.395 million barrels. Propane imports fell -0.018 to 0.104 million barrels. Propane exports rose by 0.143 to 1.457 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers increased by 22.0 thousand contracts. Buyers entered the market, sellers left it in approximately the same volumes. The spread between long and short positions widened. Bulls continue to control the situation.

Growth scenario: we are considering the June futures, the expiration date is May 22. It is impossible to exclude a trip to 88.00. Stronger growth is not yet considered. Buying from current levels is better to work out on the «hours».

Fall scenario: from 84.00 you can sell. We put a stop nearby. This is a somewhat provocative sale, but the market may surprise and fall.

Recommendations for WTI oil:

Purchase: when approaching 76.00. Stop: 73.00. Target: 88.00. Count the risks.

Sale: when approaching 84.00. Stop: 84.70. Target: $60.10 per barrel.

Support — 79.17. Resistance — 88.63.

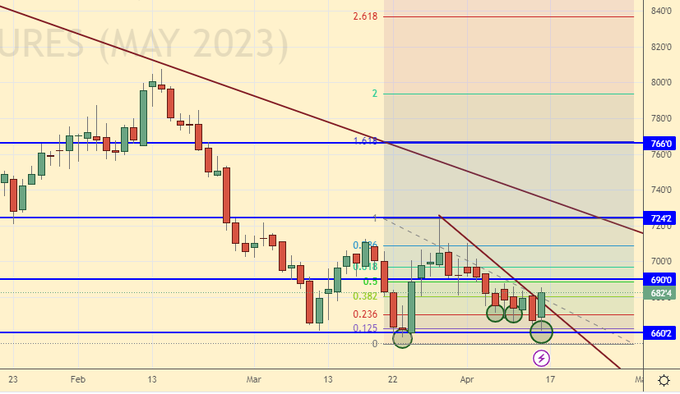

Gas-Oil. ICE

Growth scenario: we are considering the May futures, the expiration date is May 11. We do not see a surge in the bulls. The situation becomes dangerous for buyers. We keep old shorts, do not open new ones.

Fall scenario: in case of a fall below 743.0, those who wish can add to the shorts. Surprisingly, the bulls have nothing to offer the market.

Gasoil recommendations:

Purchase: no. Who is in position from 790.0, keep the stop at 740.0. Target: 1000.0.

Sale: no. Who is in position from 900.0, keep the stop at 810.0. Target: 670.0.

Support — 753.50. Resistance is 808.00.

Natural Gas. CME Group

Growth scenario: we are considering the May futures, the expiration date is April 26. Nothing interesting happened during the week. The market is depressed. We continue to stay away from trading on this instrument.

Fall scenario: it makes no sense to sell. Prices are low. Out of the market.

Recommendations for natural gas:

Purchase: no.

Sale: no.

Support — 1.000. Resistance — 2.243.

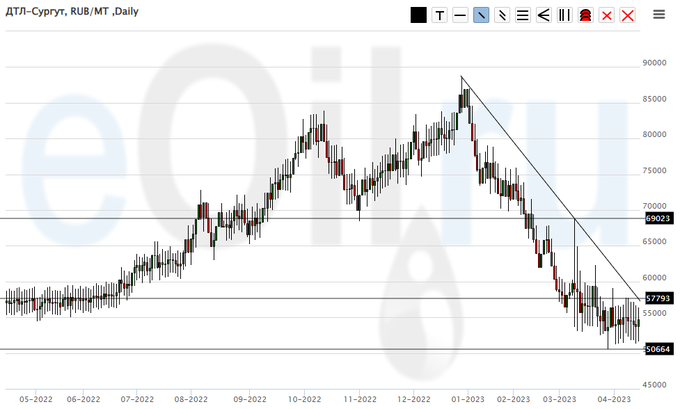

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: Again recommend buying. A fall below 50,000 is unlikely to take place. We continue to believe that fuel taxes will be increased in the near future.

Fall scenario: sales are not interesting. We need a rise to the 70,000 area in order for us to talk about selling again.

Diesel market recommendations:

Purchase: now. Stop: 49000. Target: 65000 (70000). Count the risks. Whoever is in position from 55000, keep the stop at 49000. Target: 65000 (70000).

Sale: no.

Support — 50664. Resistance — 57793.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we have the right to expect attempts to storm the level of 11000. If it goes up, then we will go to 15000.

Fall scenario: shorts from 15000 are possible. Sales from lower levels will not be considered yet.

Recommendations for the PBT market:

Purchase: no. Those in positions between 5000 and 5200, move the stop to 4400. Target: 15000 (20000).

Sale: no.

Support — 7275. Resistance — 11196.

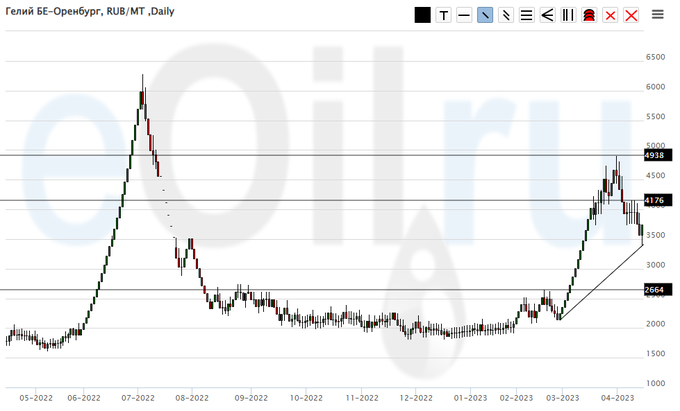

Helium (Orenburg), ETP eOil.ru

Growth scenario: we continue to assume that if prices go to the 2700 area, then it will be possible to buy. Purchases from current levels look risky and we will not explicitly recommend them.

Fall scenario: you can continue to keep open short from 4500. It makes sense to move the stop lower. The target for 2800 remains.

Recommendations for the helium market:

Purchase: when approaching 2700. Stop: 2400. Target: 5000.

Sale: not. Who is in position from 4500, move the stop to 4300. Target: 2800.

Support — 2664. Resistance — 4176.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 16.6 thousand contracts. Sellers entered the market, buyers did not change their positions at the end of the week. The spread between short and long positions widened. Sellers have strengthened the advantage.

Growth scenario: consider the May futures, the expiration date is May 12. The picture remains attractive for purchase. If you are knocked out of the long, you should enter again. Target at 765.0 still remains.

Fall scenario: we continue to talk about the need for growth to 765.0. We will not sell. Due to the uncertainty in the Black Sea region, there should be no low prices for wheat.

Recommendations for the wheat market:

Purchase: now. Stop: 664.0. Target: 765.0. It can be aggressive.

Sale: when approaching 765.0. Stop: 774.0. Target: 600.0.

Support — 660.2. Resistance — 690.0.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers keep the edge. Over the past week, the difference between long and short positions of managers increased by 4.3 thousand contracts. Both buyers and sellers entered the market. There were a few more buyers. The bulls have strengthened their advantage.

Growth scenario: consider the May futures, the expiration date is May 12. There was a chance to buy from 640.0. Now the market will head towards 690.0. Growth to higher levels is not yet considered.

Fall scenario: did not fall. We will sell when we approach 689.0. Current levels for sales are not interesting.

Recommendations for the corn market:

Purchase: no. Who is in position from 640.0, move the stop to 648.0. Target: 688.0.

Sale: no.

Support — 651.4. Resistance — 668.4.

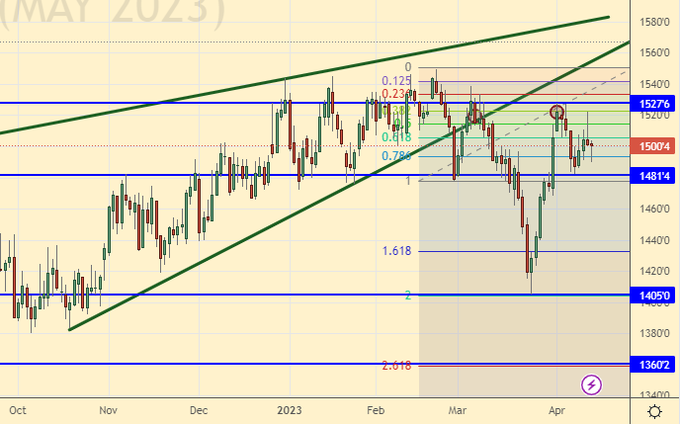

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We will continue to stop shopping. Soybeans were harvested a lot last year. It makes no sense to bet on rising prices.

Fall scenario: we continue to short soybeans. There will be nothing surprising in the fall against the backdrop of good stocks.

Recommendations for the soybean market:

Purchase: when approaching 1360.0. Stop: 1340.0. Target: 1420.0.

Sale: now. Stop: 1526.0. Target: 1360.0. Who is in position from 1510.0, keep the stop at 1528.0. Target: 1360.0 (1000.0) cents per bushel.

Support — 1481.4. Resistance — 1527.6.

Gold. CME Group

Growth scenario: One more move up by 2060 cannot be ruled out, and only then a correction will begin. A fall from current levels looks premature. We keep open longs, we do not open new ones.

Fall scenario: sales from 2060 can be tried. The decline from current levels is a surprise.

Recommendations for the gold market:

Purchase: no. Who is in position from 1960, keep the stop at 1970. Target: 2500 (3000) dollars per troy ounce.

Sale: approaching 2060. Stop: 2080. Target: 1600.

Support — 1960. Resistance — 2051.

EUR/USD

Growth scenario: and we took it and jumped to 1.1100, quickly flying through 1.1025. Who would have thought. We hold longs. We are not opening new positions.

Fall scenario: the dollar may strengthen to 1.0800. However, we will refrain from going short for now.

Recommendations for the EUR/USD pair:

Purchase: no. Who is in position from 1.1035, keep the stop at 1.0940. Target: 1.1930.

Sale: no.

Support — 1.0712. Resistance is 1.1108.

USD/RUB

Growth scenario: we continue to wait for a pullback to 78.00 for a new round of buying. Growth from current levels to 88.00 should be recognized as possible. But in itself it will be inconvenient for speculation. It’s good that there are previously open longs.

Fall scenario: we will not sell. We need positive fundamental, including political, successes.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 78.00. Stop: 77.40. Target: 88.70. Who is in position from 76.70, keep the stop at 77.40. Target: 88.70.

Sale: think when approaching 88.70.

Support — 77.96. Resistance — 83.76.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. The index is looking for optimism. A strengthening ruble could help him, but this is not happening against expectations.

Fall scenario: we will continue to recommend sales. Entering shorts from 100,000 looks natural. Keep open shorts.

Recommendations for the RTS index:

Purchase: on pullback to 97500. Stop: 94500. Target: 112000.

Sale: when approaching 100,000. Stop: 101,200. Target: 80,000 (50,000, then 20,000) points. Who is in position from 106000, 103000, 101000 and 98000, keep the stop at 101200. Target: 80000 (50000, then 20000) points.

Support — 96630. Resistance — 99320.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.