18 July 2022, 12:00

Price forecast from 18 to 22 of July 2022

-

Energy market:

This strange American way of asking for indulgence, blaming a journalist for the murder. Right in the eyes, right in the negotiations. Biden had only to take off his shoe and try to hit Prince Salman. We have never seen such a movie!

Hello!

It doesn’t take a great strategist to understand that now Saudi Arabia will not only not increase oil supplies, but will also begin to seriously think about whether its people, in principle, need to learn English. There is Russian, as well as Chinese, French, German. If this continues, then with the next US President, Prince Salman, long years of his life, will have to fight in hand-to-hand combat.

After the “nice” Biden-Salman meeting, we had doubts that oil would continue its fall.

Europe, with its extravagant dances about the rejection of Russian energy carriers, is beginning to suspect that its bizarre “pas” have led it somewhere in the wrong direction. Nord Stream is under repair. Maybe the Russians will resume deliveries on July 22nd, maybe not. There are no prospects for normal heating in winter. But there is the prospect of political squabbles in the very center of the old woman, since in an attempt to strangle Russia, their strategists began to strangle their own peoples.

Most likely, closer to winter we will see some reshuffles at the top of the leading European countries.

By reading our predictions, you could make money in the gold market by taking a move down from $1845 to $1700 per troy ounce.

Grain market:

Turkey, with its national currency continuing to fall into hell, and indeed the entire economy, is more interested in the supply of grain than Russia and Ukraine combined in the sale of this grain to Turkey. Therefore, Erdogan gathers everyone at his place. He encourages everyone to find a solution in terms of logistics. And most likely it will be found.

The July USDA report confirmed the positive expectations of analysts about a good gross grain harvest in the 22/23 season. This fact had a significant pressure on prices, primarily on wheat, which seriously thought about reaching the level of 650 cents per bushel. In Novorossiysk, wheat with a protein content of 12.5% continues to fall in price. The current price levels are 355 — 365 dollars per ton, but we should expect a stronger drop in prices. A move to the level of $320 per ton against the backdrop of a new crop is possible.

USD/RUB:

On July 22, the next meeting of the Central Bank of the Russian Federation will take place. On it, as expected, the interest rate will be reduced by 0.5% points, and possibly more, it all depends on the mood of Elvira Sakhipzadovna. Inflation in Russia has stopped, which gives the Central Bank room to maneuver. It cannot be ruled out that the policy of lowering rates will be continued in the fall. Cheaper credit will be extremely useful for the country in this period.

It is expected that prices in Russia will grow only in the luxury segment, and the cost of servicing expensive machinery and equipment will also increase. Food and clothing prices will stop rising.

The level of 55 rubles per dollar is currently perceived as fair.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers has decreased by 500 contracts. In conditions of uncertainty, money left the market. Note that there are still more bulls than bears in the market.

Growth scenario: we are considering the July futures, the expiration date is July 29. A new attempt to consolidate above 108.00 next week cannot be ruled out. The probability of success is low, but still it is worth going long now.

Fall scenario: we will keep the short, opened earlier from the level of $120 per barrel. We will endure. In terms of technology, the advantage belongs to the sellers.

Recommendations for the Brent oil market: Purchase: now. Stop: 97.00. Target: $140.00 per barrel.

Sale: no. Those in positions between 117.00 and 120.00 move the stop to 113.00. Brent target: $77.00 per barrel.

Support — 94.61. Resistance is 107.35.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 2 units and now stands at 599 units.

Commercial oil reserves in the US increased by 3.254 to 427.054 million barrels, while the forecast was -0.154 million barrels. Inventories of gasoline rose by 5.825 to 224.937 million barrels. Distillate inventories rose by 2.668 to 113.803 million barrels. Inventories at Cushing rose by 0.316 to 21.646 million barrels.

Oil production fell by -0.1 to 12 million barrels per day. Oil imports fell by -0.164 to 6.675 million barrels per day. Oil exports rose by 0.412 to 3.024 million barrels per day. Thus, net oil imports fell by -0.576 to 3.651 million barrels per day. Oil refining increased by 0.4 to 94.9 percent.

Gasoline demand fell by -1.351 to 8.062 million barrels per day. Gasoline production fell by -1.425 to 8.921 million barrels per day. Gasoline imports fell by -0.23 to 0.715 million barrels per day. Gasoline exports fell by -0.175 to 0.84 million bpd.

Demand for distillates fell by -1.014 to 3.368 million barrels. Distillate production fell -0.246 to 5.133 million barrels. Distillate imports rose by 0.033 to 0.137 million barrels. Exports of distillates rose by 0.239 to 1.521 million barrels per day.

Demand for petroleum products fell by -1.744 to 18.72 million barrels. Production of petroleum products fell by -0.752 to 21.638 million barrels. Imports of petroleum products increased by 0.032 to 2.199 million barrels. Exports of petroleum products fell by -1.134 to 5.827 million barrels per day.

Propane demand fell by -0.032 to 0.557 million barrels. Propane production increased by 0.086 to 2.421 million barrels. Propane imports rose by 0.034 to 0.101 million barrels. Propane exports fell by -0.131 to 1.552 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that this data is three days old (for Tuesday of the last week), it is also the most recent one published by the ICE exchange.

Last week the difference between long and short positions of managers increased by 8.8 thousand contracts. Bulls continue to dominate the market. Some sellers decided to close their positions.

Growth scenario: consider the September futures, the expiration date is August 22. Growth is possible from current levels. If we manage to consolidate above 107.50, then this will lead to a reversal in the market up.

Fall scenario: we hold the previously open shorts. People are waiting for bad data on US and EU GDP in the second quarter. This can push prices down.

Recommendations for WTI oil:

Purchase: now. Stop: 94.00. Target: $130.00 per barrel.

Sale: no. Those in positions from 114.00, 108.00 and 106.00, move the stop to 111.20. Target: $70.00 per barrel.

Support — 95.14. Resistance — 105.14.

Gas-Oil. ICE

Growth scenario: we are considering the August futures, the expiration date is August 11. Can buy. We are back in a growing channel, which is actually somewhat unexpected.

Fall scenario: we will hold the previously open shorts. We hope that the market will still be able to consolidate below the level of 1000.0.

Gasoil recommendations:

Purchase: now. Stop: 1040.00. Target: 1400.00.

Sale: no. Who is in position between 1320.0 and 1180.0, move the stop to 1210.0. Target: $850.0 per ton!

Support — 998.75. Resistance is 1131.25.

Natural Gas. CME Group

Growth scenario: we are considering the August futures, the expiration date is July 27. We recommended buying for a month. Now we are in position.

Fall scenario: do not sell. There is not a single reason why gas can become cheaper. Recommendations for natural gas:

Purchase: no. Who is in position between 6.000 and 5.500, move the stop to 5.400. Target: $15,000 for 1 million BTUs.

Sale: no.

Support — 6.500. Resistance — 8.002.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 8.5 thousand contracts. There are more bears in the market than bulls. Buyers left the market. Sellers, on the contrary, increased their positions.

Growth scenario: consider the September futures, the expiration date is September 14th. The bulls were unable to counter the positive data on the gross harvest from the USDA. The market fell. Now purchases are possible only from the level of 650.0 cents per bushel.

Fall scenario: we didn’t sell a week ago, thinking the levels are low. Moreover, we will not sell at the moment. The chances of making money on the fall are now extremely small.

Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 630.0. Target: 860.0 cents per bushel.

Sale: no.

Support — 640.0. Resistance — 828.4.

Let’s look at the volumes of open interest of corn managers. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Last week the difference between long and short positions of managers decreased by 29.5 thousand contracts. Buyers actively left the market, sellers increased their positions.

Growth scenario: consider the September futures, the expiration date is September 14th. We continue to wait for the touch of the level 560.0. We will buy there, and we will count on a move to the level of 660.0 cents per bushel.

Fall scenario: nothing has changed for sellers. Only growth to the level of 700 cents per bushel will be interesting from the point of view of entry into the shorts. We do not sell from current levels. Recommendations for the corn market:

Purchase: when approaching 560.0. Stop: 520.0. Target: 685.0 cents per bushel.

Sale: no.

Support — 559.0. Resistance is 615.0.

Soybeans No. 1. CME Group

Growth scenario: consider the September futures, the expiration date is September 14th. We continue to stay out of the market. Judging by the behavior of palm oil, a further fall is possible.

Fall scenario: there is a threat of a market collapse. The levels are not the best, but you can bet on the fall.

Recommendations for the soybean market: Purchase: no.

Sale: now. Stop: 1390.0. Target: 1150.0 cents per bushel.

Support — 1324.6. Resistance — 1457.2.

Sugar 11 white, ICE

Growth scenario: consider the October futures, the expiration date is September 30th. We don’t buy. While the level of 1940 is not taken, the sellers have a chance.

Fall scenario: here you can sell. We can still talk about the fall. Keep open shorts.

Recommendations for the sugar market:

Purchase: not yet.

Sale: now. Stop: 19.80. Target: 16.50 cents a pound. Who is in position from 19.00, keep the stop at 19.80. Target: 16.50 cents a pound.

Support — 17.69. Resistance — 19.40.

Сoffee С, ICE

Growth scenario: we are considering the September futures, the expiration date is September 20. The market fell to 190.00. When approaching 180.00, you can go long.

Fall scenario: we will keep the previously open shorts. The past week has been a good one. Target down at 182.00 is within reach.

Recommendations for the coffee market:

Purchase: when approaching 180.00. Stop: 170.00. Target: 208.00 cents per pound.

Sale: no. Who is in position from 225.0, move the stop to 220.00. Target: 182.00 cents per pound.

Support — 191.40. Resistance is 209.40.

Gold. CME Group

Growth scenario: from current levels, a move up to 1800 is possible. Above this level, the market is not yet visible.

Fall scenario: The market reached our previously announced level of 1700. New sales are only from $1800 per troy ounce.

Recommendations for the gold market:

Purchase: now. Stop: 1670. Target: 1800 (2300!). Who is in position from 1700, keep the stop at 1670. Target: 1800 (2300!).

Sale: up to 1800. Stop: 1830. Target: $1,612 a troy ounce.

Support — 1688. Resistance — 1802.

EUR/USD

Growth scenario: dropped below parity and somehow grew up. picture is weak. On the 21st of July the ECB meeting, before it we remain out of the market.

Fall scenario: we continue to assume that the pair is able to go to 0.9700. We do not open new positions, we keep the old ones.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: no. Who is in position from 1.0600, move the stop to 1.0120. Target: 0.9700.

Support — 0.9952. Resistance is 1.0363.

USD/RUB

Growth scenario: the pair was declining last week amid expectations of an extraordinary convocation of the State Duma on the 15th on Friday. In fact, there were no surprises. We can assume that the ruble will get stronger to the level of 54.00, while the passage to 50.00 is brushed aside.

Fall scenario: The government continues to express concern about the strong exchange rate of the ruble. On Friday, the Central Bank of the Russian Federation may lower the rate, which will help keep the Russian ruble in the range of 52-57 rubles per US dollar.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 54.00. Stop: 52.70. Target: 73.00 rubles per dollar.

Sale: no.

Support — 55.96. Resistance — 64.74.

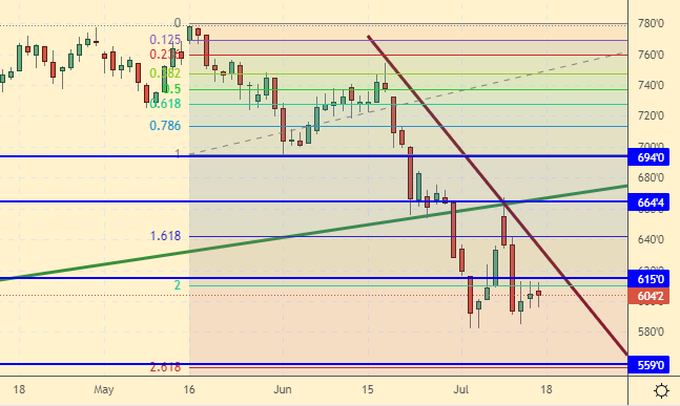

RTSI

Growth scenario: oil and steel companies face a difficult situation due to the loss of foreign markets. Shares are falling. In the current situation, it is clear that all the profits of large corporations will be withdrawn. Shareholders will not receive dividends for the next couple of years. We don’t buy.

Fall scenario: The market is unlikely to be able to show growth in the coming days. We stay in shorts. We are counting on a move to the level of 94,000 points.

Recommendations for the RTS index:

Purchase: no.

Sale: no. Who is in position from 129000, move the stop to 123000. Target: 94000 points.

Support — 104440. Resistance — 117340.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.