04 July 2022, 12:09

Price forecast from 4 to 8 of July 2022

-

Energy market:

Even if you can print as many dollars as you want, you can still run out of oil. Gasoline and diesel inventories in the US are at their lowest levels in the past five years for this time of year, and gas station prices are at their highest. In order to save money, Americans will soon pick up the new European trend and also stop taking regular showers.

Hello!

The OPEC+ coalition has promised to increase production by 648,000 barrels per day from August. The market reacted favorably to this news and the prices fell somewhat, however, while we are above the level of $100 per barrel, it is too early to say that the phase of relaxation has begun on the market. An attempt by the G7 countries to determine a certain price level for oil from Russia runs into a misunderstanding of representatives of their own Western energy companies, such as Shell, for example. Today, politicians will determine the price level for Russians, and tomorrow for their own. No market, no business. This is another step on the road to chaos. All attempts to regulate prices at all times led to only one thing — to a shortage.

By reading our forecasts, you could make money in the wheat market by taking a move down from 1100.0 to 860.0 cents per bushel.

Grain market:

Egypt at the last tender collected applications from wheat sellers for the supply of lots for several months at once: from August to October. For example, the French, taking into account the freight, are already ready to sign a contract for the supply of wheat in October at $440 per ton, and this suggests that the market is currently overheated and prices may be lower.

Turkey is making every effort to get Russian or Ukrainian grain of a new crop through the Black Sea. The negotiation process is underway, but it can be interrupted at any moment, which will cause another rise in prices for wheat and corn on the world market. Russia can harvest a record 130 million tons of grain this year, including 87 million tons of wheat. Approximately 45 million tons of wheat can be exported. Consequently, Russia will be interested in all possible channels for the sale of its products, and primarily in shipments through ports in the south.

USD/RUB:

Next week we are waiting for new proposals from the Government to depreciate the ruble against the US dollar. The growth of the national currency makes the business of exporters unprofitable. Moreover, domestic enterprises supplying their products to the domestic market will not be able to compete with Asian and Latin American producers under such a course and will be forced to stop their activities.

Obviously, in order to normalize the situation, it is necessary for the couple to return to the area of 70 rubles per dollar, but the Government does not have the levers to solve this problem in the current realities. However, by winter Europe promised to stop buying Russian energy resources. So the ruble will depreciate on its own in the near future without any additional measures.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers has decreased by 9.2 thousand contracts. There is a small outflow of buyers. While the situation is perceived as equilibrium. Growth scenario: we are considering the July futures, the expiration date is July 29. While we continue to refrain from buying, but it is worth following the news. Market sentiment may turn bullish again.

Fall scenario: we will keep short from 120.00. The market may fall below $100.00 per barrel. Move the stop order down.

Recommendation:

Purchase: no.

Sale: no. Those in positions between 117.00 and 120.00 move the stop to 119.00. Target: 77.00. Support — 106.81. Resistance is 120.39.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 1 unit and now stands at 595 units.

Commercial oil reserves in the US fell by -2.762 to 415.566 million barrels, while the forecast was -0.569 million barrels. Inventories of gasoline rose by 2.645 to 221.608 million barrels. Distillate inventories rose by 2.559 to 112.401 million barrels. Inventories at Cushing fell -0.782 to 21.261 million barrels.

Oil production increased by 0.1 to 12.1 million barrels per day. Oil imports fell by -0.228 to 5.998 million bpd. Oil exports fell by -0.192 to 3.38 million barrels per day. Thus, net oil imports fell by -0.036 to 2.618 million barrels per day. Oil refining increased by 1 to 95 percent.

Gasoline demand rose by 0.417 to 8.922 million barrels per day. Gasoline production increased by 0.143 to 9.497 million barrels per day. Gasoline imports rose by 0.041 to 0.824 million barrels per day. Gasoline exports rose by 0.039 to 0.969 million barrels per day.

Demand for distillates fell by -0.294 to 3.568 million barrels. Distillate production increased by 0.085 to 5.136 million barrels. Distillate imports rose by 0.002 to 0.097 million barrels. Distillate exports up 0.035 to 1.299 million barrels in a day.

Demand for petroleum products increased by 0.093 to 19.997 million barrels. Production of petroleum products fell by -0.12 to 21.563 million barrels. Imports of petroleum products increased by 0.358 to 2.346 million barrels. Exports of petroleum products fell by -0.025 to 6.111 million barrels per day.

Demand for propane rose by 0.321 to 1.116 million barrels. Propane production fell -0.055 to 2.341 million barrels. Propane imports rose by 0.009 to 0.076 million barrels. Propane exports fell by -0.07 to 1.294 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Over the past week, the difference between long and short positions of managers increased by 9.4 thousand contracts. Bulls do not want to leave the market yet, some participants continue to bet on growth.

Growth scenario: we are considering the August futures, the expiration date is July 20. The technical picture for WTI remains bullish, unlike Brent. You can buy from the current levels.

Fall scenario: holding the previously open shorts, we will expect the market to fall below $100.0 per barrel. We do not open new positions for sale. Recommendation:

Purchase: now. Stop: 103.80. Target: 150.00!!!

Sale: no. Those in positions between 108.00 and 114.00 move the stop to 115.20. Target: 70.00.

Support — 101.89. Resistance is 114.09.

Gas-Oil. ICE

Growth scenario: we are considering the July futures, the expiration date is July 12. Refrain from shopping. However, it is worth following the news, the situation may change.

Fall scenario: while we continue to recommend sales. A move below 1000.0 will cause a reset to 800.0.

Recommendation: Purchase: not yet.

Sale: now. Stop: 1330.0. Target: 1000.0. Who is in position from 1320.0, move the stop to 1330.0. Target: 1000.0.

Support — 1011.50. Resistance is 1247.50.

Natural Gas. CME Group

Growth scenario: we are considering the August futures, the expiration date is July 27. We recommend shopping. It is unlikely that prices will continue to fall in the current tense situation.

Fall scenario: do not sell. Demand for gas remains at a high level.

Recommendation:

Purchase: now and when approaching 5.000. Stop: 4.000. Target: 15.000! Who is in position from 6.000, keep the stop at 4.000. Target: 15.000!

Sale: no.

Support — 5.004. Resistance is 6.065.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 4.4 thousand contracts. For six consecutive weeks, the outflow of buyers from the market continues. It is likely that the bears will run out of steam soon, and we will see prices move up.

Growth scenario: consider the September futures, the expiration date is September 14th. We buy at current levels. We expect prices to rise to around 1000.0 cents per bushel.

Fall scenario: the market has reached the target set by us earlier at 860.0. All with a profit. We do not open new positions for sale.

Recommendation:

Purchase: now and when approaching 800.0. Stop: 780.0. Target: 1400.0. Count the risks.

Sale: no.

Support — 819.2. Resistance — 914.6.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Last week the difference between long and short positions of managers decreased by 29.8 thousand contracts. Both buyers and sellers leave the market. Buyers fled noticeably more. The outflow of money from the market suggests that it is becoming less predictable.

Growth scenario: consider the September futures, the expiration date is September 14th. While out of the market. In case of a fall to the level of 560.0 cents per bushel, buy.

Fall scenario: the market is oversold. We do not enter shorts.

Recommendation: Purchase: when approaching 560.0. Stop: 520.0. Target: 670.0.

Sale: no.

Support — 603.6. Resistance — 655.6.

Soybeans No. 1. CME Group

Growth scenario: consider the September futures, the expiration date is September 14th. Let’s keep going long. We do not open new buy positions.

Fall scenario: a fall towards 1330.0 is in sight, but short entry levels are not ideal. Out of the market. Recommendation:

Purchase: no. Who is in position from 1440.0, keep the stop at 1410.0. Target: 1540.0.

Sale: no.

Support — 1329.4. Resistance — 1522.6.

Sugar 11 white, ICE

Growth scenario: consider the October futures, the expiration date is September 30th. The market continues to unwind. Until we buy. From 16.50 it is obligatory to go long.

Fall scenario: we will keep open short two weeks ago with targets at 16.50. Sellers are in complete control.

Recommendation:

Purchase: no.

Sale: no. Who is in position from 19.00, keep the stop at 18.90. Target: 16.50.

Support — 17.38. Resistance — 18.79.

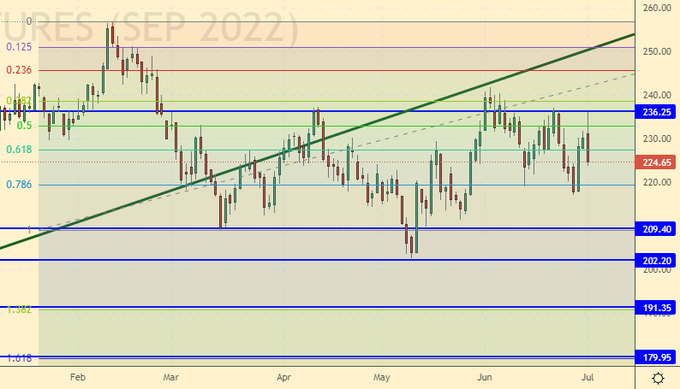

Сoffee С, ICE

Growth scenario: we are considering the September futures, the expiration date is September 20. The market is prone to fall. Growth is incredible. We are not opening new positions.

Fall scenario: levels are acceptable for short entry. It is impossible to exclude moves to 175.00, then 150.00.

Recommendation:

Purchase: no. Who is in position between 211.0 and 217.0, keep the stop at 219.00. Target: 248.00.

Sale: now. Stop: 238.00. Target: 175.00. Who is in position from 225.0, keep the stop at 238.00. Target: 175.00.

Support — 209.40. Resistance is 236.25.

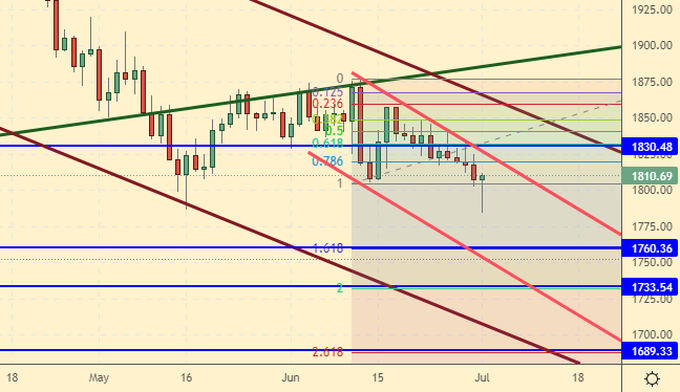

Gold. CME Group

Growth scenario: sellers are still pressing. We remain out of the market. But! You need to follow the news, the situation may change.

Fall scenario: we will no longer sell. We hold previously opened positions.

Recommendations:

Purchase: when approaching 1690. Stop: 1660. Target: 2300! Also think after rising above 1900. Sale: no. Those in positions between 1845 and 1825 move the stop to 1837. Target: 1690.

Support — 1760. Resistance — 1830.

EUR/USD

Growth scenario: we are unlikely to hear anything aggressive from the ECB on July 21st. Until we buy a couple.

Fall scenario: we continue to assume that the pair is able to go to 0.9700. Levels for sales are slightly underestimated, however, in case of breakdown below 1.0350, those who wish can go short. Recommendations:

Purchase: no.

Sale: no. Who is in position from 1.0600, move the stop to 1.0620. Target: 0.9700.

Support — 1.0358. Resistance is 1.0619.

USD/RUB

Growth scenario: In the event of a fall in oil prices and increased tensions in the international environment, the pair may go up. If there are no cataclysms, then we will remain at the current levels.

Fall scenario: we continue to refuse sales. Note that it is impossible to predict the development of the current situation. Those who wish to trade are still looking for other instruments.

Recommendations:

Purchase: think when approaching the level of 46.00.

Sale: no.

Support — 49.90. Resistance is 55.93.

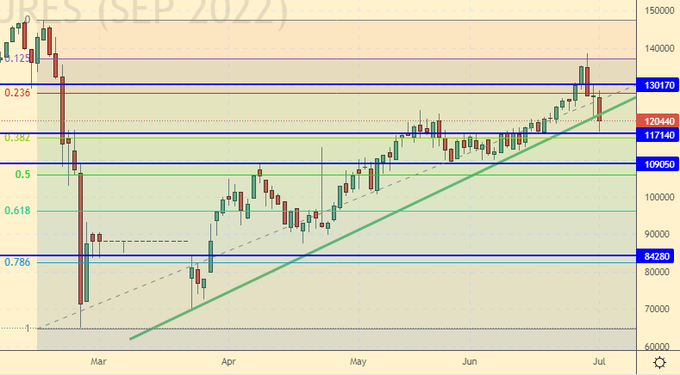

RTSI

Growth scenario: since no global positive signals came to us during the week, we continue to believe that the growth of the Russian stock market under the current conditions is impossible. Purchases are not recommended. We note that Gazprom’s refusal to pay dividends to shareholders did not add optimism to domestic investors.

Fall scenario: last week we recommended going short on a red daily candle. If you followed our advice, you should be short from the 129000 level. Hold this short as there is a chance the market will cool down to the 100000 level.

Recommendations:

Purchase: no.

Sale: no. Who is in position from 129000, move the stop to 131000. Target: 100000.

Support — 117140. Resistance — 130170.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.