29 January 2024, 14:29

Price forecast from 29 January to 2 February 2024

-

Energy market:

Migrants and the National Guard in Texas fight for the truth by dancing on barbed wire. Washington gave notice at first that the fence, or lack thereof, was a federal issue, but then shut up. Too many guns. Scary.

Yeah. One meter of border between the U.S. and Mexico is a high margin asset. Maybe they’ll start selling it privately to pay off the foreign debt. Don’t miss it. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Yemeni Hussites again fired on a tanker with Russian oil. This outrage is unlikely to stop in the near future, which means that oil prices will get some support due to the violation of transportation security in the Red Sea.

As long as Brent oil prices are above the 80.00 level, none of the Arab leaders will make any statements. They are clearly happy with the current state of affairs in the market. There are rumors that Russia is producing slightly more than the agreements stipulate, but we will be forgiven, at least for now.

For several weeks now, 14 tankers carrying 10 million barrels of Russian Sokol crude oil have been standing off the coast of South Korea and have been unable to unload because of sanctions. The situation is stalemate, but the ships are in no hurry to change their destination. At least one third of the oil from the Sakhalin-1 project (Rosneft) was intended for India, but this country is consistently reducing its purchases from Russia due to U.S. sanctions pressure. It should be noted that if Russian oil cannot reach the market in the previous volumes, it will lead to a rise in prices.

Grain market:

Globally, we are more resilient than ever. The logistical problems associated with the Red Sea have had no effect on the price. And there is so much food that the governments of developed countries allow crowds of refugees to move around the world almost freely. True, at one point Germany may turn into one big Texas, and possibly another Reich. Now, you know, there’s DNA testing and it will be very easy to establish who has the right to live… to live on German territory, of course, and who doesn’t. But so far so good. Tolerance still remains in society.

China imported almost 325 million dollars worth of grain crops from Russia in 2023, which is 3.7 times more than in 2022. Purchases of wheat rose to $35 million, barley to $110 million, and corn to $92 million. Note that the West continues to push Russia and China into each other’s arms with its policies. Perhaps we will allow the yuan to circulate in parallel with the ruble, but it will not happen in the 24th year, maybe in the 26th. Yes, there will be two price tags in stores, and yes, there will be Chinese salespeople in the same stores.

The old wisdom of a farmer, a collective farmer, if you like, that one should not be in a hurry to sell grain, and in case of adversity one should keep money in grain, will be fully realized this year. Against the background of inflation, consumers will increasingly focus on the consumption of food products: bread, cereals, poultry. Despite the fact that current domestic grain prices are low, by the 24/25 season it is possible that we will see an increase in local ruble prices, provided that current exports return to last year’s pace. So far for January we are behind due to weather.

USD/RUB:

Lower inflation expectations may help the Russian economy. Between 12 and 14% per annum price growth is expected this year. This is a very moderate forecast, which may incline the Central Bank to lower the rate, provided that the forecasts coincide with reality.

For the dollar/ruble exchange rate, it should be understood that very few dollars come into the country. Some volumes can be bought by selling yuan, but the Chinese will obviously put, if they have not already put some restriction on the volume of transactions.

It should be noted that the dollar has lost its role as a strategically important currency for Russia, as well as the euro. We are left with the yuan and gold. And… and the population’s money.

On January 31st, the Fed will meet. Whatever decision is made, our assessment is that the rate will remain at the same level and will not affect the USD/RUB pair.

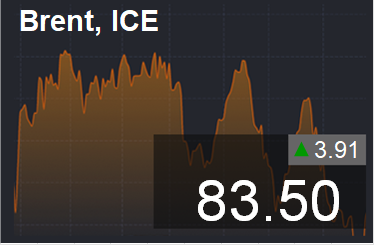

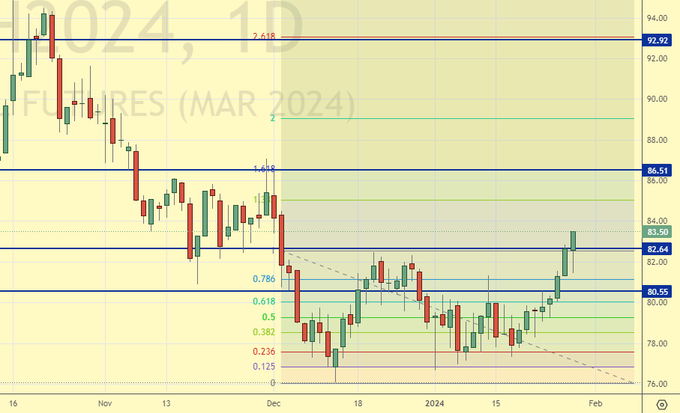

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 15.3 thousand contracts. Buyers entered the market, sellers ran in small volumes. Bulls keep the advantage.

Growth scenario: we switched to February futures, expiration date is February 29. Bulls finally showed their strength. The nearest targets are at 86.50 and at 92.92.

Fall scenario: the situation has become uncomfortable for sales. Off-market.

Recommendations for the Brent oil market:

Purchasing: on a pullback to 81.00. Stop: 80.40. Goal: 120.00. Those who are in the position from 81.70, move the stop to 80.40. Goal: 120.00.

Sale: no.

Support — 82.64. Resistance — 86.51.

WTI. CME Group

US fundamental data: the number of active drilling rigs rose by 2 units to 499.

U.S. commercial oil inventories fell by -9.233 to 420.678 million barrels, with a forecast of -2.15 million barrels. Gasoline inventories rose by 4.912 to 252.977 million barrels. Distillate stocks fell -1.417 to 133.336 million barrels. Cushing storage stocks fell by -2.008 to 30.066 mln barrels.

Oil production fell by -1 to 12.3 million barrels per day. Oil imports fell -1.84 to 5.58 million barrels per day. Oil exports fell by -0.595 to 4.434 million barrels per day. Thus, net oil imports fell by -1.245 to 1.146 million barrels per day. Oil refining fell by -7.1 to 85.5 percent.

Gasoline demand fell -0.389 to 7.88 million barrels per day. Gasoline production fell -1.04 to 8.325 million barrels per day. Gasoline imports rose 0.079 to 0.628 million barrels per day. Gasoline exports fell -0.38 to 0.717 million barrels per day.

Distillate demand rose by 0.139 to 3.784 million barrels. Distillate production fell by -0.402 to 4.5 million barrels. Distillate imports rose 0.086 to 0.201 million barrels. Distillate exports rose 0.087 to 1.12 million barrels per day.

Demand for petroleum products fell by -0.313 to 19.556 million barrels. Petroleum products production fell by -2.48 to 19.779 million barrels. Petroleum product imports fell -0.349 to 1.621 million barrels. Exports of refined products fell -0.054 to 6.329 million barrels per day.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 49.3 thousand contracts. The change is significant. Sellers ran in large volumes. Buyers entered the market. Bulls stepped up their control.

Growth scenario: we consider March futures, expiration date February 28. Gone above 76.30. It is possible to buy. The upside targets are at 81.00 and 89.00.

Fall scenario: we don’t sell. It is possible that a long way up awaits us.

Recommendations for WTI crude oil:

Purchase: on a pullback to 76.00. Stop: 75.00. Goal: 110.00. Those who are in the position from 76.60, move the stop to 75.00. Goal: 110.00.

Sale: no.

Support — 70.53. Resistance — 75.37.

Gas-Oil. ICE

Growth scenario: we consider February futures, expiration date is February 12. The bulls, apparently, broke the stop orders on Friday. The growth is likely to continue.

Fall scenario: sales went nowhere. Off-market.

Gasoil Recommendations:

Purchase: when approaching 800.00. Stop: 770.00. Goal: 1200.00. Those who are in the position from 830.00, keep the stop at 770.00. Goal: 1200.00.

Sale: no.

Support — 815.75. Resistance — 881.00.

Natural Gas. CME Group

Growth scenario: we consider the March futures, expiration date February 27. Showed a new low last week. Out of the market.

Fall scenario: let’s keep shorting. Biden decided to review the LNG export policy, this may lead to extremely low prices in the US.

Natural Gas Recommendations:

Purchase: no.

Sale: no. Those in position from 2.570, move your stop to 2.410. Goal: 2,000.

Support — 2.085. Resistance — 2.336.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: continue to stay out of the market. Prices are too high for interesting purchases.

Fall scenario: we will continue shorting. We have a target at 65000, those who need money can cut a part of the position.

Diesel Market Recommendations:

Purchase: no.

Sell: No. Who is in position from 90300, move stop to 87000. Goal: 65000. It is possible to close 25% of the position at 76500.

Support — 67500. Resistance — 90547.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: buying from current levels is possible, but it is better to wait until the market either falls to 10000 or rises above 20000.

Fall scenario: short from 23000 is interesting. Those who have already entered, here you go.

PBT Market Recommendations:

Purchase: not yet.

Sell: No. Those in position from 22500, move stop to 22000. Goal: 15000.

Support — 15215. Resistance — 24092.

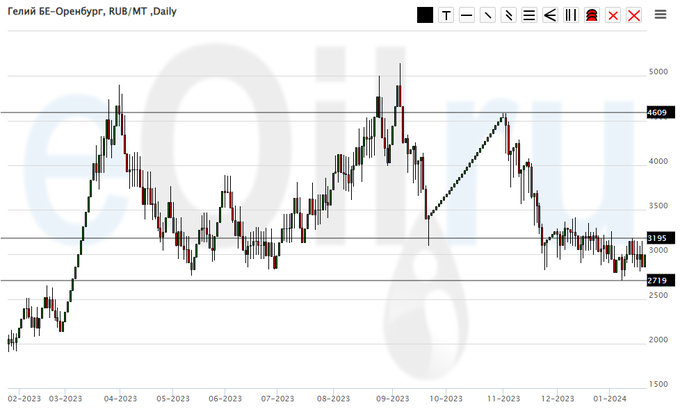

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will keep longing. We continue to count that the market will not go below 2700.

Fall scenario: stay out of the market, prices are low.

Helium market recommendations:

Purchase: No. Who is in position from 3200, keep stop at 2700. Goal: 5000.

Sale: no.

Support — 2719. Resistance — 3195.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 6.5 th. contracts. There were no buyers, with sellers running in small volumes. Bears are maintaining control.

Growth scenario: we consider March futures, expiration date March 14. We hold the long. Not a bad situation to increase the purchase volume.

Fall scenario: out of the market. Yes, we are not expecting a strong market recovery, but it is likely to happen. Against the backdrop of weather uncertainty, betting on a fall is uncomfortable.

Recommendations for the wheat market:

Purchase: no. Who is in position from 580.0, keep stop at 560.0. Goal: 700.0.

Sale: no.

Support — 593.5. Resistance — 617.2.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 3.8 th. contracts. Both buyers and sellers entered the market. Bears strengthened their advantage.

Growth scenario: we consider the March futures, expiration date March 14. The idea of visiting the level of 420.0 continues to live. Waiting.

Fall scenario: the probability of a move to 420.0 remains. Keep shorting.

Recommendations for the corn market:

Purchase: when approaching 420.0. Stop: 407.0. Goal: 600.0.

Sale: no. Those in position from 470.0, move the stop to 456.0. Goal: 422.0.

Support — 443.7. Resistance — 453.6.

Soybeans No. 1. CME Group

Growth scenario: we consider March futures, expiration date March 14. We continue to refrain from buying. There’s a lot of soybeans. We are likely to break 1200.

Fall scenario: we will continue to keep shorting. Lower levels are also possible. In case of a fall below 1190, we can build up the position.

Recommendations for the soybean market:

Purchase: not yet.

Sale: no. Those in position from 1295.0, move your stop to 1256.0. Goal: 1000.0?!

Support — 1201.7. Resistance — 1248.4.

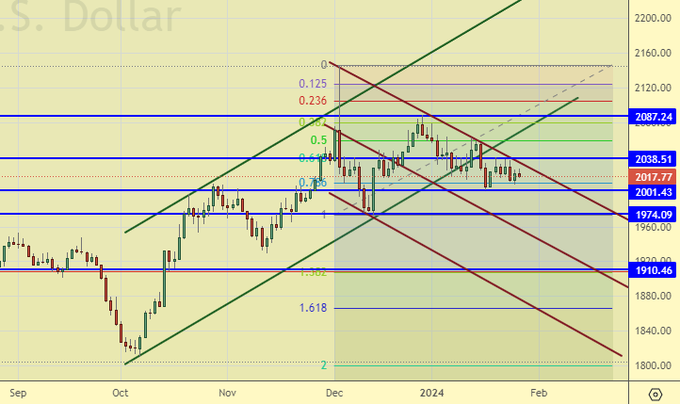

Growth scenario: we can’t get not only above 2050, but also 2040. We continue to refrain from buying. A move to 1910 remains highly probable.

Fall scenario: if the Fed doesn’t cut rates on the 31st it will lead to a move to 1910 and possibly a drop to 1870.

Gold Market Recommendations:

Purchase: no.

Sale: no. Who is on sale from 2090, move the stop to 2047. Goal: 1910 (1810).

Support — 2001. Resistance — 2038.

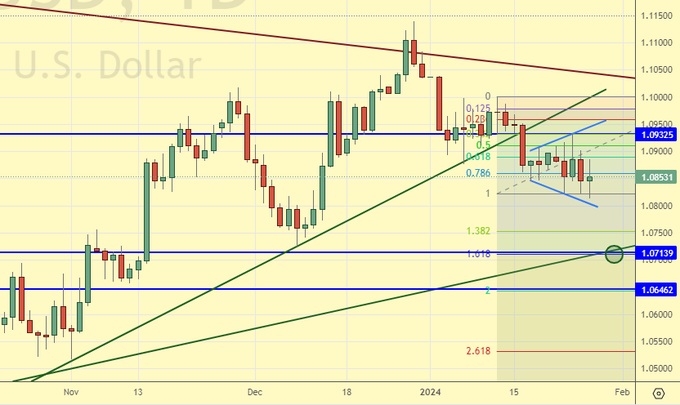

EUR/USD

Growth scenario: we continue to count on touching the level of 1.0720. ECB left the rate unchanged — 4.5%. If the US Fed does the same, we are likely to touch the level of 1.0720, where we can buy.

Fall scenario: keep shorting. There is a prospect of a move to 1.0720.

Recommendations on euro/dollar pair:

Purchase: when approaching 1.0720. Stop: 1.0620. Goal: 1.2000.

Sale: no. Those who are in position from 1.1050, move your stop to 1.0960. Goal: 1.0720 (1.0000?!).

Support — 1.0713. Resistance — 1.0932.

USD/RUB

Growth scenario: in the current situation, we will always have time to buy. So far, we cannot say unequivocally that the ruble is doing badly. Outside the market. In case of growth above 91.60, the mark 97.00 will open.

Fall scenario: a long shadow knocked us out of the short. Let’s try to enter the short again.

Recommendations on dollar/ruble pair:

Purchase: after growth above 91.60. Stop: 89.40. Goal: 97.00 (120.00?!).

Sale: when approaching 91.00. Stop: 92.20. Goal: 85.00 (80.00).

Support — 88.32. Resistance — 91.02.

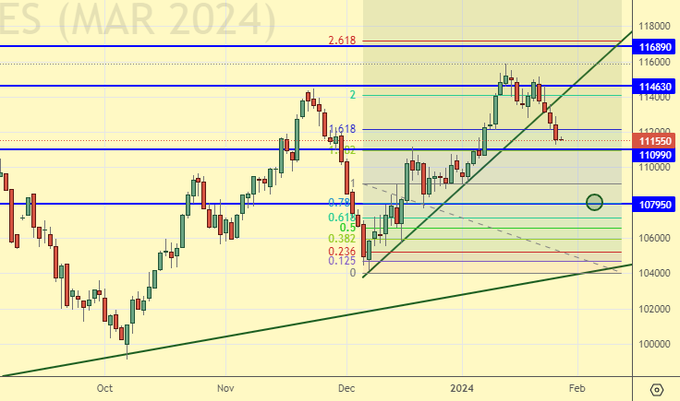

RTSI

Growth scenario: we consider March futures, expiration date March 21. Growth to 125000 is still possible. Here we should look for buying opportunities. At the same time, we note that the sanctions pressure of the West is increasing.

Fall scenario: there are still options that we will reach 117000. From this level it will be possible to sell. We do not sell from the current levels.

Recommendations on the RTS index:

Purchase: when approaching 111000. Stop: 110600. Goal: 124750. Those who are in the position from 112000, move the stop to 110600. Goal: 124750.

Sale: on approach to 117000. Stop: 118600. Goal: 107000?!

Support — 110990. Resistance — 114630.

The recommendations given in this article are NOT a direct guide to action for speculators and investors. All ideas and variants of work on the markets, presented in this material, do NOT have 100% probability of fulfillment in the future. The site does not bear any responsibility for the results of transactions.