Price forecast from 11 to 15 March 2024

-

Energy market:

«Roscosmos» considers the possibility of delivering a nuclear power plant to the Moon in 10 years. The main problem of working on the Moon is that the temperatures there change too much. Therefore, in order to blossom apple trees must constantly maintain a favorable microclimate. The cost of this venture will probably be a trillion rubles, maybe two.

And if you start building a city on the moon, it’s totally expensive. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

As we can see, and without a magnifying glass, the market does not want to react to the shelling of ships in the Red Sea, to the reduction of OPEC oil production, and even to the increase in selling prices for Asia by KSA. Yes, we are above 80.00 in Brent, but at the same time, the bulls’ attempts to rock the market have been unsuccessful so far.

India is now willing to buy oil for rupees from other resource suppliers, not just Russia. Apparently, it likes it. However, KSA, UAE, and Iran have rejected this proposal and for some reason want US dollars. All the more so because Indians will credit rupees to your account, but you cannot withdraw them from the country. Such a clever Indian movie about a very clever raja.

If official statistics are to be believed, we have not yet seen a strong drop in oil production in Russia after the withdrawal of Western oil service companies. The OPEC+ cuts are in hand and everything looks decent so far, but experts are inexorable: without the discovery of new, and most importantly, easily accessible fields with low production costs, we will see a 20% drop in production by 2030, which is not far off.

Grain market:

We saw another USDA report. We see an increase in the forecast for gross harvest of wheat by 0.12% to 786.701 million tons. The gross corn harvest fell by 0.19% to 1230.21 million tons. A 0.34% drop in soybean gross harvest to 396.850 million tons. Overall, the numbers remain strong, but note that soybean expectations were lowered for the second month in a row.

Retail chains in Lithuania, Latvia and Estonia have refused to sell food products from Russia and Belarus. Poles may join this act in the coming weeks. Moscow gets good revenue selling grain and processed products. By banning purchases and making it difficult to allow agro-products to enter their own and neighboring markets, the enemies, now at least it should be written that way, are trying to harm Russia. However, against the background of digging up roads and mining border areas in the Baltics (judging by bloggers’ reports), one should not be surprised by such initiatives.

Cereals in Chicago are trading at low levels. Yes, we can talk about the growing probability of a reversal, but so far we do not see it. At the same time, FOB prices continue to fall and have dropped to $195 per ton from $220. Algeria’s recent purchase of 600,000 tons of milling wheat at $195 ($227 C&F) confirms this.

USD/RUB:

The ruble has been trying to strengthen against the dollar all week. It didn’t work out so well. But, it is worth recognizing that we are gravitating towards the 90.00 area, and this level seems equilibrium. Indeed, as long as oil is above 80.00, we can reason that the ruble does not necessarily need to move towards 100.00.

Note the rise in gold last week. If it continues as a «rally», it could lead to large-scale shifts in the value of currencies. Compact export-oriented economies will benefit. Kuwait, for example.

Recall that Russia has 2,400 tons of gold in its gold reserves. No one has counted how much of it is still in the ground.

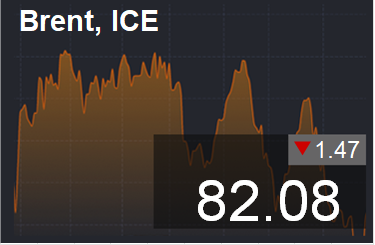

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 21.9 th. contracts. Buyers are leaving the market. Bulls retain the advantage.

Growth scenario: we consider the March futures, expiration date March 28. It is possible to continue holding longs, however, the build-up of the position is not welcome.

Downside scenario: there are suspicions of a possible reversal, but they are still implicit. Out of the market.

Recommendations for the Brent oil market:

Buy: no. Who is in position from 83.55, keep stop at 81.40. Target: 90.45.

Sale: no.

Support — 79.44. Resistance — 85.36.

WTI. CME Group

Fundamental US data: the number of active drilling rigs decreased by 2 units to 504 units.

U.S. commercial oil inventories rose by 1.367 to 448.53 million barrels, with +2.4 million barrels forecast. Gasoline inventories fell by -4.46 to 239.745 million barrels. Distillate stocks fell by -4.131 to 117.01 million barrels. Cushing storage stocks rose by 0.701 to 31.671 mln barrels.

Oil production fell by -0.1 to 13.2 million barrels per day. Oil imports rose by 0.837 to 7.222 million barrels per day. Oil exports fell by -0.091 to 4.637 million barrels per day. Thus, net oil imports rose by 0.928 to 2.585 million barrels per day. Oil refining rose by 3.4 to 84.9 percent.

Gasoline demand increased by 0.546 to 9.013 mln barrels per day. Gasoline production increased by 0.207 to 9.626 mln barrels per day. Gasoline imports rose 0.204 to 0.588 million barrels per day. Gasoline exports increased by 0.03 to 0.782 mln barrels per day.

Distillate demand increased by 0.538 to 4.074 mln barrels. Distillate production increased by 0.056 to 4.345 mln barrels. Distillate imports rose 0.083 to 0.195 million barrels. Distillate exports rose 0.118 to 1.055 million barrels per day.

Demand for refined products increased by 0.765 mln barrels to 20.294 mln barrels. Production of petroleum products increased by 0.346 mln barrels to 21.286 mln barrels. Petroleum product imports rose 0.473 to 1.84 million barrels. Exports of refined products increased by 0.348 to 6.36 mln barrels per day.

Propane demand fell by -0.597 to 0.839 million barrels. Propane production rose 0.033 to 2.515 million barrels. Propane imports rose 0.056 to 0.181 million barrels. Propane exports fell -0.156 to 0.13 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 8.0 th. contracts. Both buyers and sellers walked the market. Sellers did it more actively. Bulls are keeping control.

Growth scenario: we consider April futures, expiration date March 20. We entered the long. We expect the growth to continue. We can hold positions for now.

Downside scenario: refuse to sell for now, however it is possible that we will recommend them in the future.

Recommendations for WTI crude oil:

Buy: on a pullback to 77.00. Stop: 76.30. Target: 90.00. Those who are in position from 79.97, keep stop at 76.30. Target: 90.00.

Sale: no.

Support — 75.50. Resistance — 80.81.

Gas-Oil. ICE

Growth scenario: switched to April futures, expiration date April 11. It is possible to buy, but with a short stop order.

Downside scenario: you can sell. The stop is near. Those who have already sold — hold your positions.

Gasoil Recommendations:

Buy: now (804.25). Stop: 790.0. Target: 1000.00?!

Sell: no. Who is in the position from 825.0 (taking into account the carry on futures), move the stop to 843.0. Target: 760.0.

Support — 777.00. Resistance — 860.75.

Natural Gas. CME Group

Growth scenario: we switched to April futures, expiration date March 26. We continue to be in the falling channel. Out of the market.

Downside scenario: refrain from selling.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 1.591. Resistance — 2.099.

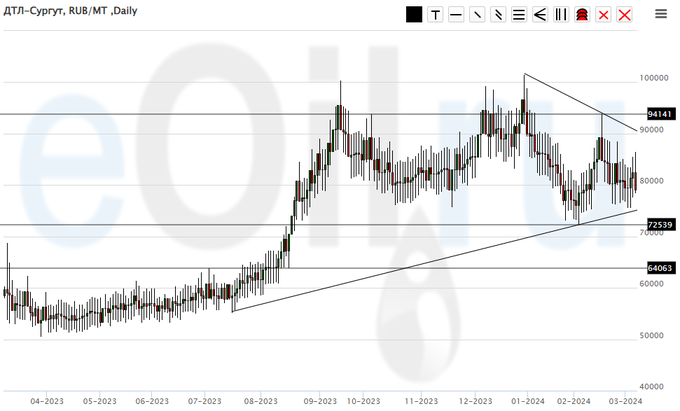

Diesel arctic fuel, ETP eOil.ru

Growth scenario: continue to stay out of the market. Prices are too high for interesting purchases.

Downside scenario: nothing new. Uncomfortable situation for speculations. Even if we fall below 70000, it is unlikely that this fall will continue, for example, to 60000. Diesel is needed now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 72539. Resistance — 94141.

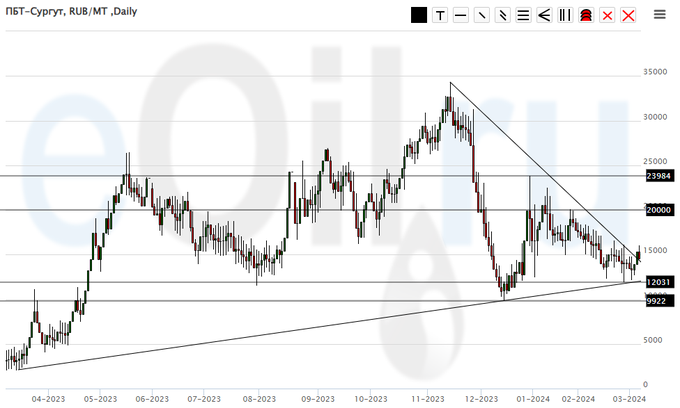

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to hold the long. We never managed to go below 10000. That’s good for the bulls.

Downside scenario: out of the market as there are chances that we will continue to rise.

PBT Market Recommendations:

Buy: No. Who is in position from now 13000, keep stop at 11000. Target: 25000.

Sale: no.

Support — 12031. Resistance — 20000.

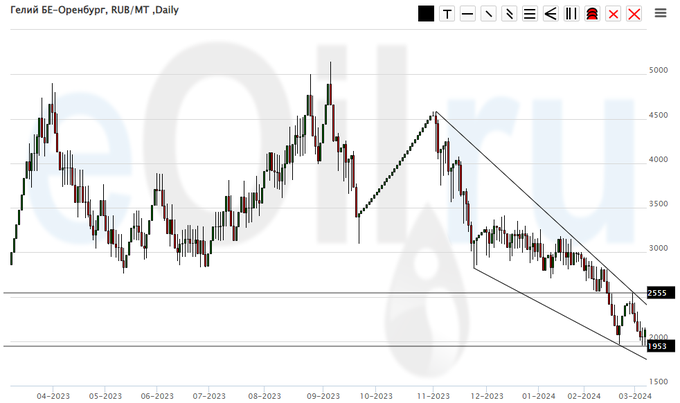

Helium (Orenburg), ETP eOil.ru

Growth scenario: nothing new. We continue to wait patiently for growth. Our stop at 1900 is intact. It should be noted that in case prices continue to fall, we can increase aggression in purchases.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no. Who is in position from 2200 and 2100, keep stop at 1900. Target: 5000.

Sale: no.

Support is 1953. Resistance is 2555.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 8.9 th. contracts. Both sellers and buyers entered the market. Sellers did it in large volumes. Bears keep the control.

Growth scenario: we consider May futures, expiration date May 14. We are waiting for the market at 515.0. We can buy there. There is not much left.

Downside scenario: the market continues to look down. The target at 516.0 looks natural.

Recommendations for the wheat market:

Buy: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sale: no.

Support — 514.7. Resistance — 553.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the last week the difference between long and short positions of asset managers decreased by 2.2 th. contracts. Both sellers and buyers left the market in insignificant volumes. Bears keep control.

Growth scenario: we consider the May futures, expiration date May 14. We will continue to wait for lower levels for long entry.

Downside scenario: and we started to grow. Out of the market for now.

Recommendations for the corn market:

Buy: when approaching 370.0, add at 350.0 aggressively. Stop: 320.0. Target: 500.0. Consider the risks!!!

Sale: no.

Support — 432.6. Resistance — 447.5.

Soybeans No. 1. CME Group

Growth scenario: we consider the May futures, expiration date May 14. Above! We’re still going up. Who would have thought? Our cautious buying has begun to pay off.

Downside scenario: we won’t say anything new. If we grow to 1230, it makes sense to look for selling opportunities. We are not selling yet.

Recommendations for the soybean market:

Buy: no. Who is in position from 1141.6, move the stop to 1130.0. Target: 1230.0.

Sale: not yet.

Support — 1126.7. Resistance — 1189.4.

Growth scenario: the market broke through 2100 without a wince and went… we still think to 2400. Buy on pullbacks.

Downside scenario: refrain from selling. It is not excluded that for a long period of time.

Gold Market Recommendations:

Buy: on a pullback to 2100. Stop: 2060. Target: 2400.

Sale: no.

Support — 2078. Resistance — 2220.

EUR/USD

Growth scenario: keep longs. We continue to grow and claim a rise above 1.1000.

Downside scenario: let’s give up selling for now. It is not excluded that the dollar will have problems in the near future.

Recommendations on euro/dollar pair:

Buy: no. Those who are in position from 1.0722, move the stop to 1.0810. Target: 1.2000.

Sale: no.

Support — 1.0887. Resistance — 1.1019.

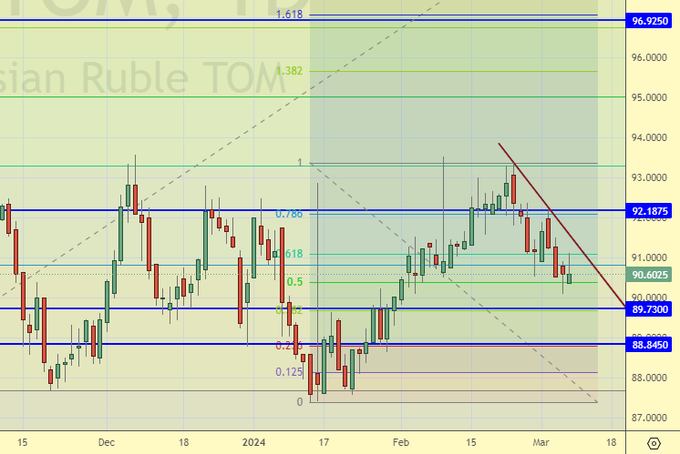

USD/RUB

Growth scenario: in case of growth above 92.30 we will resume buying. Out of the market for now.

Downside scenario: we would be happy to go short on the dollar if the domestic economic situation was softer. Off-market.

Recommendations on dollar/ruble pair:

Buy: no.

Sale: no.

Support — 89.73. Resistance — 92.18.

RTSI

Growth scenario: we are looking at the March futures, expiration date March 21. And we closed above 115000… who would have thought it. That opens the way to 116700. Only above that, we can’t see the market. We’re not buying. Only if the dollar starts a total fall to all currencies, we can talk about some other marks, for example, 120000.

Downside scenario: selling from 116700 makes sense.

Recommendations on the RTS index:

Buy: no.

Sell: on a move to 116700. Stop: 117700. Target: 110800.

Support — 115440. Resistance — 113300.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.