|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-29-april-to-3-may-2024/318894/

|

Energy market:

In the Yamalo-Nenets Autonomous District, locals found oil in a hole in a river. Everyone got excited and worried. Called a helicopter. Reindeer herders, paratroopers, everyone who was at hand. And it turned out to be some kind of algae. It dries up and turns from brown to green.

Well, that’s okay. There’s always hope. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

According to most public reports, Russia has managed to maintain high levels of oil sales on the world market. Heavy crude, including Urals, has been in high demand in recent weeks, all because the Americans for some reason have fallen out with Venezuela again. But they will come back to Maduro and he will accept them, because money, but later. Also the demand for heavy oil is provided by the fable that, say, summer is coming soon, we will need a lot of fuel oil for power plants, otherwise air conditioners will have nothing to work on. What if the summer will be cold, why do they expect hot summer?

The UAE has started exporting Iraqi oil. People say about such people, “you live richly”. They used to run Russian oil through themselves, and now Iraqi oil. We, they say, are loading our refineries. Well done. What the hell. Soon Iranian oil will also be accepted, Tehran is already in line for sanctions, brand it “Murban grade” and go on, on camels and to Lisbon.

Grain market:

Folks are starting to play up the rising temperatures in some regions of the planet, which could negatively impact the overall gross harvest. This is what the bulls do every year, causing terror before the USDA report in May. Yes, perhaps in some distant Morocco, where it is located, it is necessary to clarify on the map, plus in the south of Russia, there is little moisture. Well, how can these 5 million tons that will disappear affect prices? It’s very simple: you need to write more about it and stir up terror. And it is better not to mention the fact that Germany and Scandinavia have plenty of moisture, because it does not fit into the artificially created agenda.

Yes, if the Red Sea is completely closed to shipping, it will be a blow to logistics and we might be at 700 then. On the other, totally pragmatic side, the sooner the highly agitated get each other over, the sooner peace will come and things will get better again.

Note that 790 million tons of wheat is enough for the planet and there will be more left, while the latest IGC forecast is 798 million tons. The current price rise is a bullish prank and nothing more. If we are at 650.0, we can think about shorts.

USD/RUB:

Nabiullina, left the rate unchanged. It still stands at 16%. So far we can hope, but not expect, that inflation will slow down in the second half of the year. But this may not happen, and then we can expect further tightening of the MPC. I would not like that, frankly speaking, because at such a rate we can put a cross on the country’s development.

Judging by the RGBI index, our debt securities are of little use to anyone. Their prices continue to fall. This is unnerving, because quotes, not bloggers, tell us that market professionals do not see the sense in buying something (SU26233RMFS5) even at a 39% discount and a yield of 6.1% per annum. The paper’s yield at the current price of 59.12 is 13.61%. Little.

Without demand for rubles in the debt market, the ruble’s appreciation against other currencies will be weak. Yes, a strongly positive trade balance could help, but not with the current appetite for imported goods.

Powell may add rigor on Wednesday, which will be positive for the dollar. However, his eloquence should not affect the USDRUB pair.

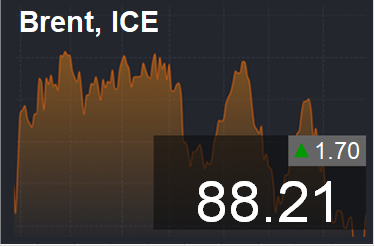

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 33.2 thousand contracts. The number of buyers decreased sharply. Sellers have been inert. Buyers are controlling the situation.

Growth scenario: we consider May futures, expiration date May 31. We do not buy. We wait for a pullback to 81.00. And then we can go to 120.00.

Downside scenario: we will keep shorting from 89.50 (90.10 on the previous contract). It is possible that we will manage to go down to 81.00.

Recommendations for the Brent oil market:

Buy: when approaching 81.00. Stop: 79.00. Target: 120.00!

Sell: no. Those who are in the position from 89.50 (taking into account the transition to the current contract), move the stop to 90.10. Target: 81.00.

Support — 85.09. Resistance — 91.21.

WTI. CME Group

US fundamentals: the number of active rigs fell by 5 to 506.

U.S. commercial oil inventories fell by -6.368 to 453.625 million barrels, with a forecast of +1.6 million barrels. Gasoline inventories fell -0.634 to 226.743 million barrels. Distillate stocks rose 1.614 to 116.582 million barrels. Cushing storage stocks fell by -0.659 to 32.367 million barrels.

Oil production remained unchanged at 13.1 million barrels per day. Oil imports increased by 0.036 to 6.497 million barrels per day. Oil exports rose by 0.453 to 5.179 million barrels per day. Thus, net oil imports fell by -0.417 to 1.318 million barrels per day. Oil refining rose by 0.4 to 88.5 percent.

Gasoline demand fell -0.239 to 8.423 million barrels per day. Gasoline production fell -0.275 to 9.142 million barrels per day. Gasoline imports rose -0.071 to 0.78 million barrels per day. Gasoline exports fell -0.048 to 0.778 million barrels per day.

Distillate demand fell by -0.114 to 3.552 million barrels. Distillate production rose by 0.178 to 4.779 million barrels. Distillate imports fell -0.011 to 0.138 million barrels. Distillate exports fell -0.344 to 1.134 million barrels per day.

Demand for petroleum products increased by 0.315 to 19.535 million barrels. Production of petroleum products increased by 0.784 to 21.869 million barrels. Petroleum product imports rose 0.114 to 1.967 million barrels. Exports of refined products increased by 0.542 to 6.915 million barrels per day.

Propane demand fell by -0.236 to 0.439 million barrels. Propane production rose 0.088 to 2.823 million barrels. Propane imports rose 0.006 to 0.091 million barrels. Propane exports rose 0.76 to 2.335 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 24.4 th. contracts. Buyers are fleeing. Sellers too, but in several times smaller numbers. Bulls keep control.

Growth scenario: we consider June futures, expiration date May 21. The market is high. A correction is needed for new purchases. We are waiting for the market at 76.00.

Downside scenario: we will keep the short, which we opened earlier. The market is able to roll back before the next saber dance.

Recommendations for WTI crude oil:

Buy: ideal on a pullback to 76.20. Stop: 75.20. Target: 100.00.

Sell: no. Those who are in the position from 85.66, keep the stop at 85.76. Target: 76.20 (revised).

Support — 80.76. Resistance — 86.99.

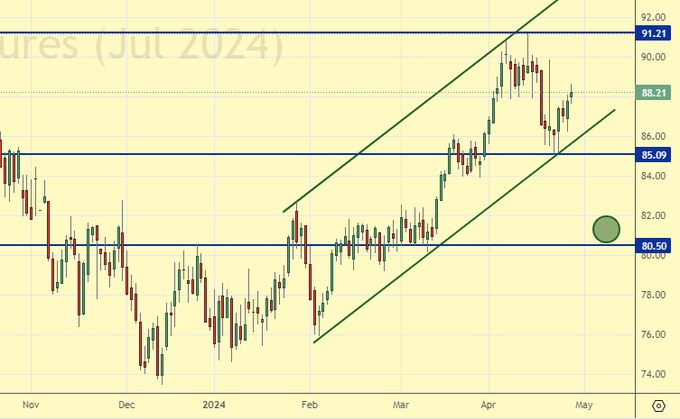

Gas-Oil. ICE

Growth scenario: we consider May futures, expiration date May 10. It is possible to buy now. We will keep the long opened earlier. From 743.00, of course, is more interesting, but these levels for purchases can be considered as working ones.

Downside scenario: the market has not given us 880.00 yet. We are waiting for it to do so.

Gasoil Recommendations:

Buy: no. Those in position from 781.00, move stop to 762.00. Target: 880.00.

Sell: to think when approaching 880.00.

Support — 765.50. Resistance — 814.25.

Natural Gas. CME Group

Growth scenario: we consider June futures, expiration date May 29. We hold the long opened earlier. We hope for an upward bounce.

Downside scenario: refrain from selling, market is low.

Natural Gas Recommendations:

Buy: no. Those in position from 1.988, move your stop to 1.780. Target: 3.000?!

Sale: no.

Support — 1.905. Resistance — 2.137.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we are above 82000, we don’t think about buying. At the same time: purchases from 62000 are welcome.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: on approach to 62000. Stop: 58000. Target: 100000!

Sale: no.

Support — 61523. Resistance — 75352.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: and again we will be persistent in buying, but only after rising above 11000. We will stop burying sooner or later.

Downside scenario: we stay out of the market. A move to 5000 is possible, but selling is risky now. It is better to be in commodities than in cash.

PBT Market Recommendations:

Buy: in case of growth above 11000. Stop: 8800. Target: 25000. You can be aggressive.

Sale: no.

Support — 6846. Resistance — 9922.

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market gives us a chance to take it at a low price. Those who wish can buy, we will keep longs.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no. Who is in position from 1450, 1500 and 1600, keep stop at 1300. Target: 3500.

Sale: no.

Support — 1352. Resistance — the area of 1967.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 20 th. contracts. Buyers entered the market, sellers fled. Bears are maintaining control.

Growth scenario: switched to July futures, expiration date July 12. Hot weather provoked the growth. Off-market.

Downside scenario: rise from 550.0. This is unexpected, and not too justified. It looks like a collection of stop orders. Sell.

Recommendations for the wheat market:

Buy: no.

Sell: Now (622.2). Stop: 643.0. Target: 450.0?!

Support — 585.4. Resistance — 632.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 45.7 thousand contracts. Sellers scattered. Buyers entered the market. The volumes are substantial. Bears are still in control.

Growth scenario: we switched to the July futures, expiration date July 12. As before, we have very low hopes for continued growth. Prospects for corn are good despite the reduction of areas in the USA. The upward move can take place only on the breakdown of sellers’ stop orders.

Downside scenario: we suggest shorting, but only in case of falling below 432.0.

Recommendations for the corn market:

Buy: no. Who is in the position from 442.0 (taking into account the transition to a new contract), move the stop to 432.0. Target: 500.0.

Sell: in case of falling below 432.0. Stop: 454.4. Target: 360.0!!!

Support — 435.6. Resistance — 460.2.

Soybeans No. 1. CME Group

Growth scenario: we consider July futures, expiration date July 12. Buying is very doubtful with IGC’s soybean forecast of 413 million tons.

Downside scenario: managed to cling to the shorts. Let’s see what happens. Target is 980.0.

Recommendations for the soybean market:

Buy: thinking strongly after rising above 1200.

Sell: no. Those who are in position from 1185.0, move the stop to 1196.0. Target: 980.00.

Support — 1141.0. Resistance — 1191.0.

Growth scenario: we are waiting for, or rather want, a significant correction, then we can talk about buying.

Downside scenario: we have caught from the area of 2420. It is possible to keep shorts. Those who wish can enter shorts from 2380, if the market will let them.

Gold Market Recommendations:

Buy: from 2100 would be interesting, from 2000 would be perfect.

Sell: No. Those who are in position from 2415, move the stop to 2400. Target: 2100 (2000).

Support — 2223. Resistance is 2352.

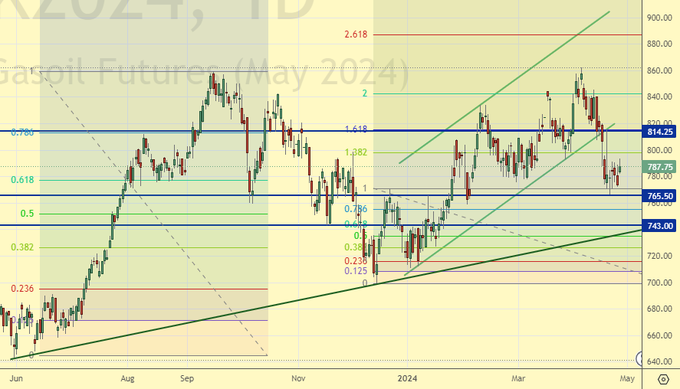

EUR/USD

Growth scenario: you should not buy now. The euro will be under pressure amid continued high interest rates in the US.

Downside scenario: keep shorting. At the same time, we understand that a surge to 1.0800 is possible on Wednesday, May 1. Fed meeting.

Recommendations on euro/dollar pair:

Purchase: no.

Sell: when approaching 1.0800. Stop: 1.0860. Target: 1.0000. Those who are in the position from 1.0690, keep the stop at 1.0860. Target: 1.0000. Consider the risks!

Support — 1.0678. Resistance — 1.0802.

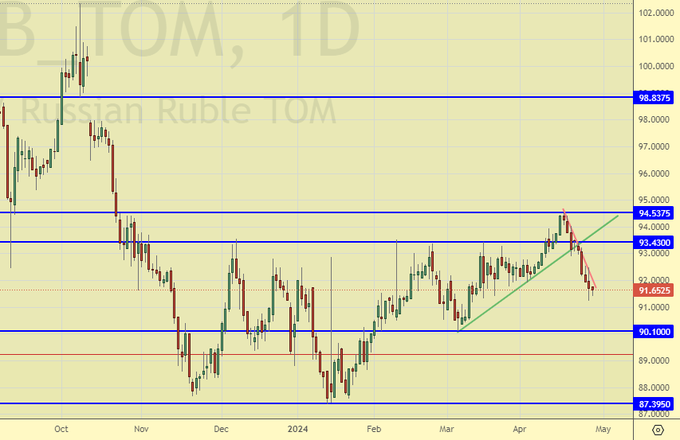

USD/RUB

Growth scenario: somewhat fearful for our positions with stop order at 90.00. It is worth recognizing that the market is behaving aggressively.

Downside scenario: exporters have finished selling foreign currency before the next tax period. And we will not sell dollars.

Recommendations on dollar/ruble pair:

Buy: no. Who is in position from 92.79 and 92.90, keep stop at 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: no.

Support — 90.10. Resistance — 93.43.

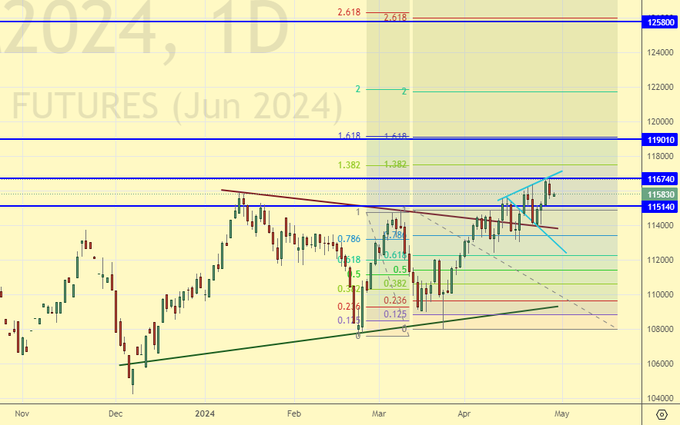

RTSI

Growth scenario: we consider June futures, expiration date June 20. We are growing very sluggishly. Jumps and deep pullbacks do not inspire optimism. We are looking for other markets.

Downside scenario: frozen in a way that couldn’t be worse. Complete equilibrium. No recommendations.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 115140. Resistance — 116740.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.