27 March 2023, 12:53

Price forecast from 27 to 31 of March 2023

-

Energy market:

Following the Swiss bank Credit Swiss may fall and others. The American and European banking systems must figure out what to do: either flood all the problems with money, and then you need to print trillions, or let the situation develop in an arbitrary way. Only the strong survive.

Trillions of dollars, it’s such a headache, it’s such nerves. Let’s be modest, a few billion will suffice. Is it true? Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Until preliminary data on US and Chinese GDP for the first quarter come in, economists in high positions can afford to speculate about growth, that everything is fine with us.

But the oil market shows that no one expects great demand for raw materials. If the madhouse with Western banks continues, it is unlikely to have a positive impact on the entire economy. The inability of oil to pass to the level of 100.0 tells us that the probability of a recession is very high.

OPEC+ countries, including Russia, plan to uphold the decision to reduce oil production by 2 million barrels per day until the end of 2023. No further reductions are planned. The cartel believes that the current price cuts are speculation. This means that strategists see prices returning to the corridor of 80-90 dollars per barrel after some time.

Reading our forecasts, you could make money on the Brent oil market by taking a move down from 80.00 to 70.10 dollars per barrel. You could also earn by buying PBT (Surgut) on the eOil.ru site at 2600 and fix the profit at the level of 7500 rubles per ton.

Grain market:

A number of farmers in Russia have found themselves in a difficult position due to the inability to sell their grain. Money is needed to carry out the sowing campaign, but at the moment all the demand within the country is satisfied, and exporters are physically unable to take more than 4 million tons per month. So, only in the Rostov region remains in the form of surpluses of 5 million tons of wheat.

Stocks at the end of the season are estimated at almost 20 million tons, which will create problems with the acceptance of a new crop for storage, provided that it is comparable to last year’s crop.

Despite the current situation, the Ministry of Agriculture of the Russian Federation suggested the suspension of exports due to falling wheat prices. This news immediately lifted quotes. So far, wheat is unable to gain a foothold in Chicago below 650.0 cents per bushel, which is broadly in line with our expectations for this crop.

USD/RUB:

The US Federal Reserve raised the rate by 0.25% to 5%. At the same time, Powell was told that he would continue to fight inflation. Note that as long as the US labor market remains strong, nothing can stop the Fed from raising rates. The chairman did not directly link the problem with the Silicon Valley bank to the rate. Most likely, middle-sized banks should not wait for help from the Fed.

The ruble remains in a rather difficult position. We have not seen any significant corrections over the past week, which suggests continued weakening of the national currency against the backdrop of an increase in the budget deficit.

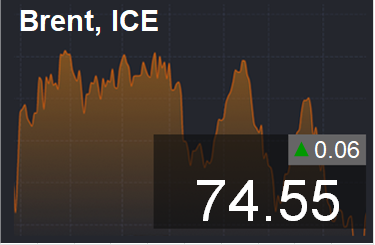

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers has decreased by 60.9 thousand contracts. The change is huge. Buyers continue to flee the market while sellers actively enter it. The spread between long and short positions has narrowed significantly. There are most bulls on the market, but a sharp change of mood is visible.

Growth scenario: we are considering the April futures, the expiration date is April 28. From 70.00 you could buy. Now we have to wait for the approach to 79.00.

Fall scenario: a new round of sales can be made from the area of 79.00 — 80.00. The move to 66.64 is not out of the question.

Recommendations for the Brent oil market:

Purchase: no. Who bought from 70.10 move the stop to 70.40. Target: 79.00 (110.00).

Sale: when approaching 79.00 and 80.00. Stop: 81.70. Target: $66.64 per barrel.

Support — 70.03. Resistance — 79.06.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 4 units and now stands at 593 units.

Commercial oil reserves in the US increased by 1.117 to 481.18 million barrels, while the forecast was -1.565 million barrels. Inventories of gasoline fell -6.399 to 229.598 million barrels. Distillate inventories fell -3.313 to 116.402 million barrels. Inventories at Cushing fell -1.063 to 36.849 million barrels.

Oil production increased by 0.1 to 12.3 million barrels per day. Oil imports fell by -0.044 to 6.172 million barrels per day. Oil exports fell by -0.095 to 4.932 million barrels per day. Thus, net oil imports rose by 0.051 to 1.24 million barrels per day. Oil refining increased by 0.4 to 88.6 percent.

Gasoline demand rose by 0.366 to 8.96 million barrels per day. Gasoline production increased by 0.392 to 9.503 million barrels per day. Gasoline imports rose by 0.021 to 0.471 million barrels per day. Gasoline exports rose by 0.001 to 0.892 million barrels per day.

Demand for distillates rose by 0.238 to 3.974 million barrels. Distillate production increased by 0.075 to 4.503 million barrels. Distillate imports rose by 0.067 to 0.222 million barrels. Exports of distillates rose by 0.016 to 1.225 million barrels per day.

Demand for petroleum products increased by 0.913 to 20.026 million barrels. Production of petroleum products increased by 0.524 to 21.029 million barrels. Imports of petroleum products rose by 0.608 to 2.077 million barrels. The export of oil products increased by 0.809 to 7.012 million barrels per day.

Demand for propane rose by 0.321 to 1.034 million barrels. Propane production fell by -0.033 to 2.4 million barrels. Propane imports fell -0.052 to 0.115 million barrels. Propane exports rose by 0.048 to 1.804 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 44.1 thousand contracts. The change is significant. Sellers actively entered the market. Buyers were reluctant to close their positions. The spread between long and short positions narrowed. Bulls continue to control the situation, but their dominance is under threat.

Growth scenario: we are considering the May futures, the expiration date is April 20. If we fall to 60.00 you can buy. It would be convenient to work out purchases from current levels on the watch.

Fall scenario: We are capable of falling towards 60.00 with the possibility of a rise to the 75.00 area from which there will be a new round of decline cannot be denied.

Recommendations for WTI oil:

Purchase: when approaching 60.00. Stop: 58.40. Target: 100.00.

Sale: when approaching 75.00. Stop: 77.00. Target: 60.10. Who remained in the position from 74.00, keep the stop at 72.70. Target: $60.10 per barrel.

Support — 64.28. Resistance is 71.71.

Gas-Oil. ICE

Growth scenario: we are considering the April futures, the expiration date is April 12. You can buy at current levels. We can go up to 825.0, maybe 850.0.

Fall scenario: we will continue to keep short with the target at 670.0. Consider selling from 850.0 if the market allows.

Gasoil recommendations:

Purchase: now. Stop: 748.0. Target: 850.0.

Sale: no. Who is in position from 900.0, keep the stop at 810.0. Target: 670.0.

Support — 749.00. Resistance is 857.50.

Natural Gas. CME Group

Growth scenario: we are considering the May futures, the expiration date is April 26. Here you have to fight for long. We will buy again.

Fall scenario: there is no point in selling. Prices are low.

Recommendations for natural gas:

Purchase: now. Stop: 2.238. Target: 4,000 (8,000?!).

Sale: no.

Support — 2.243. Resistance — 3.160.

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: buys can be recommended. We are able to return to 65,000. Stronger growth will be called into question for now.

Fall scenario: further sales with speculative purposes are not interesting. Buyers cheerfully take diesel in the region of 55000.

Diesel market recommendations:

Purchase: now. Stop: 52000. Target: 65000.

Sale: no.

Support — 52549. Resistance — 62480.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: after the current flight up, the market needs to cool down. We are able to fall to 5000, after which the growth can continue.

Fall scenario: we refuse to sell for now, although the current situation makes us think about looking for options to enter a short position.

Recommendations for the PBT market:

Purchase: when approaching 5000. Stop: 3000. Target: 15000.

Sale: no.

Support — 4751. Resistance — 12754.

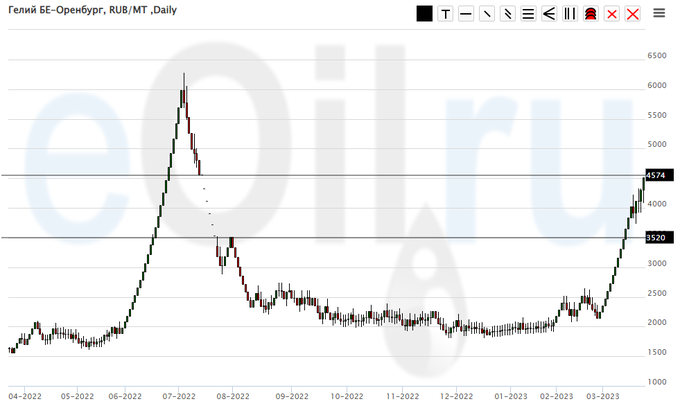

Helium (Orenburg), ETP eOil.ru

Growth scenario: against expectations, the market went to 4500 without correction, which created a strong overbought situation. We do not enter long.

Fall scenario: we have come to the 4500 area, now we need to see one red candle in order to start selling.

Recommendations for the helium market:

Purchase: no.

Sale: in the current area when a red daily candle appears. Stop above its maximum. Target: 2700 (2300) rubles per cubic meter.

Support — 3520. Resistance — 4574.

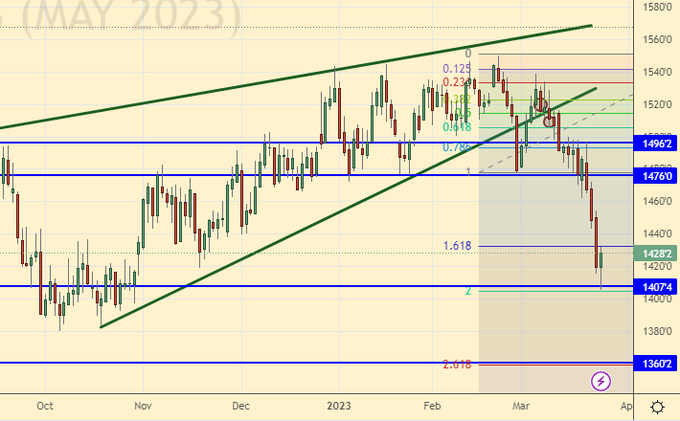

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 9,000 contracts. Sellers left the market, buyers entered it in small volumes. The spread between short and long positions narrowed. Sellers keep the edge.

Growth scenario: consider the May futures, the expiration date is May 12. The market tested the 650.0 mark for strength, but could not go lower. We will buy again. Target at 770.0 remains.

Fall scenario: we need a rise to 770.0 in order to sell from this mark with a target at 600.0.

Recommendations for the wheat market:

Purchase: now. Stop: 644.0. Target: 770.0.

Sale: when approaching 770.0. Stop: 790.0. Target: 600.0.

Support — 654.0. Resistance is 719.0.

We look at the volume of open interest of managers in corn. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. The sellers seized the initiative from the buyers. Over the past week, the difference between long and short positions of managers has decreased by 14 thousand contracts. A small number of buyers entered the market, sellers left the market. The spread between long and short positions narrowed. Sellers control the market, but their advantage is not great.

Growth scenario: consider the May futures, the expiration date is May 12. Despite Friday’s green candle, we will continue to refuse to go long in corn. There is a lot of it and the growth in this culture looks unreasonable.

Fall scenario: continue to hold shorts. We have come to 650.0. You can sell here and when approaching 660.0.

Recommendations for the corn market:

Purchase: no.

Sale: now and when approaching 660.0. Stop: 670.0. Target: 550.0 cents per bushel. Who is in position from 688.0, move the stop to 670.0. Target: 550.0 cents per bushel.

Support — 623.2. Resistance — 648.4.

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. The market began to bring our idea to life. So far we refrain from buying, but from 1360.0 it is already possible to go long.

Fall scenario: keep holding shorts with 1,000 cents per bushel targets. If the market gives the opportunity, then you can close part of the position at 1360.0.

Recommendations for the soybean market:

Purchase: when approaching 1360.0. Stop: 1340.0. Target: 1420.0.

Sale: when approaching 1480.0. Stop: 1510.0. Target: 1360.0 (1000.0). Those in positions between 1540.0 and 1530.0 move the stop to 1510.0. Target: 1360.0 (1000.0) cents per bushel.

Support — 1407.4. Resistance — 1476.0.

Growth scenario: we do not deny a rollback to 1860 and even to 1730. Most likely we will see a fall in the US stock market next week, which may pull gold down at first.

Fall scenario: failure to rise above 2010 provokes us into a sell entry. We do not expect a deep dive, but the move to 1730 is also money.

Recommendations for the gold market:

Purchase: no. If you are in position from 1960, move your stop to 1940. Target: $2500 (3000) per troy ounce.

Sale: now. Stop: 2007. Target: 1730. Count the risks.

Support — 1960. Resistance — 2010.

EUR/USD

Growth scenario: the growth of the pair has stopped. We are able to go above 1.1000 if problems in the US banking sector escalate. We hold longs, but we will tighten the stop orders.

Fall scenario: The Fed has raised rates. The euro bears launched a counterattack. Let’s support them.

Recommendations for the EUR/USD pair:

Purchase: no. Who is in position from 1.0600, move the stop to 1.0610. Target: 1.2000.

Sale: now. Stop: 1.0947. Target: 1.0480 (1.0120).

Support — 1.0511. Resistance is 1.0931.

USD/RUB

Growth scenario: There is no doubt that we are headed for 88.00. Oil did not go to 100.00, which will put pressure on the ruble. We hold longs.

Fall scenario: very vague signs of a market reversal to the downside. Can be sold with little risk.

Recommendations for the dollar/ruble pair:

Purchase: no. Who is in position from 76.70, keep the stop at 74.40. Target: 88.00.

Sale: now. Stop: 77.17. Target: 73.00.

Support — 74.71. Resistance — 79.61.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. Technically, the market is ready to grow further, but it has little fundamental positive. The level of 102000 is the only thing we can see within the current growth. 112000 will be just a miracle.

Fall scenario: those who wish can sell at current levels. Further growth is not obvious.

Recommendations for the RTS index:

Purchase: now. Stop: 95400. Target: 112000.

Sale: now. Stop: 101000. Target: 80000 (50000, then 20000) points. Who is in position from 106000, 103000, 101000 and 98000, keep the stop at 101000. Target: 80000 (50000, then 20000) points.

Support — 93980. Resistance — 99730.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.