20 September 2021, 10:45

Price forecast from 20 to 24 of September 2021

-

Energy market:

The oil market is stable. It is possible that in winter Europe and the United States will have an increased demand for any type of fuel. Fear of cold weather will support oil prices in the medium term. At the moment there is a chance to reach the level of $ 80.00 per barrel of Brent oil. Climbing higher will be extremely difficult.

On September 22, on Wednesday, a regular meeting of the Fed will take place. The slowdown in US inflation and the sharp decline in the number of new jobs created in August tell us that there will be no reason for Mr. Powell to raise the rate and roll back the quantitative easing program.

In the current environment, the dollar may strengthen against other currencies. At the same time, we note that currency pairs on FOREX can measure against each other by the degree of their own emptiness, but this tug-of-war should not lead to a decrease in the cost of minerals and agricultural goods. In the current situation, even in the event of an increase in the rate in America, which is not even discussed at the moment, the fall in prices for a commodity group will be regarded as the last provocation of the current elites against the background of flooding old problems with new money.

By reading our projections, you could have made money in the natural gas market by going up from 3.650 to 5.400 per 1 million British thermal units. Also, you could make money on the RTS Index futures by taking a move up from 165,000 to 175,000.

Grain market:

The cereal market went up a week after the publication of the USDA report. The growth does not look strong yet, but we can already state that the bearish reaction to the information about the volumes of the new harvest has passed. Further, market participants will assess whether consumption will grow or not in the fall and winter. Most likely, states will increase their own stocks amid uncertainty with COVID-19, which will support prices. More globally, we note: if we take into account that the population on Earth is growing at a rate of almost 3 children per second, then an increase in food consumption is inevitable.

USD/RUB:

Elections in Russia. In the event of a significant redistribution of seats between parties in the State Duma, the ruble may react with a fall. If there are no significant changes, the situation on the foreign exchange market will remain stable.

Strengthening the dollar against other currencies will be difficult if we do not hear from the Fed on Wednesday hints to curtail the program to buy back assets of $ 120 billion per month.

On the other hand, what is 120 billion, when the Biden administration wants to scrape together 3.5 trillion on bridges, roads, child benefits and villas in California, no, villas not for children, villas for themselves.

In 100 dollar bills, 3.5 trillion is 35 thousand tons of colored paper, taking into account that 1 million dollars is 10 kilograms. The advantage of electronic money is that at least there is no need to cut down trees.

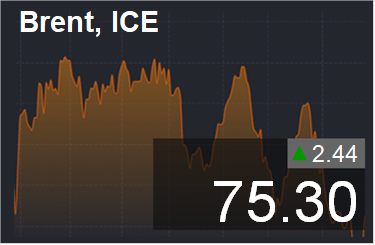

Brent. ICE

We’re looking at the volume of open interest of Brent. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 15.4 thousand contracts. The bulls were actively entering the market. At the same time, the exodus of sellers was not massive, which indicates the confidence of some bears in the fall in prices.

Growth scenario: September futures, expiration date September 30. The market is looking at 80.00. You can buy here. We hold previously opened positions.

Falling scenario: only when the market approaches 80.00 does it make sense to sell. While the bulls are in complete control of the situation. Recommendation:

Purchase: now. Stop: 73.10. Target: 80.00. Those who are in the position from 74.00, move the stop to 73.10. Target: 80.00.

Sale: on touch 80.00. Stop: 81.30. Target: 68.00.

Support — 74.46. Resistance — 76.63.

WTI. CME Group

Fundamental data from the USA: the number of active drilling rigs increased by 10 units and is 411 units.

Commercial oil reserves in the US fell by -6.422 to 417.445 million barrels, while the forecast was -3.544 million barrels. Gasoline inventories fell -1.857 to 218.142 million barrels. Distillate stocks fell -1.689 to 131.897 million barrels. Cushing’s stocks fell -1.103 to 35.316 million barrels.

Oil production increased by 0.1 to 10.1 million barrels per day. Oil imports fell by -0.049 to 5.761 million barrels per day. Oil exports rose 0.282 to 2.624 million barrels per day. Thus, net oil imports fell by -0.331 to 3.137 million barrels per day. Oil refining increased by 0.2 to 82.1 percent.

Gasoline demand fell by -0.716 to 8.892 million barrels per day. Gasoline production fell by -0.851 to 9.271 million barrels per day. Gasoline imports fell by -0.261 to 0.638 million barrels per day. Gasoline exports fell by -0.1 to 0.634 million barrels per day.

Distillate demand rose 0.11 to 3.795 million barrels. Distillate production fell by -0.029 to 4.156 million barrels. Distillate imports rose 0.022 to 0.164 million barrels. Distillate exports fell by -0.323 to 0.767 million barrels per day.

The demand for petroleum products fell by -0.043 to 19.911 million barrels. Production of petroleum products fell by -0.148 to 20.618 million barrels. Imports of petroleum products fell by -0.509 to 1.998 million barrels. Exports of petroleum products fell -1.29 to 4.493 million barrels per day.

Propane demand rose 0.027 to 0.888 million barrels. Propane production fell by -0.077 to 2.217 million barrels. Propane imports fell by -0.021 to 0.074 million barrels. Propane exports fell by -0.112 to 1.3 million barrels per day.

We’re looking at the volume of open interest of WTI. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 22.8 thousand contracts. According to the data, active traders have turned over. How many contracts were closed down, the same amount were opened up. While the bulls run the show.

Growth scenario: November futures, the expiration date is October 20. Prices did not manage to close above 73.00, which gives rise to some doubts about the growth, but in general, the situation is behind the bulls.

Falling scenario: sellers have released the situation out of control as prices exited the falling channel upwards. We do not sell.

Recommendation:

Purchase: Think after the daily candle closes above 73.00. Stop: 70.30. Target: 78.00. Consider the risks!

Sale: no.

Support — 70.63. Resistance — 73.22.

Gas-Oil. ICE

Growth scenario: October futures, the expiration date is October 12. We did not believe in the growth of the market, but he picked up and lifted his nose. If there is a rollback to 610.0, we will buy it.

Falling scenario: the short from 660.0 looks good. We consider sales from lower levels to be premature.

Recommendation:

Purchase: on a rollback to 610.0. Stop: 590.0. Target: 665.0.

Sale: on touch 660.0. Stop: 680.0. Target: 570.00. Support — 619.00. Resistance — 636.75.

Natural Gas. CME Group

Growth scenario: October futures, expiration date September 28. The market reached our target at 5.40. If there is a rollback to 4.20, you can buy again. The gas situation in Europe will be difficult for the entire heating season.

Falling scenario: we refuse to sell. The gas situation in the Old World is not improving. Recommendation:

Purchase: on touch 4.220. Stop: 3.800. Target: 6.000.

Sale: no.

Support — 4.226. Resistance — 5.650.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 12.4 thousand contracts. At the beginning of the week, speculators did not believe in the growth of quotations and closed buy positions. In fact, we see a rise in prices. If sellers increase pressure here, prices may turn down.

Growth scenario: December futures, expiration date December 14. If the day closes above 715.0, we will buy.

Falling scenario: selling from current levels is both interesting and provocative. Let’s go in short. Recommendation:

Purchase: after the close of the day above 715.0. Stop: 677.0. Target: 925.0.

Sale: now. Stop: 719.0. Target: 652.0.

Support — 676.4. Resistance — 716.6.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 4.4 thousand contracts. Speculators left the market, taking a wait and see attitude. The current rise in prices does not seem necessary, as the market sentiment is mixed.

Growth scenario: December futures, expiration date December 14. Let’s keep last week’s recommendation: if prices rise above 558.0, we will buy. The second option for buying is a drop in prices to 430.0.

Falling scenario: keep short from 584.0. The situation now is such that we cannot deny the appearance of another downward price branch. Recommendation:

Purchase: think after a rise above 558.0.

Sale: no. Those who are in positions between 570.0, 560.0 and 584.0, move the stop to 558.0. Target: 430.0.

Support — 520.2. Resistance — 537.6.

Soybeans No. 1. CME Group

Growth scenario: November futures, expiration date November 12. We see that there is no growth in the market. We keep old purchases, we don’t open new ones.

Falling scenario: here you can safely hold old shorts, moreover, you can add lots to the position in case of a long red candlestick.

Recommendation:

Purchase: no. Whoever is in the position from 1290, keep the stop at 1244.0. Target: 1880.0 ?!

Sale: no. Whoever is in the position between 1400.0 and 1350.0, keep the stop at 1343.0. Target: 1111.0. Support — 1262.0. Resistance — 1338.4.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date is February 28. We will stay out of the market. Bulls are gradually losing their advantage.

Falling scenario: a fall to 18.20 cannot be ruled out. Let’s go in short.

Recommendation:

Purchase: think when approaching 18.20.

Sale: now. Stop: 20.57. Target: 18.20.

Support — 19.26. Resistance — 20.43.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 20. The market is not growing. The location is not the best, but there is a small chance of growth. Let’s buy.

Falling scenario: weekly changes are minimal. We are on sale. If there is a fall below 180.00, you can increase aggression and add volume to the shorts.

Recommendation:

Purchase: now. Stop: 182.00. Target: 245.00.

Sale: no. Whoever is in the position from 190.00, keep the stop at 196.00. Target: 162.00.

Support — 177.05. Resistance — 202.25.

Gold. CME Group

Growth scenario: good shopping area. With Elliott Wave, the market is charged to move higher with the first target at 1920.

Falling scenario: the US Federal Reserve is unlikely to surprise the market with strong rhetoric on Wednesday. The bet on falling gold is extremely risky. We don’t open the new shorts, but keep the old ones.

Recommendations:

Purchase: now. Stop: 1740. Target: 2060. Whoever is in the position from 1760, keep the stop at 1740. Target: 2060.

Sale: no. Who is in the position from 1790, move the stop to 1803. Target: 1650?

Support — 1744. Resistance — 1781.

EUR/USD

Growth scenario: the week ended at attractive buying levels. Let’s go to the long.

Falling scenario: if the pair continues to fall before the Fed meeting, it will look extremely tough. Will the market sentiment change in favor of the dollar?

Recommendations:

Purchase: now. Stop: 1.1712. Target: 1.2100.

Sale: no. Those who are in the position from 1.1900, move the stop to 1.1890. Target: 1.1060. Support — 1.1717. Resistance — 1.1908.

USD/RUB

Growth scenario: the dollar strengthened slightly at the end of the week, but it is too early to talk about a change in sentiment. Nevertheless, those who wish can buy if the pair rises above 73.00.

Falling scenario: we will continue to hold the short opened a month ago from 73.90. Strengthening the Fed’s policy in the near future is questionable.

Recommendations:

Purchase: in case of growth above 73.00. Stop: 72.40. Target: 80.00.

Sale: no. Anyone in the position from 73.90, move the stop to 73.67. Target: 67.60.

Support — 72.23. Resistance — 73.53.

RTSI

Growth scenario: the US stock market fell on Friday. Negative sentiment will most likely spread to other sites as early as Monday. Most likely we will face a decline. We do not buy.

Falling scenario: possible short from current levels. In case of growth to 175,000, it is obligatory to sell. It is possible that a correctional move begins on the global market.

Recommendations:

Purchase: no.

Sale: now and when climbing to 175000. Stop: 178000. Target: 151000. Consider the risks!

Support — 167610. Resistance — 176050.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.