|

15 April, 12:26Пульс рынка

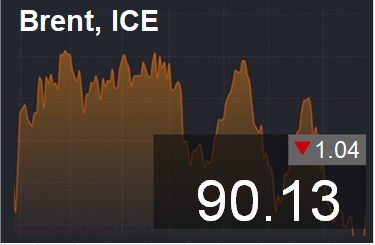

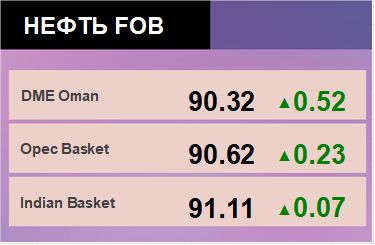

Аналитики Bloomberg сообщили, что стоимость нефти может резко подскочить на открытии торгов на фоне иранских атак по Израилю. С 1 апреля, когда Тель-Авив атаковал здание консульства в Дамаске, стоимость Brent выросла на 3,12% |

Архив за 15 апреля, 2024

15 April, 10:36Отчеты

|

Energy market: Now in order to predict price fluctuations you need to know about missiles and air defense systems, P/E ratios and other multiples are a thing of the past, and so is a CFA degree. I should have studied tourism. I’d know where to get away from it all. Hello! This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market. Well… the Persians sent their fiery greetings to the Jews. And they said no way, we’ll ship you something soon. And so on and so forth. And it should be like before, people go out with clubs into the field and there, locally, without traumatizing the civilian population to find out all the issues. OPEC in its report cheerfully wrote that we are going to see an increase in fuel demand. Of course we are. I bet everyone’s rushing to build up their strategic reserves. And what to do? In fact, the forecast of demand growth up to 107.3 million barrels per day in the 4th quarter of 2025 is a bit ambitious, but perhaps it will happen, but not due to the development of economies, but due to the growing horror on a planetary scale. And then all the excitement will die down. We will ride horses, if not two-headed ones. People are seriously speculating about the price of oil per barrel at 100 dollars. Of course, it will continue to rise if you take Iran and Russia out of the market. You’ll get 150, you’ll get 200. And this will lead to higher inflation in the West, higher interest rates, cooler economies, higher unemployment. Only the collapse will happen a year after we reach, for example, 150 dollars per barrel. At the same time, somewhere in Tyumen, the same barrel will be available for 10 dollars. And with such a difference, the demand for small tankers and for desperate guys will increase. |

15 April, 08:06Пульс рынка

|

По нашим оценкам, цены на нефть уже включают премию за риск в размере от $5 до $10 за баррель из-за снижения предложения. |

15 April, 08:00Отчеты

|

Рынок нефти пока спокойно реагирует на то, что Иран сейчас может подвергнуться атаке со стороны Израиля. Если удар будет нанесен по буровым или инфраструктуре добычи и переработки, то тогда это вызовет идеальный шторм на рынке и мы быстро окажемся на 120.00. Но вряд ли Вашингтон будет заказывать у Тель-Авива такую музыку. Будет ли еще один подход к 92.70, вот в чем вопрос. Нам светит коррекция к 84.00, возможно к 82.40. И её пропускать нежелательно. Наши отчеты и прогнозы можно найти здесь. |